Earnings per share (EPS) has always been a key measure for investors, analysts and other stakeholders. For listed companies, it is therefore essential to understand the key drivers of this metric and manage them properly. Under IAS 33, basic EPS is calculated by dividing profit or loss attributable to ordinary equity holders by the weighted average number of ordinary shares outstanding during the reporting period (see Figure 1).

Figure 1: Basic EPS

Source: KPMG in Germany, 2025

However, this figure does not take into account any dilution effects from potential ordinary shares (POS). Diluted EPS, on the other hand, reflects those effects in both the numerator and denominator (see Figure 2).

Figure 2: Diluted EPS

Source: KPMG in Germany, 2025

Depending on how share-based payment programs are designed and how extensive they are, they can have a noticeable impact on diluted EPS under IAS 33.1 Companies should therefore understand how share-based payments interact with EPS, how diluted EPS is determined and be aware of the potential pitfalls. Just as important is knowing which program features influence diluted EPS, so that compensation plans can be designed in a way that aligns with shareholder interests. Two critical factors are the settlement type and any vesting conditions.

Type of Settlement

IFRS 2 classifies share-based payments primarily by type of settlement. While IAS 33 does not explicitly reference this classification, it matters for diluted EPS only if the settlement involves, or could involve, actual equity instruments. Programs that require cash settlement only are ignored in the EPS calculation. If the company has the choice of settling either in cash or in equity instruments, EPS must always be calculated as though settlement occurred in equity. This applies even if the company classifies and accounts for the plan as cash-settled under IFRS 2.

Vesting and Exercise Conditions

When options are granted under a share-based payment plan, IAS 33 requires that the denominator in diluted EPS be determined using the Treasury Share Method. Whether and to what extent options are included depends on the contractual vesting or exercise conditions. If service conditions alone apply, the options are classified as forfeitable potential ordinary shares and must be considered under the Treasury Share Method.

If market and/or non-market performance conditions are added, however, the options are treated as contingent potential common shares to be issued, which are to be valued using a two-step process. First, determine the number of options that meet the performance conditions as of the reporting date. Second, only those options are included in the Treasury Share Method. Options that do not meet the performance conditions by the reporting date are ignored.

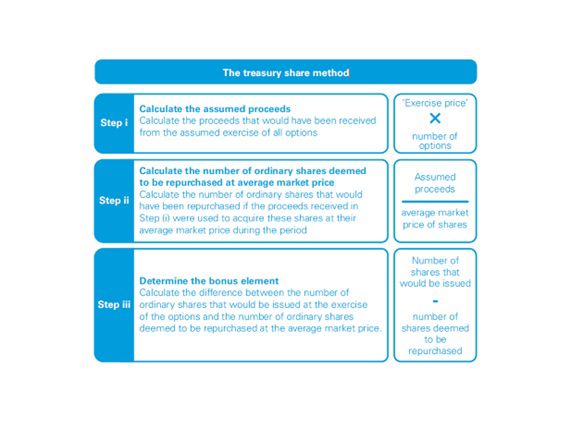

Applying the Treasury Share Method

A core element of the Treasury Share Method (see Figure 3) is determining the so-called bonus element (step iii) and adding it to the denominator of basic EPS. The dilution effect comes from the difference between:

- the number of shares that would theoretically be repurchased at the average market price to satisfy the participants’ claims (step ii), and

- the number of in-substance issued forfeitable potential common shares.

Figure 3: Treasury Share Method

Source: KPMG in Germany, 2025

For share-based payment options, the assumed proceeds (step i) consist of two components:

- Exercise price × number of shares, and

- Grant-date fair value under IFRS 2, to the extent not yet vested.

This means that, over time, and under otherwise stable conditions, these instruments become increasingly dilutive: as vesting progresses, the unrecognized fair value decreases, which in turn reduces assumed proceeds. The dilution effect also depends on the average share price during the reporting period. If that price rises, the number of shares that would have to be repurchased at the average market price decreases, which amplifies the dilutive impact. The exercise price also matters: the lower the exercise price, the stronger the dilution.

Conclusion

Depending on how they are structured, share-based payments can significantly affect EPS due to their dilutive effect. It is often not immediately clear whether the related instruments should be included in the calculation at all. And if they are, applying the Treasury Share Method can be complex and involve numerous pitfalls. Companies should keep this in mind when designing compensation programs.

Our services for you

We are here to support and advise you on all questions relating to EPS calculations in connection with share-based payments. We can also show you the possible effects of introducing new compensation plans on EPS.

Source: KPMG Corporate Treasury News, Edition 157, August 2025

Authors:

Ralph Schilling, CFA, Partner, Head of Finance and Treasury Management, Treasury Accounting & Commodity Trading, KPMG AG

Jan-Philipp Wallis, Senior Manager, Finance and Treasury Management, Treasury Accounting & Commodity Trading, KPMG AG

__________________________________________________________________________________________________________________

1 Depending on their structure, share-based payments can also affect undiluted EPS.

Ralph Schilling

Partner, Audit, Head of Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft