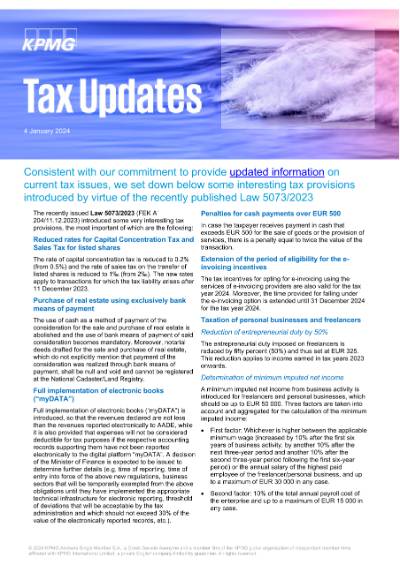

Tax Updates: January 4th 2024

Consistent with our commitment to provide updated information on current tax issues

Consistent with our commitment to provide updated information on current tax issues

Article Posted date

04 January 2024

1 min read

Consistent with our commitment to provide updated information on current tax issues, we set down below some interesting tax provisions introduced by virtue of the recently published Law 5073/2023.

In this edition (Download PDF , 0.19 MB)

- Reduced rates for Capital Concentration Tax and Sales Tax for listed shares

- Purchase of real estate using exclusively bank means of payment

- Full implementation of electronic books (“myDATA”)

- Penalties for cash payments over EUR 500

- Extension of the period of eligibility for the e-invoicing incentives

- Taxation of personal businesses and freelancers

- Reduction of entrepreneurial duty by 50%

- Determination of minimum imputed net income

- Transfer of losses

- Arrangements for short-term lease of real estate

- Other regulations for real estate

- Climate crisis resilience duty

- Deduction of building renovation costs from personal income tax

- Other regulations

- VAT: Extension of reduced and super-reduced rates

- Special Excise Duty (EFK)