IFRS 15 Revenue – The reality may surprise you

IFRS 15 Revenue – The reality may surprise you

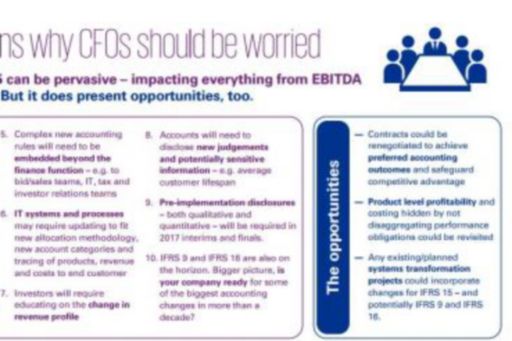

10 reasons why CFOs should be worried

On a daily basis, I’m getting calls from clients who are expressing surprise that their IFRS 15 conversion project isn’t going to be as straightforward as they first thought.

Why? Well, they’ve usually either identified a broader range of contract terms than expected – making the impact of IFRS 15 far greater – or they’ve underestimated the commercial opportunities presented by the new standard.

Should you be worried?

Yes, particularly if your organisation is – like many others – just starting its conversion project. The implications of IFRS 15 can be pervasive – impacting everything from EBITDA to systems and processes – so until you’re certain what the impacts are, I can think of at least ten reasons why you should be worried.

IFRS 15 needs to be one of your key priorities for the coming months – not only to avoid a crisis, but also to safeguard your organisation’s commercial advantage.

How to avoid a crisis

The task of securing enough resource – both internal and external – to deliver by 2018 is the most common challenge that my clients are facing. For example, having multiple teams dealing with the separate, but related, programmes on IFRSs 9, 15 and 16.

Commercial managers must be integrated into the implementation team. You’ll only get to the right accounting treatment if your accountants understand how your contracts work in practice.

To secure the right resource, you’ll need the right buy-in. There needs to be a high level of support and understanding at the board level to make this happen.

Early engagement with advisors and auditors is also important. Your auditors will need to validate the core judgements at an early stage. You wouldn’t want to spend $xm transforming your systems only to find out that the auditors don’t agree with the accounting treatment!

Educate your investors

No doubt you’re already thinking about the qualitative pre-implementation disclosures that you’ll make in your interim accounts.

Your preferred strategy may be to keep your messaging bland in your interims. But bear in mind that the regulators have stated clearly that they’re anticipating information on expected impacts. A statement that an implementation project is under way isn’t going to cut it.

The reality is that your investors are likely to need educating about the change in your revenue profile. Come December, you’ll be expected to quantify the impact in your year-end accounts. So the sooner you start managing expectations, the better.

The breadth and specificity of your disclosures will reflect the progress of your implementation project. The risk here is that you make an unsupported statement that there will be no impact, only to discover later that isn’t the case. How confident are you that there won’t be any nasty surprises?

How do you compare?

Think how you currently benchmark against your peers in terms of judgements made. Are you confident that you’ll remain aligned with your peers when you give your pre-implementation disclosures in your interim and final accounts this year?

Don’t overlook the commercial opportunities presented by the new requirements. Your competitors may already be renegotiating their contracts to achieve the preferred accounting outcome.

Your stakeholders are going to be disappointed if your peers gain competitive advantage and your organisation misses the opportunity.

The regulator will be calling

The fundamental question here is: will you be able to prove to the regulators that you’ve undertaken your conversion project in the right spirit? Will you have an audit trail showing the analysis performed and the conclusions drawn?

You’ll need documentation that stands up to regulatory scrutiny, even if IFRS 15 has a minimal impact on your accounts.

What should you do right now?

My recommendation to CFOs is to go into this thinking that it is difficult. By taking it seriously, and over-investing rather than under-investing – at least in the early stages – you’ll hopefully have a pleasant surprise rather than a nasty one.

And don’t forget about IFRS 16. Or IFRS 9… Bigger picture, you’re facing the biggest accounting changes in more than a decade. Your stakeholders are already in the mood for asking questions. They will expect to be kept informed, so it will pay to be prepared on all fronts.

Our website contains a wealth of information on all these matters. Visit our Revenue, Financial Instruments, Leases and Insurance Contracts hot topics pages to find out more.

Nick Chandler

Comments? Questions? Join the conversation on KPMG's IFRS showcase page on LinkedIn.

About the author

Nick leads a team of technical accounting specialists which supports clients in their IFRS conversion projects and provides accounting advice to a large number of listed companies in the UK.

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.