How social commerce is fuelling online retail

New Consumer Barometer from KPMG in Germany and IFH COLOGNE analyses the importance of social commerce.

New Consumer Barometer from KPMG& IFH COLOGNE analyses the importance of social commerce.

Very high overall potential among German consumers - especially for impulse purchases. A high level of trust, social interaction and sufficient product information are advantages over traditional online shops.

Cologne, 14. March 2024

Whether via Instagram, TikTok, online games or brand websites: Many companies have long since discovered the potential of social commerce1 for their own purposes. In addition to visibility and branding, the focus is increasingly shifting to purchase preparation and direct purchase transactions in the sense of a seamless shopping experience: social commerce has great potential - both for consumers and for companies. This is shown by the Consumer Barometer from KPMG and IFH Cologne, which has analysed the relevance and opportunities of social commerce in its latest edition. The result: 87 per cent of consumers are generally open to the concept and 75 per cent have already made a purchase via social commerce. The most popular product categories - similar to traditional e-commerce - are fashion and accessories (23%), consumer electronics (16%) and leisure and hobbies (14%).

"Social commerce as a form of e-commerce has reached the masses of consumers since the coronavirus pandemic at the latest and has incredible potential. Retailers and manufacturers should definitely get to grips with this complex topic and investigate the extent to which social commerce concepts can be useful for their business as an additional sales channel," says Dr Kai Hudetz, Managing Director of IFH COLOGNE.

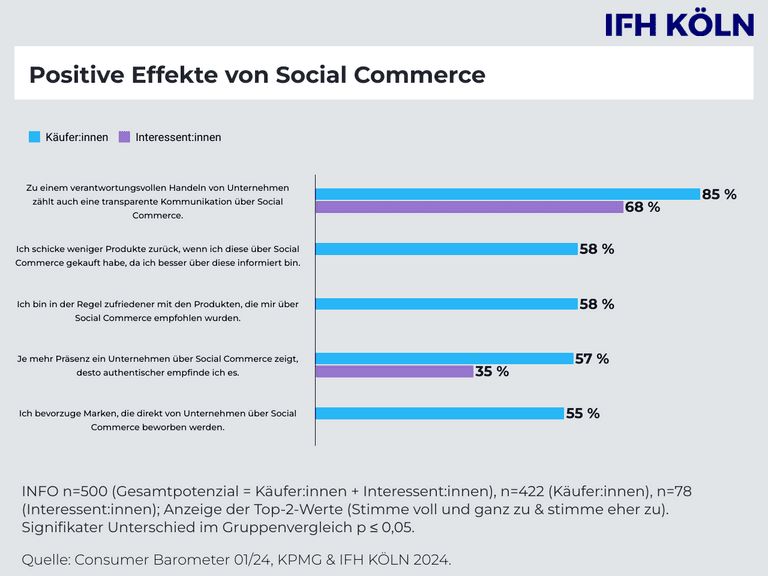

Positive effects through transparency and authenticity

If a social commerce strategy is appropriately aligned to the target group and channel, it has a positive influence on company perception, brand loyalty and customer satisfaction. For example, 82 per cent of consumers believe that transparent communication via social commerce is part of responsible corporate behaviour and more than half (53%) consider companies that are active via social commerce to be particularly authentic. Products recommended via social commerce are returned less frequently and are met with greater satisfaction (58%). Companies can use an authentic brand and product presentation in social networks, online games or on their own websites to circumvent the weaknesses of traditional e-commerce, in particular a lack of trust in providers (37%) or insufficient product information (30%).

Whether spontaneous or planned, buying is always an expression of trust. Social commerce is a catalyst for trust and not only promotes the purchase of products, but also loyalty to brands. Social commerce will therefore significantly boost e-commerce once again. Social commerce offers retailers and manufacturers the opportunity for more authenticity in individual customer communication and an enhancement of their brand in the eyes of consumers.

Potential not yet fully utilised by companies

The great market relevance of social commerce is also reflected in the average spend: Four out of ten shoppers spent more than 50 euros on their last purchase. Consequently, two thirds of consumers currently see sales promotion and sales growth in particular as reasons for corporate social commerce activities. Companies should also utilise the opportunities that social commerce offers in terms of customer loyalty (38% of consumers agree). Other advantages of social commerce include the possibility of creating a seamless shopping experience (23%) and more social interaction (18%).

1 Social commerce refers to purchases via "social" online channels such as social media (e.g. via linked products as a post in the feed or story), virtual reality (e.g. via VR glasses), online/video games (e.g. within a game) or live video shopping.

Über das Consumer Barometer

Das Consumer Barometer von IFH KÖLN und KPMG beleuchtet aktuelle Entwicklungen, Trends und Treiber im Handel und Konsumgütermarkt. Für die vorliegende Ausgabe wurde das Thema „Social Commerce“ gewählt. Für die Studie wurden rund 500 Konsument:innen aus Deutschland im Januar 2024 online befragt.

Die ausführlichen Ergebnisse können hier heruntergeladen werden.

About the IFH KÖLN

As an industry insider, IFH KÖLN provides information, market research and advice on retail-related issues relating to successfully shaping the future and developing suitable business models. IFH COLOGNE is the first point of contact for independent, well-founded data, analyses and strategies that make companies and retail locations successful and fit for the future. By analysing markets, customers and the competition, IFH KÖLN offers a 360° view for deriving strategies for retail-relevant topics. In customised projects, customers are supported with strategic issues relating to digital strategies, the development of new markets and target groups or issues relating to channel excellence. With its subsidiary brand ECC KÖLN, IFH KÖLN has been active in e-commerce since 1999 and is dedicated to community and know-how transfer for digitalisation in retail.

More at: www.ifhkoeln.de

About KPMG

KPMG is an organisation of independent member firms with more than 265,000 employees in 143 countries and territories. KPMG is also one of the leading auditing and advisory firms in Germany and has over 13,100 employees at 26 locations. Our services are organised into the Audit, Tax, Consulting and Deal Advisory divisions. Audit centres on the auditing of consolidated and annual financial statements. Tax stands for KPMG's tax advisory activities. The Consulting and Deal Advisory divisions combine our high level of expertise in business, regulatory and transaction-orientated topics.

We have undertaken cross-divisional specialisation for key sectors of our economy. This is where the experience of our experts worldwide comes together and contributes to the quality of our advice.

More at: www.kpmg.de/consumergoods

Press contact

Deputy Head Corporate Communications

KPMG AG Wirtschaftsprüfungsgesellschaft

T +49 89 9282 1722

creisbeck@kpmg.com