What is GRI?

GRI stands for Global Reporting Initiative. Founded in 1997, GRI is an independent, international organisation wanting to provide global reporting standards within corporate transparency. The first aim for GRI was to create the first accountability mechanism and hereby ensure that companies adhere to responsible environmental conduct principles. Over the years, this has broadened to also include social, economic and governance issues – now known as the GRI Standards.

The GRI standards

The GRI Standards consist of three series of standards: the Universal Standards, Sector Standards and Topic Standards. This means that GRI recommends that the Universal Standards should all be taken into use in a company’s reporting, whereas the Sector Standards should only be used, if they apply to a company’s sector. The Topic Standards are only for reporting of specific information on topics that are material to a company.

GRI 207 on Tax is a Topic Standard.

Reporting standard on tax

GRI 207 was developed as a response to calls for more transparency on tax from many organisations’ various stakeholders – such as governments, investors, civil society, media and the public. The UN has acknowledged tax to have a vital role in achieving the Sustainable Development Goals. Tax is also – among other things – organisations’ way of contributing to the society in which they operate. Prior to GRI 207, many other independent organisations had set up guiding principles on “good tax behaviour” – such a Fair Tax Mark and the B-team.

However, GRI 207 combines tax strategy with public country-by-country information on revenue, profit and tax. In other words, GRI 207 – as a reporting standard – gives an impression of the qualitative and quantitative part of tax within an organisation.

This is due to the four categories within the GRI 207:

- GRI 207-1: Approach to tax

- GRI 207-2: Tax Governance, control and risk management

- GRI 207-3: Stakeholder engagement and management of concerns related to tax

- GRI 207-4: Country-by-country reporting.

How to start reporting with GRI 207?

When starting reporting in alignment with GRI, the first thing an organisation needs to do is:

1. Decide upon the level of ambition within GRI 207.

It may seem a bit overwhelming when looking at all the disclosure requirements listed in GRI 207. Therefore, you should decide the level of ambition first. It is important to remember that – at this point – the reporting standard is voluntary. Therefore, an organisation could, for example, start on developing a Tax Strategy/Tax Policy, where the focus is set on some of the topics within GRI 207.

After setting the level of ambition, the next step is:

2. Review the tax governance processes within the organisation.

It is important to know how the present Tax Governance Framework is set up to know both the strengths and the flaws in connection with GRI. Perhaps the current Tax Governance Framework already meets some of the requirements in GRI 207. Nevertheless, it is important to assess the maturity of the already existing tax governance and controls.

When the maturity and level of ambition towards tax reporting has been assessed, then you should:

3. Align with the ESG team.

This step would be valuable, both in terms of ensuring that the agreed approach to tax transparency will support the broader aims within sustainability reporting and for CSRD purposes. Tax might be considered a material topic within CSRD. The consequence of this is that the CSRD report will have to include Tax as a topic.

Our previous blog post wrote about this. Go to this blog post by clicking here.

And last but not least:

4. Plan ahead and start now!

It is important to plan the development of the future tax reporting and start right away.

Many new required regulations on reporting will use the same data as required in GRI 207 – such as public country-by-country and Pillar 2. It is time consuming and overwhelming to collect and validate all this data. Therefore, we recommend that you start as soon as possible.

The GRI Standards are not only for organisations within the scope of e.g. Pillar 2 or Public Country-by-Country reporting.

The GRI Standards can be used by all organisations. While some organisations are not within the scope for mandatory reporting now, in the future they might reach the set threshold and consequently be obligated to report.

How many report by using the GRI 207?

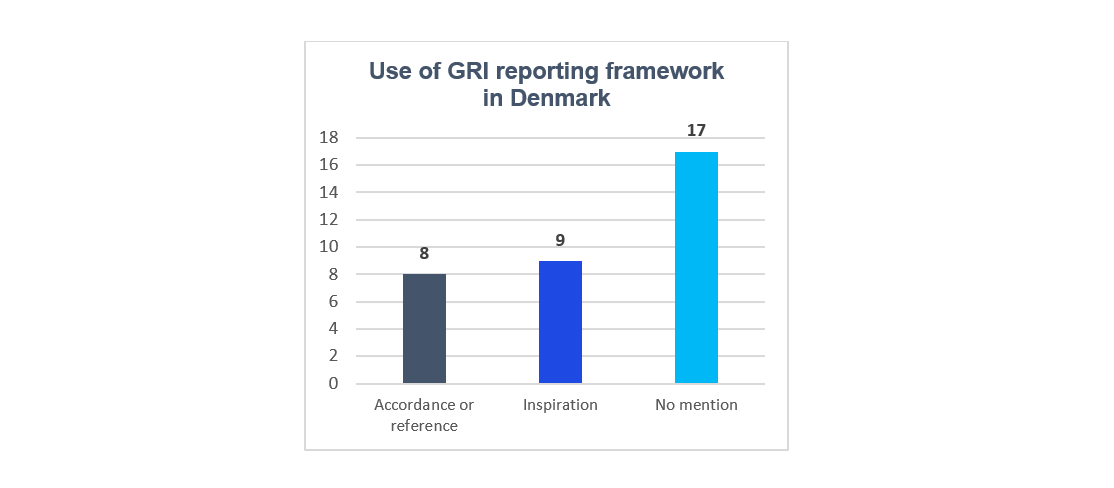

KPMG Acor Tax has – along with colleagues in Norway, Sweden, Finland and Iceland – made a GRI 207 benchmark in 2023 on both listed and unlisted companies in these countries. In Denmark, 32 companies were assessed.

17 Danish companies mentioned the GRI 207 to some degree in their tax reporting, and 17 did not mention GRI 207 at all.

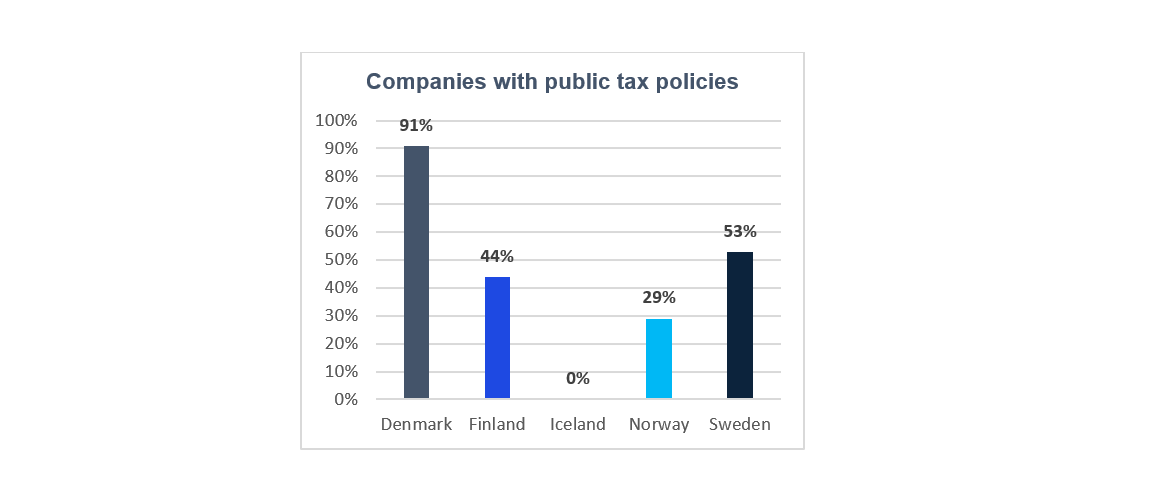

A topic within GRI 207-1 is whether the company has a public tax policy. 31 of 32 Danish companies had a public tax policy, making Denmark the best with this topic. Therefore, the current state of play is that GRI 207 – as the first and most acknowledged reporting standard – is seen as a valuable tool and is finding its way into the companies’ tax reporting.

So, a good way to go when planning ahead is to get started with GRI 207.