Artificial intelligence is already penetrating almost all areas of life at breakneck speed. Whether in software development, financial analytics or medical diagnostics, AI has long been more than just a future promise. It quickly becomes apparent that anyone who wants to actively contribute to shaping the future cannot avoid grappling with its possibilities, opportunities and risks. Due to this range of applications, artificial intelligence is developing into one of the central concepts for innovation and efficiency in the 21st century and prompted us to write this newsletter article.

Currently, ChatGPT is probably the most prominent and widely used AI tool in the global market. Not too long ago, the applications of such a tool were limited to general text processing and basic question answering. Today, however, it increasingly serves as an interface to operate complex application systems such as programming environments, automation platforms or financial applications more easily and efficiently through natural language.

Corporate treasury departments can also benefit from this trend and technological advancement. However, particularly in the treasury area, the question repeatedly arises of how helpful a tool like ChatGPT can actually be when dealing with third-party systems. The primary problem frequently encountered is not the lack of programming skills among developers, but rather the fact that the chatbot has no direct access to internal system data or proprietary or vendor-specific interfaces.

This inevitably leads to application and efficiency problems, as relevant information cannot be automatically processed or placed in the right context. Additionally, there are further functional limitations since most processes are individually configured and heavily system-dependent.

However, the probably biggest concerns in this context are associated with data protection. Using external AI when handling sensitive financial data raises legitimate concerns regarding regulatory requirements and data security (Navigating Consumer Data Privacy in an AI World, 2024).

But precisely because the need for intelligent, dialog-based support is so great and to prevent the aforementioned problems, many software system providers have begun integrating their own AI tools and machine learning applications directly into their systems. Tools like "Kyriba Trusted AI" (TAI) or ION Treasury Machine Learning features are intended to increase efficiency and user-friendliness while simultaneously ensuring maximum data security (Cash Management AI Boosts Accuracy, Efficiency, & Foresight — Kyriba, 2025/ION Treasury Machine Learning, 2024).

SAP also integrates intelligent AI functions into S/4 HANA with the AI assistant Joule to support treasury processes through voice commands. It seems obvious that the various AI solutions strongly overlap in general function, since the basic requirements of users are largely identical across systems. The differences lie rather in the respective implementation, as each solution is specifically tailored to the individual system architecture and software environment, thus enabling the most efficient use and seamless integration in the respective system context.

The above list with SAP, ION and Kyriba is only a partial excerpt of existing AI treasury solutions and thus makes no claim to be a complete representation of system solutions.

Definition and differentiation

Artificial intelligence (AI) generally refers to technologies that enable machines to imitate human behavior such as language processing, decision-making or problem-solving. This is not a single system, but a combination of technical procedures that work together to tackle complex tasks (Fraunhofer IKS, n.d.).

A central sub-area of AI is machine learning (ML). Here, systems learn independently from large amounts of data by recognizing patterns and deriving decisions from them, without a fixed solution path being predetermined. The performance of such algorithms improves continuously through repetition and a growing database (Google Cloud, 2025; Fraunhofer IKS, n.d.).

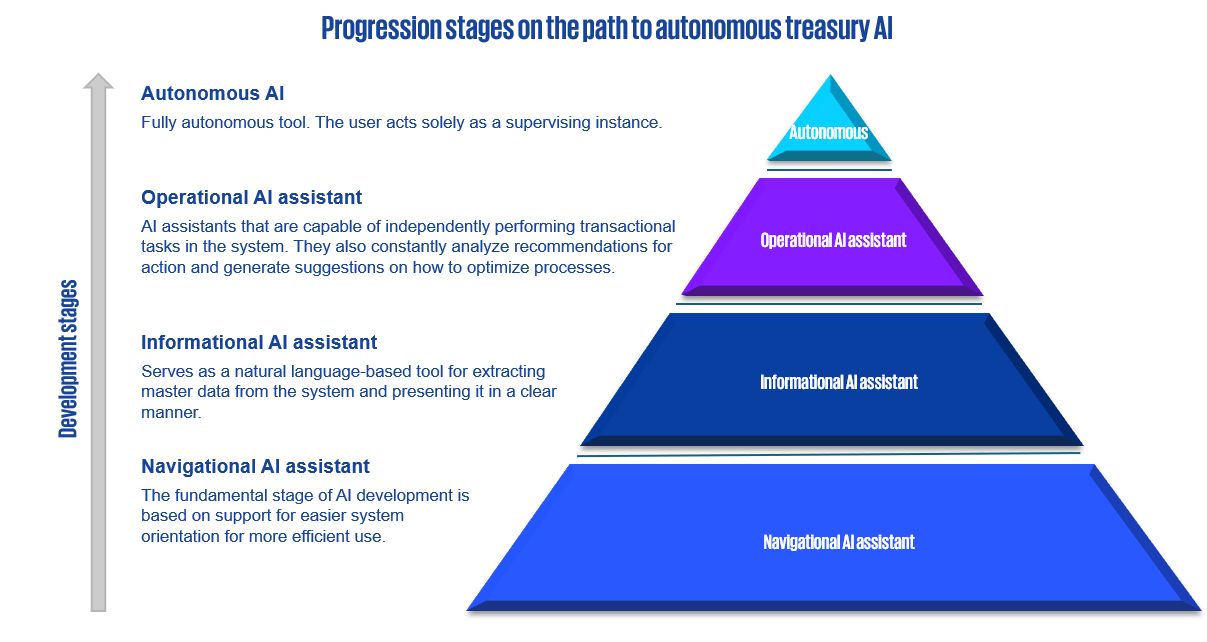

Development stages of AI in Treasury

Artificial intelligence is increasingly finding its way into treasury systems, but is still in the development phase in many places or is only available in preliminary forms. Initial solutions show how AI can enable simplified navigation in complex applications, faster information provision, transaction automation or comprehensive analyses. These application areas mark the central development directions of AI in Treasury to make its processes more efficient in the future.

Fig. 1: Progression stages on the path to autonomous treasury AI

Source: KPMG in Germany, 2025

Navigating Functions

The most basic development stage of AI in Treasury is based on navigating features that simplify system application and orientation. Whether searching for tools for setting up bank accounts, displaying specific account balances or targeted cash flows, users are guided directly to relevant modules, reports, or transactions with the help of natural language inputs. Depending on the system provider, the AI leads the user directly to the desired target module, creates the appropriate link or offers a user-friendly guide that leads step by step to the right area and ideally provides assistance with operation. This completely eliminates the tedious search in complex menu structures or even remembering transaction codes.

Informational AI assistant

Building on this basic functionality, the next development stage is found in informative applications. This type of AI has the ability to respond specifically to questions and provide answers, whereby relevant company or market data can be made available in structured and understandable form. It serves as a natural language-based reporting tool, allowing information to be retrieved much faster and more precisely, without users having to waste time searching through different treasury systems and reports.

AI does not replace the underlying database, but instead acts as an intelligent nexus by making existing data more accessible, more usable and contextually interpretable.

A practical example in this case would be a treasurer who wants to find out how high the utilization of his credit lines will be in the coming three months. Instead of calling up a report or even manually combining several reports, an AI-supported treasury system immediately delivers a clear overview of the desired information.

Operational AI assistant

Beyond pure information provision and simplified navigation, artificial intelligence in treasury opens up a third expansion stage, which is based on transactional and analytical characteristics. This is no longer just about making data accessible or paving the way to certain modules, but about the direct execution of operational tasks. Approvals, bookings or even the creation of new data records can be directly done by AI from start to finish. This naturally occurs based on a clearly defined set of rules, authorizations and compliance requirements, which can be individually set out in the system beforehand.

In practice, this might look like a treasurer receiving a notification from his or her AI-based treasury assistant that unused liquidity is available on a UK account. The system automatically checks the relevant investment guidelines, suggests an appropriate measure and executes the corresponding booking directly after confirmation. In this way, AI takes over activities that previously had to be done manually and creates a more efficient working environment.

On top of that, it should be capable of analyzing large amounts of data, recognize patterns and derive forecasts or recommend concrete actions from these. It then visually prepares results so that you can quickly recognize risks, opportunities and anomalies and initiate proactive measures.

Let's look, for example, at an internationally active production company that notices that high balances have accumulated on several foreign accounts while a short-term liquidity bottleneck threatens in the German parent company. The responsible user can now use the AI assistant to ask via voice input how the current liquidity situation of all companies looks and how available funds can be optimally redistributed. The AI analyzes in real-time all account balances, open receivables and liabilities, creates a graphic overview and suggests concrete transfers. On request, the corresponding tool also directly initiates the internal transfers between accounts and releases them automatically according to stored user settings. The result is liquidity that is distributed optimally and efficiently, after only a few minutes and without data having to be manually compiled or payments individually triggered. While parts of such tasks can already be automated already today using rule-based principles, with interaction and decision-making being further supported by AI.

Autonomous Treasury

The final development stage of AI in Treasury envisions a (almost) completely autonomously operating system. Operational tasks run independently, while the user only acts as a controlling instance and merely receives status reports. This is a vision of Treasury that works efficiently, self-directing and almost without manual intervention. In one of the next articles, we will deal in-depth with the prerequisites needed for this.

Conclusion

The various stages illustrate the differentiated development of AI in Treasury. These stages build progressively on each other and together span the arc from pure information support to "autonomous Treasury."

One thing is true for all treasury systems: the more advanced applications are not yet fully functional. Even though a lot of providers are already promoting solutions that are supposed to cover everything from informational to analytical AI, so far, it's mostly just informational and navigational functions that have proven to be useful in practice. Transactional and analytical functions are usually still in pilot phases or on roadmaps, meaning that their implementation in everyday work only makes limited sense at this point in time.

We therefore see enormous potential for the future in terms of the Treasury tapping into this, hopefully soon, with diverse application possibilities. The opportunities are manifold and have the potential for significant added value in the long term through increased efficiency and automation.

The providers' roadmaps and the perspectives we have outlined sketch a picture of tomorrow, a Treasury that works more efficiently, intelligently and autonomously than ever before. We have not yet reached this goal, but the direction in which we are heading is already clear. Today's solutions are the first steps on a path to a future where an autonomous Treasury is no longer a mere vision, but a reality.

Source: KPMG Corporate Treasury News, Edition 158, September 2025

Authors:

Börries Többens, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Marvin Berning, Manager, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Börries Többens

Partner, Financial Services, Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft