Global payment systems are undergoing major changes. As cash continues to lose ground, central banks around the world are working on digital currencies, not just as a technological leap, but also as a strategic tool to reinforce financial sovereignty. For treasury teams, the question is no longer if, but when and how central bank digital currencies (CBDCs) will impact liquidity management, payment processing, and the traditional role of banks. This article explores the latest developments across a range of national and international CBDC projects and initiatives. We then look ahead to the changes treasuries can expect in the coming years.

In today’s geopolitical climate, where financial globalization faces increasing resistance, digital central bank currencies have taken on new significance. Many countries are now focused on making their banking systems less vulnerable to external shocks. Russia, for example, has developed SPFS as an alternative to SWIFT. China is expanding its own cross-border payment system, CIPS, while India’s UPI is a national payment solution that is gaining international traction. Similarly, the Europe-an Union’s digital euro project aims to support Europe’s “strategic autonomy and monetary sovereignty” and strengthen the resilience and competitiveness of the European payments landscape against non-European providers.1

At the same time, decentralized finance (DeFi) is emerging as an innovation space in its own right, offering new ways to transact beyond traditional financial infrastructure. Built on blockchain, DeFi enables transactions without central intermediaries. Especially in geopolitically sensitive settings, these solutions are seen as attractive alternatives, as they allow cross-border payments that are largely independent of legacy financial systems. However, stability and reliability remain crucial. That’s why stablecoins, digital tokens pegged to established currencies, are gaining ground, serving as a bridge between volatile decentralized assets and stable means of payment.

International examples and pilot projects

Interest in CBDCs is growing, as seen in the increasing number of pilot projects, studies and global collaborations. Digital currencies combine the drive for national sovereignty with technological innovation and elements of decentralized infrastructure. They allow for payment systems under national control, without relying on foreign infrastructure, while also boosting the efficiency, transparency, and speed of digital payments. By 2024, cash accounted for only 24% of everyday payments in the euro area, down from 40% in 2019, highlighting the need for a digital alternative to cash.2 We already discussed the definition and technical details of digital central bank currencies in-depth in issue 134 of our newsletter dated 20 July 2023. However, innovation-led developments have now made this topic relevant in both theory and practice.

Some countries are already leading the way. The Bahamas introduced the “Sand Dollar” in 2020 and Nigeria followed with the “eNaira” in 2021. These projects provide valuable insights into the potential effects of digital currencies. China’s e-CNY initiative is the world’s largest. Since 2020, it has been tested and gradually rolled out in several regions.3 By June 2024, transactions in China’s digital currency had reached a total value of 7 trillion yuan (about 982 billion US dollars)4, nearly quadrupling the figure from June 20235. China is also extending the use of its digital currency to other countries, such as Vietnam and Cambodia.6

To encourage adoption, China has launched pilot programs in cities like Shenzhen, Suzhou and Beijing, where citizens could receive digital yuan through lotteries or subsidies.7 The e-CNY is now integrated into popular payment platforms such as Alipay and WeChat Pay.8 The digital yuan is also being introduced in the public sector for salaries, social benefits and taxes.9 China is fostering cross-border cooperation with Hong Kong and Southeast Asian countries to support international use of the e-CNY. This blend of technology, incentives and institutional support is designed to build trust and accelerate adoption.

By September 2024, 134 countries representing 98% of the global economy had launched initiatives to explore CBDCs.10 Some, however, remain skeptical or have recently changed course. In the United States, for instance, authorities were barred in January 2025 from taking steps toward introducing or promoting a CBDC within the United States or abroad11, and Federal Reserve Chair Jerome Powell confirmed in February 2025 that the Fed would not pursue its own digital currency during his term (i.e., until May 2026.12 The decree also ordered the immediate suspension of all ongoing CBDC programs and established a “Working Group on Digital Asset Markets,” which, among other things, is tasked with submitting draft regulations for digital assets and stablecoins within six months. This sets the stage for growing competition between stablecoins and CBDCs, a trend worth watching in the years ahead.

The global momentum behind CBDCs has led to a surge in studies on how digital currencies from different countries can work together. The goal is to make cross-border payments more efficient, affordable, and faster – through shared technical standards, harmonized legal frameworks and new multilateral settlement platforms.

A leading example is Project mBridge, a joint effort since 2021 by the People’s Bank of China, the Hong Kong Monetary Authority as well as the central banks of Thailand, the United Arab Emirates, and, since 2024, Saudi Arabia. Many other countries and international organizations participate as observers.13 The aim is to create a shared platform for direct and real-time cross-border payments between the digital central bank currencies of these countries, eliminating the need for traditional correspondent banking. For treasury teams at international companies, such networks could significantly reduce banking fees and speed up global transactions.

CBDC Technologies

CBDC projects use a variety of technologies, depending on the country and the project’s goals. Three main aspects stand out: the operating model, IT infrastructure and user authentication.14

The operating model defines which parties are involved in issuing and managing the digital currency. In a direct model, the central bank handles everything – from account management to transaction processing and anti-money laundering measures. In an indirect model, these tasks are delegated to intermediaries like commercial banks or payment service providers. Many projects use a hybrid approach, with the central bank issuing the currency and intermediaries managing customer relationships.

IT infrastructure can be centralized or decentralized (using distributed ledger technologies, or DLT). Centralized systems offer efficiency and control, while DLT-based approaches promise more transparency, resilience and potentially greater resistance to cyberattacks. The choice depends on scalability, governance and national IT requirements.

User authentication models also vary. There are account-based and token-based models. Account-based CBDCs require clear user identification and are well suited for integration with existing banking infrastructure. Token-based models allow for anonymous transactions, similar to cash, and could be attractive for smaller everyday payments. However, they present greater challenges for regulatory requirements such as KYC (Know Your Customer) and AML (Anti-Money Laundering).

Despite growing interest, implementing a CBDC is a significant challenge. It requires not just technological innovation but also deep regulatory, economic and social adjustments. For this reason, pilot studies are tackling complex issues such as data privacy, cybersecurity, efficient anti-money laundering controls, interoperability with existing systems and the management of monetary policy impacts.

Other key questions include scalability, energy efficiency, system resilience, user acceptance and ease of use. The choice of technical infrastructure also has far-reaching implications for privacy. Many pilot projects are evaluating options to balance user rights and confidentiality with strict regulatory requirements: on the one hand, user rights and the confidentiality of transactions must be protected; on the other, regulatory requirements regarding for instance anti-money laundering and terrorist financing must be strictly complied with.

One widely discussed solution is to allow anonymous payments up to a certain limit to protect privacy in daily life, while subjecting larger transactions to stricter controls.15 All these technical and institutional interfaces make it clear: CBDCs are much more than just a technology project, they touch on fundamental aspects of the modern financial system.

Status and outlook for the digital euro

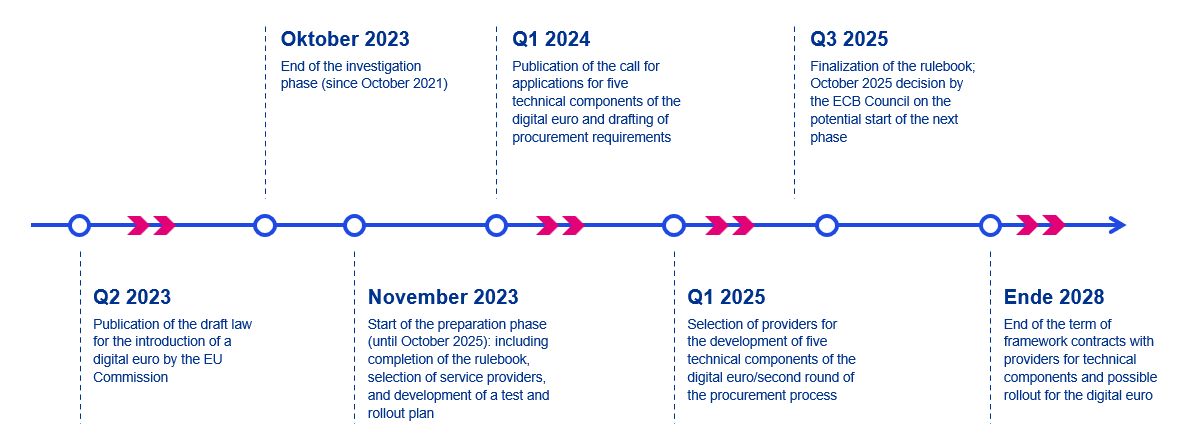

The European Union is making significant progress on developing and implementing the digital euro (D€). The official preparation phase began in November 202316, with the overarching goal of strengthening Europe’s strategic autonomy in digital payments17 and providing a sovereign digital currency. Currently, non-European payment providers handle about two-thirds of credit card transactions in the euro area.18

The published timeline calls for the “Rulebook”, a comprehensive set of technical and regulatory guidelines, to be ready by October 2025.19

The current draft was developed in collaboration with consumer groups, banks and merchants, incorporating more than 2,500 pieces of feedback. It outlines how digital euro payments will work in stores, online and between individuals, covering user experience, technical processes as well as security and fraud prevention. New planned features include QR code and link payments, as well as offline use. There are also discussions about account limits for individuals and the role of banks in distributing the digital euro. The final decision on launching the digital euro will be made by the ECB Governing Council once EU legislation has been finalized.

The complexity and scale of the project are reflected in its costs: about 1.2 billion euros have been budgeted for external contracts so far, not including the technical infrastructure.20 This underscores the EU’s commitment and the extensive technical, legal and organizational challenges involved in launching a digital currency at the EU level.

A key issue for corporates and their treasury teams is the planned account limit, which sets a maximum balance for digital euro wallets. The European Central Bank sees this as a safeguard for financial stability.21 The concern is that unlimited transfers from commercial banks to digital euro wallets could rapidly drain liquidity from the banking sector, restricting banks’ ability to lend to businesses and individuals. According to the ECB, banks are expected to remain central to the plan, as regulated intermediaries will play a key role in distributing the digital euro.22

Current discussions suggest wallet limits between 500 and 3,000 euros. Payments above this limit could be processed through a “waterfall system,” where excess funds are automatically drawn from a linked bank account.23 Final decisions on these details are still pending.

These points are crucial from a treasury perspective, as they focus on end users and affect the suitability of the digital euro for B2B transactions.24 For now, the digital euro is primarily designed for retail, B2C and personal use, with usage limits, offline functionality and privacy features tailored to individuals. The project’s focus so far has been on person-to-person payments (P2P), point-of-sale, e-commerce and government transactions (G2X and X2G), including automated payments25. Business-to-business (B2B) payments are a future development area that the ECB is now paying closer attention to26.

For classic B2B payments involving larger sums or regular processing, it remains to be seen if and how integration will happen. Adding B2B functionality would make the digital euro much more relevant for corporate treasuries and extend its use beyond consumer payments. Treasury teams should assess where CBDCs could add value, such as refunds, loyalty programs or micropayments in digital business models, once more details from the ECB become available. From October 2025, the published Rulebook is expected to provide clarity on these and other aspects of the EU’s digital euro plans.

Figure 1: Timeline for the digital Euro (27)

Source: “ECB/KPMG, 2024; own illustration“

Survey-based studies are underway to gauge public acceptance of these initiatives. For example, a study commissioned by the German Bundesbank in April 2024 found that about half of respondents were open to using the digital euro.28 Many also indicated that stronger privacy protection compared to existing digital payment options is important to them.

The EU is working closely with the central banks of its member states.

In the coming years, it will be crucial to closely monitor the results of these pilots: How do technical feasibility, privacy, interoperability, liquidity management and monetary policy play out in practice? Only then can we assess how CBDCs might complement or transform the existing financial system, and what this means for treasury processes, banking, and global liquidity.

It is conceivable that the digital euro will go live in an initial operational phase within the next few years. For treasury leaders, digital central bank money opens up new operational and strategic opportunities, such as more efficient payments, new payment channels, or alternative settlement models for cross-border transactions. Seamless end-to-end integration could deliver cost and competitive advantages.

At the same time, new dependencies will emerge: on regulatory limits, technical infrastructure such as wallet systems, and the evolving role of banks in the digital euro ecosystem. In the long run, the role of treasury in payments could see structural changes. Not overnight, but with noticeable shifts in areas such as account limits, interoperability and integration with existing liquidity management processes.

Source: KPMG Corporate Treasury News, Edition 155, June 2025

Authors:

Börries Többens, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Alexander Horn, Senior Manager, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

____________________________________________________________________________________________________

1 https://www.ecb.europa.eu/euro/digital_euro/why-we-need-it/html/index.de.html

2 https://www.ecb.europa.eu/press/inter/date/2025/html/ecb.in250228~7c25c90e4d.en.html

3 https://www.atlanticcouncil.org/cbdctracker/

4 https://www.atlanticcouncil.org/cbdctracker/

5 https://www.reuters.com/business/finance/trump-could-spur-central-banks-adopt-digital-coins-peacock-2025-04-24/

6 https://www.reuters.com/world/china/china-ramps-up-global-yuan-push-seizing-retreating-dollar-2025-04-29/

7 https://cbdctracker.hrf.org/currency/china

8 https://cointelegraph.com/news/wechat-integrates-digital-yuan-into-its-payment-platform

9 https://edition.cnn.com/2023/04/24/economy/china-digital-yuan-government-salary-intl-hnk & https://cointelegraph.com/news/residents-of-3-chinese-cities-paying-taxes-and-charges-with-digital-yuan

10 https://www.reuters.com/markets/currencies/central-bank-digital-currency-momentum-growing-study-shows-2024-09-17/

11 https://www.whitehouse.gov/presidential-actions/2025/01/strengthening-american-leadership-in-digital-financial-technology/

12 https://www.cnbc.com/2025/02/11/powell-squashes-the-possibility-that-the-fed-will-develop-its-own-digital-currency.html?&qsearchterm=powell%20cbdc

13 https://www.bis.org/about/bisih/topics/cbdc/mcbdc_bridge.htm

14 https://www.bfdi.bund.de/SharedDocs/Downloads/EN/Berlin-Group/20240613_WP-Cental-Bank-Digital-Currency-EN.pdf?__blob=publicationFile&v=2

15 https://www.bundesbank.de/de/presse/interviews/-der-umgang-mit-den-usa-und-china-wird-rau--948702

16 https://www.ecb.europa.eu/euro/digital_euro/progress/html/index.de.html

17 https://www.ecb.europa.eu/press/key/date/2025/html/ecb.sp250408~40820747ef.de.html

18 https://www.reuters.com/business/finance/trump-could-spur-central-banks-adopt-digital-coins-peacock-2025-04-24/

19 https://www.ecb.europa.eu/euro/digital_euro/progress/html/ecb.deprp202406.en.html#toc4

20 https://www.bundesbank.de/de/presse/interviews/-der-umgang-mit-den-usa-und-china-wird-rau--948702

21 https://www.ecb.europa.eu/euro/digital_euro/how-it-works/html/index.en.html

22 https://www.ecb.europa.eu/euro/digital_euro/faqs/html/ecb.faq_digital_euro.en.html#q6

23 https://www.bundesbank.de/en/press/interviews/only-balances-of-500-allowed-what-the-digital-euro-is-intended-to-deliver-and-what-not-933704

24 https://www.dertreasurer.de/news/cash-management/das-projekt-digitaler-euro-nimmt-fahrt-auf-35847/

25 https://www.ecb.europa.eu/press/intro/news/html/ecb.mipnews240805.en.html

26 https://www.bundesbank.de/en/press/speeches/envisioning-tomorrow-the-role-of-cbdcs-in-europe-s-digital-financial-ecosystem-945654

27 https://klardenker.kpmg.de/financialservices-hub/der-digitale-euro-langsam-wird-es-konkret/

28 https://www.bundesbank.de/de/presse/pressenotizen/bundesbank-umfrage-digitaler-euro-findet-als-bezahl-option-breite-akzeptanz-in-der-bevoelkerung-933320

Börries Többens

Partner, Financial Services, Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft