InfoCourier - April 2020

InfoCourier - April 2020

InfoCourier provides a monthly overview of the latest changes in legislation.

This issue of InfoCourier covers the following topics

- Summary of measures for alleviating the tax burden

- Act on Amendments to the Commercial Code

- Overview of court decisions

Please feel free to contact KPMG’s tax advisers with any queries you may have. We hope you are enjoying reading it!

Summary of measures for alleviating the tax burden

The Riigikogu passed legislation on 15 April 2020 for mitigating the economic and social consequences of the Covid-19 outbreak. Tax-related measures are described below.

Amendments to the Taxation Act

Interest on tax arrears is not charged from 1 March 2020 until the end of the state of emergency.

* Charging interest is suspended automatically – the taxpayer does not need to request it specifically.

* Tax returns should still be filed in a timely manner.

* The suspension of interest does not mean a general tax exemption: if a taxpayer falls behind with payments, tax arrears would still arise. Despite the suspension of interest, entities tendering for public contracts are therefore advised to pay their tax liabilities or to apply for payment in instalments.

From the end of the emergency state until 31 December 2021, a lower tax interest rate will apply (reduced 0.06% to 0.03% per day).

* The interest rate is lowered automatically – the taxpayer does not need to request it specifically.

From 1 May 2020 to 31 December 2021, the tax authority may decide to reduce interest by up to 100% (i.e. to zero) if tax arrears are paid in instalments, as from the date the taxpayer decides to apply for payment in instalments.

* The tax authority makes the decision on interest reduction based on the specific situation and difficulties faced by each entity.

* The taxpayer has to apply for the reduction of interest.

The tax authority is granted the right not to disclose information on tax arrears in the period from the declaration of emergency on 12 March 2020 to the date when two months have passed since the official end of the emergency state.

* The tax authority has announced that the public debt inquiry tool has been temporarily closed down as, for the time being, it does not provide a true reflection of companies’ regular performance. The list of tax debtors whose tax arrears arose before 1 March 2020, however, remains available.

The tax authority has the right to disclose information containing tax secret to government offices and to persons involved in reviewing and implementing measures to support businesses affected by the effects of the Covid-19 pandemic.

Amendments to the Value-Added Tax Act

The reduced 9% VAT rate applicable to paper-based books and educational materials is extended to electronic books and educational materials, as well as on publications on other physical media (e.g. books in audio formats). The amendment took effect on 1 May 2020.

The reduced VAT rate is applied also to electronic newspapers and magazines, excluding publications mainly containing advertisements or personal announcements, or publications with mainly erotic, pornographic, music or video content. The amendment took effect on 1 May 2020.

Customs duties and VAT are waived on the import of personal protective equipment and other medical equipment used to combat the spread of the Covid-19 virus. The exemption is based on a decision made by the European Commission.

* If the import of goods is exempt from VAT under section 17 of the Value-Added Tax Act as in this case, the intra-Community acquisitions of these goods are also covered by the exemption.

* A zero VAT rate is applied also on domestic sales of the said goods in accordance with section 15(3)14) of the VAT Act.

* It is important to note that the duty and VAT exemption is temporary and is applied from 30 January to 31 July 2020. The European Commission has assured that the period may be extended if necessary.

* The duty and VAT exemption applies to:

- state organisations, including state bodies, public bodies and other bodies governed by public law;

- organisations approved by the competent authority;

- businesses that supply goods to the above persons (supplies on behalf of entitled persons), provided there is a written agreement to this effect.

* Further information (in Estonian) is available on the tax authority’s website.

* The amendment took effect on 22 April 2020 but it is applied retrospectively as from 30 January 2020.

Amendments to the Funded Pensions Act

- The state will suspend the 4% contributions paid out of social tax to the mandatory funded pension scheme (the second pillar) from 1 July 2020 to 31 August 2021. By way of exception, regular contributions continue to be made for persons born in the years 1942–1960.

- In October 2020, the persons subscribing to the second pillar can apply for the suspension of their own payments (2%) from 1 December 2020 to 31 August 2021.

- Those born in 1942–1960 can also suspend their payments. If they choose this option, the 4% contributions by the state will be suspended as well.

- The persons who continue making payments during the period when the state contributions are suspended will be compensated by supplementary state contributions in the years 2023–2024.

- The supplementary pension contributions made by the state to the parents of young children (the so-called parental pension) are not affected by these changes and continue to be made as usual.

The amendments take effect on 1 July 2020.

Amendments to the Income Tax Act

Income tax is not charged on gifts or donations made for charitable purposes by legal persons from 12 March to 1 July 2020 to Estonian state or local government authorities or social welfare institutions or to hospitals in Estonia. The aim of these amendments is to grant a temporary income tax exemption to donations made to hospitals which, even if established as foundations, are not treated as tax-exempt charity organisations in regular circumstances. The amendment took effect on 22 April 2020 and is applied retrospectively.

A private individual or a sole proprietor may additionally deduct up to 5,000 euros from the income derived from the sale of timber felled on the land owned by the individual and from the transfer of the right to cut the standing crop growing there, as well as from Natura 2000 support for private forest land. The aim of the amendment is to give the owners of forest land a stimulus to manage their forest themselves instead of selling it. The amendment is applied retrospectively as from 1 January 2020.

Amendments to the Social Tax Act

- The obligation to pay social tax based on the monthly rate is waived from March to May 2020. The amendment applies to employment and service contracts but also to spouses of sole proprietors participating in the business.

- The state pays the advance social tax payment for the first quarter of 2020 to the Tax and Customs Board on behalf of sole proprietors.

The amendments are applied retrospectively as from 1 March 2020.

Amendments to the Health Insurance Act

- Health insurance cover will remain in force also for the persons for whom social tax is not paid to the extent of the minimum social tax liability during the state of emergency. This provision applies to the members of management or supervisory boards of legal entities, to persons receiving remuneration or service fees under the law of obligations (e.g. on the basis of a contract for services or authorisation agreement) and to persons paying tax on their business income. The insurance cover will remain in force until the 10th day of the second month following the end of the emergency period.

The amendment is applied retrospectively as from 12 March 2020.

Amendments to the Alcohol, Tobacco, Fuel and Electricity Excise Duty Act

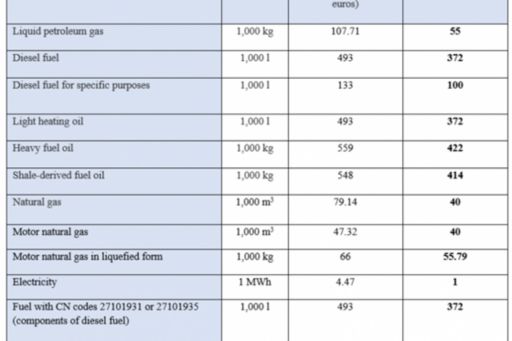

The excise duties on some fuels and electricity are reduced temporarily from 1 May 2020 to 30 April 2022 to mitigate the effects of the state of emergency. The table below shows the current and reduced excise rates.

The amendment took effect on 1 May 2020.

Act on Amendments to the Commercial Code (transfer of shares of private limited companies)

In March 2020, the Riigikogu passed an Act on Amendments to the Commercial Code with the aim of simplifying the transfer of shares of private limited companies. The main amendments are:

- the minimum value of a share is set at one cent instead of one euro;

- the formal requirement for transferring or pledging a share are simplified;

- a company with a share capital of at least 10,000 euros is allowed to provide in its articles of association that a disposition for the transfer or pledge of a share can be carried out under a simplified procedure,

- provided that the disposition for the transfer of a share is executed in a format which can be reproduced in writing,

- all shareholders consent to using the simplified procedure;

- the shareholder is required to notify the management board immediately of any changes in the shareholders’ data. The management board is required to notify the changes to the Commercial Register.

The amendments take effect on 1 August 2020.

More information on the bill is available here (in Estonian).

Additional information: Tax Advisor Ave Rego averego@kpmg.com

Court decisions

Tax residency

The circuit court has examined the obligation to file a tax return in a case brought by a natural person living and working abroad. The view held by the Tax and Customs Board was that the person was obliged to file a tax return in Estonia, reporting also any income received abroad. The Tax and Customs Board claims that the person should be treated as an Estonian resident as the person owns property in Estonia and is associated with Estonian businesses.

The tax authority did not raise doubts about the fact that the person lives and works in Norway and receives their main income there. The tax authority, however, ignored the fact that the person has never lived in their property in Estonia and that the businesses they are associated with in Estonia have been deleted from the Commercial Register or are no longer in active operation. The person has, furthermore, produced a tax residency certificate from the Norwegian Tax Administration, proving their Norwegian tax residency.

The court found that the identification of the person as a tax resident in Estonia was not grounded in sound reasoning and that the tax authority’s decision was not based on a sufficient analysis of residency and other relevant circumstances. The tax authority has thus acted in breach of the principle of investigation and other tax processing practices (obligation to provide explanation, etc.). In the Court’s opinion, there is no proof that the person has closer personal and economic relations with Estonia, which would justify being treated as a tax resident in Estonia. Therefore the Court has overturned the Tax and Customs Board’s tax decision.

More information is available here (in Estonian).

Additional information: Tax Advisor Einar Rosin erosin@kpmg.com

© 2024 KPMG Baltics OÜ, an Estonian limited liability company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

KPMG International Cooperative (“KPMG International”) is a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.