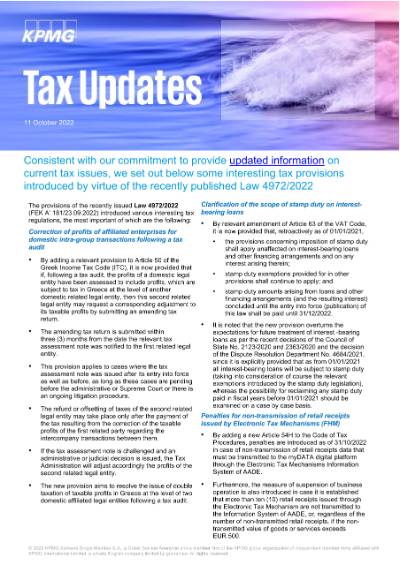

Tax Updates: October 11th, 2022

Consistent with our commitment to provide updated information on current tax issues

Consistent with our commitment to provide updated information on current tax issues

Article Posted date

11 October 2022

1 min read

Consistent with our commitment to provide updated information on current tax issues, we set out below some interesting tax provisions introduced by virtue of the recently published Law 4972/2022.

In this edition (Download PDF , 0.23 MB)

- Correction of profits of affiliated enterprises for domestic intra-group transactions following a tax audit

- Clarification of the scope of stamp duty on interest-bearing loans

- Penalties for non-transmission of retail receipts issued by Electronic Tax Mechanisms (FHM)

- Clarification of the methods for cash gifts and parental donations of cash through financial institutions for the application of the tax-free amount of

EUR 800 000 - Abolition of the Special Solidarity Contribution

- Exemption from entrepreneurial duty

- Amendment of provisions for the issuance of electronic invoices