Tax Updates: December 12th 2023

Consistent with our commitment to provide updated information on current tax issues

Consistent with our commitment to provide updated information on current tax issues

Article Posted date

12 December 2023

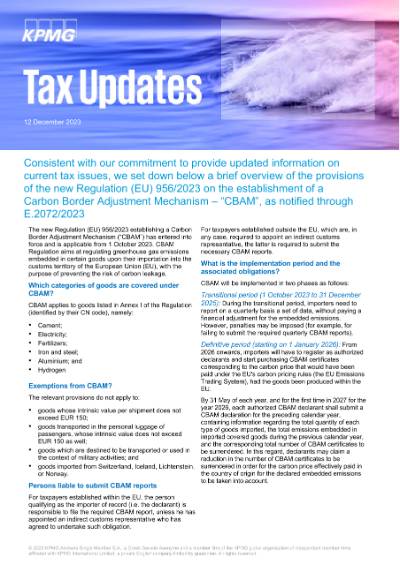

Consistent with our commitment to provide updated information on current tax issues, we set down below a brief overview of the provisions of the new Regulation (EU) 956/2023 on the establishment of a Carbon Border Adjustment Mechanism – “CBAM”, as notified through E.2072/2023

In this edition (Download PDF , 0.19 MB)

- Which categories of goods are covered under CBAM?

- Exemptions from CBAM

- Persons liable to submit CBAM reports

- What is the implementation period and the associated obligations?

- Which is the reporting process during the transitional period?

- Which are the methodologies for the calculation of embedded emissions?

- How KPMG can help