Newsletter – August 2025

On January 8, 2025, the European Banking Authority (EBA) issued its Guidelines EBA/GL/2025/01, outlining expectations for the management of environmental, social, and governance (ESG) risks by credit institutions. The objective of the guidelines is to promote the prudent management of ESG risks and ensure their integration into institutions’ risk management and governance frameworks. The regulation becomes mandatory for large institutions as of January 11, 2026, and for small and non-complex institutions from January 11, 2027. On June 3, the Hungarian National Bank (MNB) signaled its intention to fully comply with the EBA guidelines by the January 10, 2026 deadline through the revision and appropriate supplementation of its currently effective ESG recommendations.

The guidelines are structured around three main pillars: identification and measurement of ESG risks, management and monitoring of ESG risks and the development of transition plans. Institutions are required to conduct regular materiality assessments to identify the financial impacts of ESG factors. These assessments must be performed at least annually for large institutions and biennially for smaller ones, with updates required in the event of significant changes in the business environment or portfolio composition.

During the materiality assessment, institutions must consider the impact of ESG risks on traditional financial risk categories, such as credit, market, operational, liquidity, concentration, and reputational risks. Environmental risks should particularly address climate-related factors, ecosystem degradation, and biodiversity loss. The assessment must also cover transition and physical risks, taking into account geographical exposures, regulatory environments, and the sectors in which counterparties operate.

The EBA prescribes a combination of methodologies for ESG risk measurement. Exposure-based methods support short-term assessments, while sector- and portfolio-based approaches aid medium-term planning. Scenario-based methods allow for the analysis of long-term ESG impacts, particularly in alignment with climate objectives. Large institutions are required to apply at least one portfolio alignment method to assess the consistency of their portfolios and counterparties with the goals of the Paris Agreement.

In terms of data management, institutions must establish reliable information systems to collect, structure, and analyze ESG-related data. Regular reviews are necessary to ensure data quality, and estimates or proxies may be used where appropriate. Data from large corporate counterparties may include greenhouse gas emissions, energy efficiency, financial impacts of environmental risks, and alignment with social and governance standards.

ESG risks must be embedded into the institution’s overall risk management framework. This includes defining ESG-related risk appetite, integrating ESG risks into ICAAP and ILAAP processes, and incorporating ESG considerations into internal governance structures through the three lines of defense and active involvement of the management body. Emphasis is also placed on fostering internal culture, ESG training, and addressing greenwashing risks.

A dedicated chapter of the guidelines focuses on transition plans, which aim to prepare institutions for a shift toward a more sustainable economy. These plans must include specific targets, milestones, timelines, and the necessary measures to achieve them. Objectives should align with EU climate goals, such as achieving net-zero emissions by 2050. Plans must consider various scenarios, counterparties’ ESG risk profiles, and the need to transform business models and portfolios.

For monitoring purposes, institutions must operate effective internal reporting systems to regularly inform management about ESG risks. Large institutions are required to track financed greenhouse gas emissions, exposures to high-risk sectors, portfolio alignment indicators, and losses or reputational risks related to ESG factors. A proportional approach applies to smaller institutions, though they are also encouraged to expand the range of monitored indicators.

How does this differ from the MNB’s Green recommendation?

While both the EBA’s ESG risk management guidelines and the MNB’s Green Recommendation No. 10/2022 (VIII.2.) share the goal of enhancing credit institutions’ resilience to ESG-related risks and promoting sustainable operations, there are several key differences.

One of the most significant distinctions lies in scope: the MNB’s recommendation primarily focuses on climate-related and environmental risks, whereas the EBA’s guidelines cover the full spectrum of ESG risks, including social and governance factors. Consequently, the EBA adopts a broader interpretation of risk management expectations.

The EBA guidelines provide detailed methodologies for identifying, measuring, managing, and monitoring ESG risks, set mandatory minimum standards and reference values, and define the required content of transition plans. In contrast, the MNB’s recommendation serves more as a framework, offering institutions greater flexibility in how they incorporate ESG considerations, with an emphasis on awareness and preparation rather than prescriptive methodological requirements. The MNB places strong emphasis on promoting green lending, supporting sustainability objectives, and developing green financial products, while the EBA focuses on prudential risk management and capital adequacy.

Both the MNB and EBA stress the importance of using appropriate metrics to monitor material ESG risks. However, the EBA guidelines are more specific in this regard, listing mandatory indicators that institutions must at least monitor. The scope and level of detail of these requirements vary between small/non-complex and large institutions.

Another key difference is that the EBA guidelines regulate ESG data management, integration into internal control systems, and the assignment of responsibilities along the three lines of defense in detail. The MNB recommendation, on the other hand, emphasizes strategic-level ESG integration, leadership commitment, and transparent communication.

In summary, the EBA guidelines represent a more detailed, technically robust, and prescriptive regulatory framework, while the MNB’s recommendation serves as a strategic compass for domestic institutions in embedding sustainability considerations.

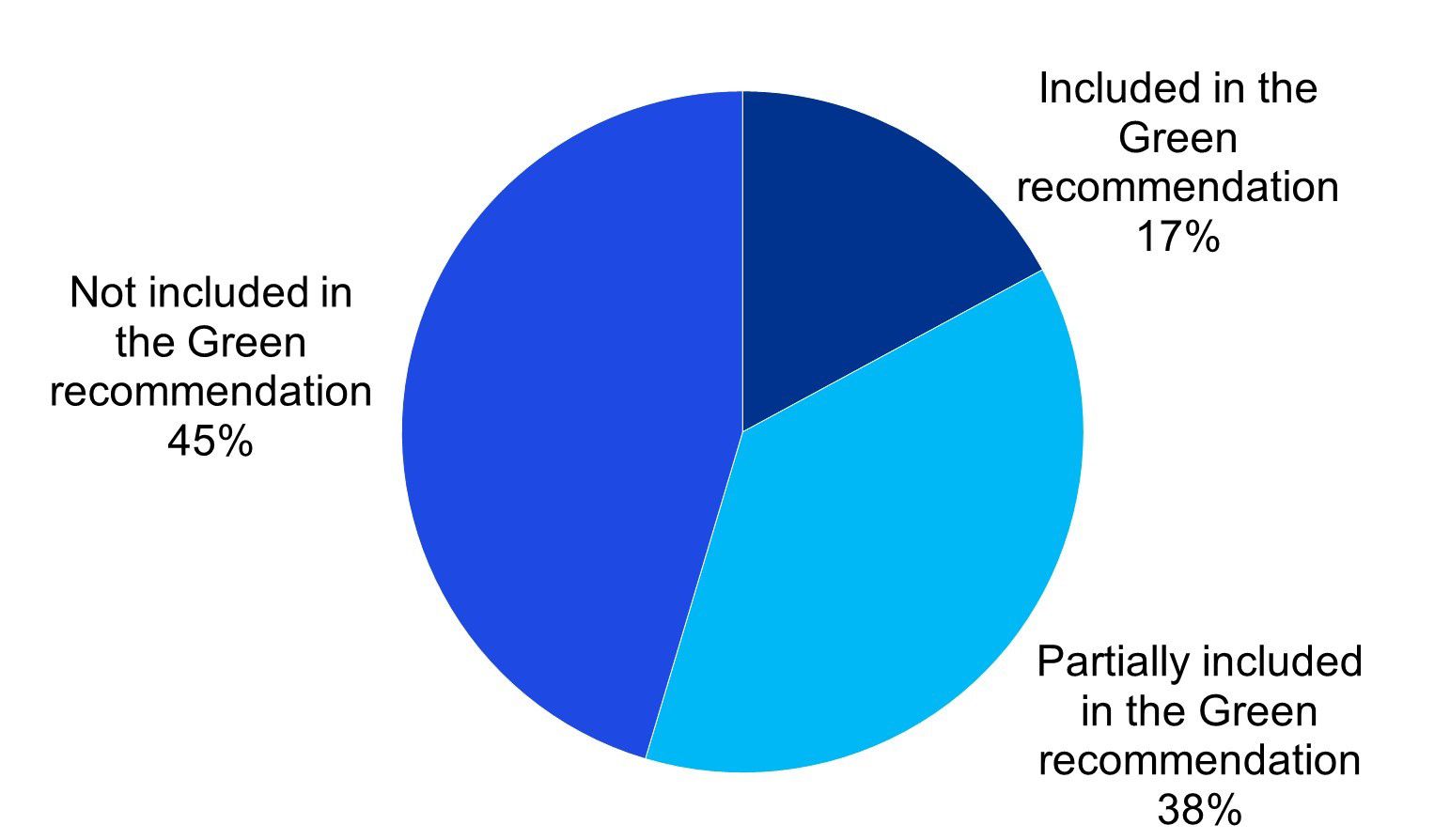

Overlap between the expectations of the EBA Guidelines and the MNB Green recommendation

Source: Own editing

Overall, the EBA guidelines—set to be implemented by the MNB—are expected to elevate ESG risk management to a new level and, in the long term, contribute to a more resilient and sustainable financial system. It is now crucial for credit institutions to assess their preparedness and begin reviewing their internal processes related to ESG risks. Institutions should also establish the necessary systems to meet the expectations set out in the guidelines. This includes conducting materiality assessments, developing data collection and management systems, integrating ESG considerations into ICAAP and ILAAP processes, and formulating and monitoring transition plans. In addition, ESG training for executives and staff, as well as the development of a strong internal culture, are of increased importance.