In our January/February 2025 issue (No. 151) of the KPMG Corporate Treasury Newsletter, we took an in-depth look at traditional counterparty risk and discussed the latest developments. Building on this, this issue takes a closer look at traditional operational credit management, including credit insurance solutions.

More than 200 years ago, the Brothers Grimm wrote in their adaptation of the fairy tale Cinderella: “The good ones go into the pot, The bad ones go into your crop.” That saying is still relevant today when it comes to risk management and credit insurance.

This is often referred to as “cherry picking” in the insurance industry. As part of so-called claim pools (usually entire bundles of claims are insured), policyholders tend to remove lower-risk claims from the pool and limit the scope of insurance coverage to selected high-risk claims, which in turn is at the expense of the insurer.

How insurers detect cherry picking

To prevent this form of cherry picking, contracts between policyholders and insurers are usually structured in a two-step process. In the first step, the insurer conducts a preliminary review of a representative portion of the receivables portfolio before a framework agreement is drawn up. This preliminary review not only serves as the basis for subsequent insurance benefits, but also allows the insurer to use the portfolio insight to assign an appropriate risk component to the insurance premium. This can lead to discounts or increases in insurance premiums, depending on the industry and portfolio. In addition, it becomes apparent whether the debtor portfolio offered is limited to high-risk tickets, i.e., whether the potential policyholder is trying to shift the “bad” risks to the insurer while keeping the “good” ones in their own portfolio so as to save on insurance premiums.

Credit insurance in operational business

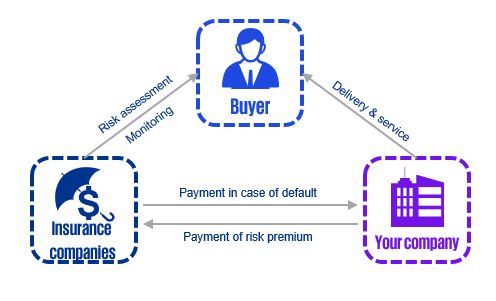

As part of the ongoing insurance process, the policyholder must fulfill the obligations agreed in the insurance policy in order to continue enjoying insurance coverage. For example, once a certain volume of receivables is reached, debtors must be reported to the insurer for review (this is referred to as the ‘designated range’). Insurance companies then have the option of responding to insurance coverage for individual debtors on a case-by-case basis, for example in the form of full coverage, partial approval, or rejection. This is illustrated in Figure 1 below, which shows the three parties involved: the insurance company, your company (i.e., the policyholder), and the customer (i.e., the debtor). While the contractual risk transfer of insurance coverage in exchange for premiums takes place between the insurer and the policyholder, the insurer continuously monitors and controls the receivables positions vis-à-vis the customers.

Fig. 1 Insurance triangle

Source: KPMG AG

The early intervention of the insurer through limit reductions or even cancellations reduces or even prevents losses in operations. To identify such risks at an early stage, insurers have a broad network of information and assessment procedures at their disposal. Above all, policyholders appreciate that their insurers are able to identify payment delays almost in real time, even for other policyholders, and immediately incorporate these into their risk assessment.

Taking a closer look at credit insurance

Broadly speaking, credit insurance can be defined as an exchange of secure payments (definite premium payments) for uncertain payments (compensation payments that are conditional on the occurrence of an insured event and are therefore uncertain). Put another way, by paying a premium, the policyholder transfers part of their income uncertainty to the insurer. There are generally two types of credit insurance: Conventional credit insurance, which follows the portfolio approach, and individual cover, which can be based on accounts receivable, projects or even individual claims (and is therefore particularly prone to “cherry picking”). These are joined by other variants and hybrid concepts such as excess-of-loss insurance, individual receivables insurance, and factoring solutions, which are not discussed in detail in this article.

With traditional accounts receivable insurance, the insurer generally insures the entire receivables portfolio of its policyholder at a contractually agreed compensation ratio (standard practice: 90% of the net receivable). In this case, the policyholder is obliged to actively monitor the limits of its insurable positions so as not to enter into any uninsured transactions, for example following the rejection of a debtor due to creditworthiness or the expansion of the business relationship. In turn, the insurer benefits from the premium payment and the diversification of its own risk portfolio. So-called master agreements are typical for this type of credit insurance, as they ensure a stable structure for the credit portfolio. The master agreement defines the parameters for recurring hedging transactions between the two contracting parties. Such parameters may include maximum agreed payment terms, insurance quotas, minimum premiums or other operational provisions such as reporting deadlines, waiting periods or collection rules.

In contrast to insuring an entire loan portfolio, individual risk positions can also be insured selectively. This may be done, for example, for orders from new customers, selected major customers or one-off projects. In many cases, such transactions are not based on a framework agreement, as the business relationship is not usually intended to be long-term. A prerequisite for this form of single claim insurance is a sufficient minimum size of the claim.

Number and volume of corporate insolvencies on the rise again

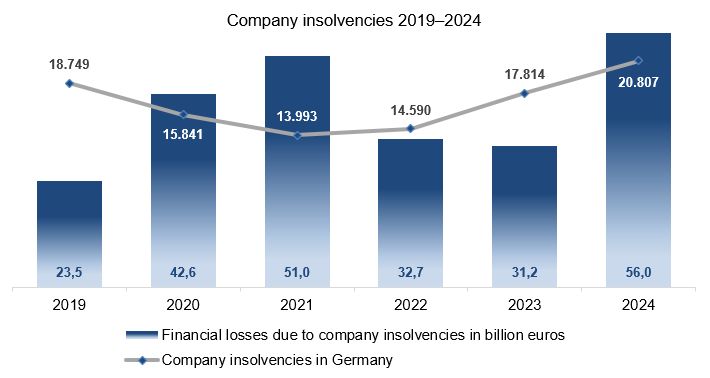

Looking at the financial losses caused by corporate insolvencies in recent years, it is easy to understand the importance of credit insurance as a complementary credit management tool for treasury organizations. Whereas financial losses amounted to EUR 23.5 billion in 2019, the estimate for 2024 stood at EUR 56 billion. This was reported by Creditreform in its publication “Insolvencies in Germany 2024” in December 2024. This corresponds to an increase of just under 240%. There is no direct correlation between the financial losses and the absolute number of insolvencies (see 2019 vs. 2024).1

Fig. 2 Company insolvencies

Source: KPMG AG

From this, it can be deduced that the insolvencies correspond to a mixed portfolio of small and large companies. Based on this assumption, it becomes clear that insuring one's own receivables pool is an attractive risk transfer tool for many companies. According to "Versicherungsmagazin", approximately 600,000 companies were using trade credit insurance in 2023, which at the time corresponded to coverage of approximately 18.4% of German companies.2

The impact of a default on my company

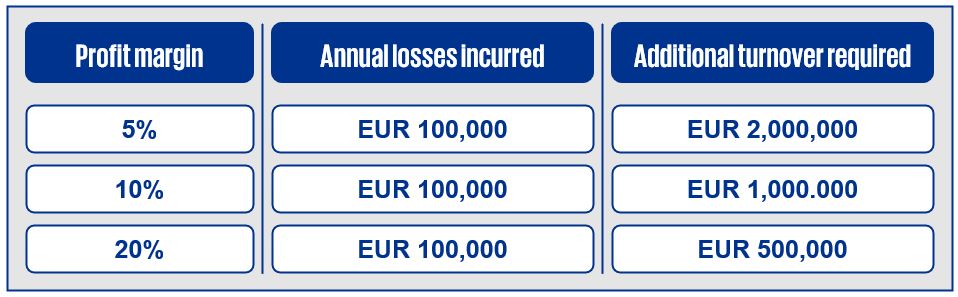

For a better understanding of what a single bad debt means for companies, let's use a mathematical example. Figure 3 below clearly shows the impact of bad debts on sales: By offsetting the loss against the profit margin (reverse fraction), you can see how much additional sales revenue would be needed to compensate for the loss. Specifically, this means that a comparatively “low” bad debt loss of EUR 100,000 with a profit margin of 10% would only be offset by additional sales totaling EUR 1,000,000. The smaller the profit margin, the higher the additional sales required to compensate for the losses incurred through bad debts.

Fig. 3 Losses vs. additional sales required

Source: KPMG AG

The risk profile will therefore determine whether it is worthwhile to exchange volatile risks for a fixed premium (usually measured in per mille of the insurable sales).

For which risk profiles does credit insurance make sense?

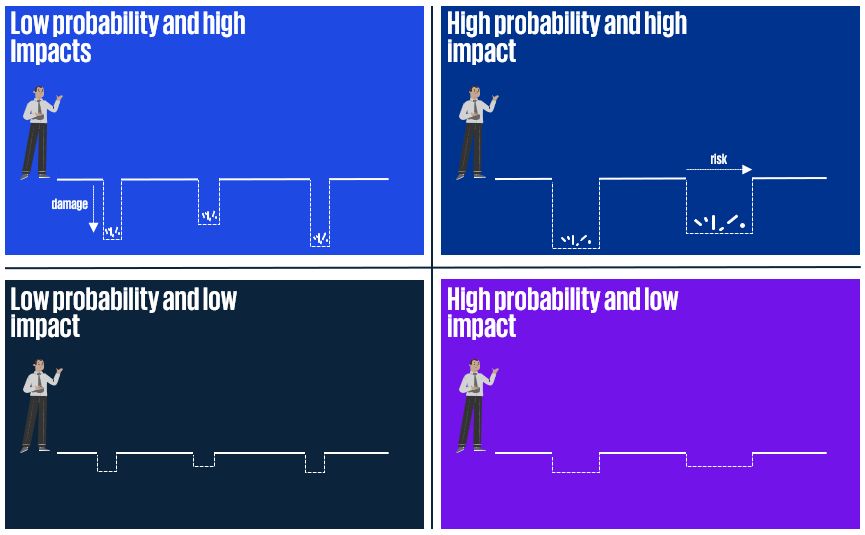

To illustrate the abstract concept of “risk” and the associated risk profiles, consider the chart below (Figure 4). The chart shows a highly simplified version of the four quadrants of possible risk profiles. The X-axis represents low or high probabilities that risks will materialize, visualized by the number and width of the circles. The Y-axis, on the other hand, represents the magnitude of the risk volume, illustrated by the depth of the circles.

Fig. 4 Risk profiles in four quadrants

Source: KPMG AG

Translated into credit risks, the upper right quadrant shows a debtor portfolio with high default probabilities and high loss volumes. With this type of risk portfolio, insurance seems an obvious choice, as default is practically inevitable. In practice, however, such profiles tend to be recognized by insurers, who actively manage and exclude them by partially underwriting or rejecting individual debtors. This means that credit insurance is not the best choice for this profile.

Instead, the recommendation here is to take a strategic look at the target customer portfolio, expand lower-risk customers, and gradually reduce high-risk positions.

The lower right quadrant represents a profile with numerous and often regular, but smaller structural losses. Although any default is annoying in business areas that fit this profile, they do not pose an existential threat. Here, we recommend recognizing the low, easily predictable losses yourself by applying an appropriate risk margin, where this is feasible in the market. In addition, actively managing credit by using external credit reports in combination with taking appropriate business measures, such as obtaining advance payment arrangements, can counteract the risk frequency.

A similar picture emerges in the lower left quadrant. With this profile, only minor defaults are likely to occur. In this case, credit management efforts can be limited to reviewing the portfolio by industry, country, and other structural factors in order to identify any changes in the risk profile at an early stage.

The last quadrant, where low probability is combined with high risk volumes, is where the most interesting potential for credit insurance lies. As a policyholder, you protect yourself against unlikely but worst-case scenarios that could threaten your existence. For the insurer, on the other hand, the economic risks are manageable, so they can offset any insurance claims that might come up through diversification effects in their own insurance pool. That's why in this case, credit insurance is a smart move for both sides and a clear recommendation.

So how do you structure your credit insurance for the best cost-benefit mix?

Once it is clear which of our business areas or services most closely correspond to which risk portfolio, we can structure our portfolio optimally as risk managers. For instance, we can use value limits for receivables to eliminate marginal risks with low volumes from the portfolio (i.e., the two lower quadrants). It can be helpful to group countries or customer industries when separating probability profiles. In practice, these can usually be incorporated into a credit insurance policy as long as there is still adequate insurable turnover.

Our Corporate Treasury Advisory team at KPMG would be happy to help you develop and implement the optimal credit management structure for your company. With our professional and technical expertise, we support you and your company every step of the way, from analyzing your current risk structure and developing standardized risk management processes to (technical) implementation in your daily business processes and decision-making. You can also count on us during and after the implementation phase of the change process, and we will help you establish your own risk culture. If you are interested, please don't hesitate to contact us.

Conclusion

The structure of the credit management mix and the benefits of credit insurance are different from company to company. Factors such as industry-specific risks, company size and structure as well as cultural differences all have a big impact on how the service mix is put together. With the right approach, you can tailor this service mix to your company and make the best use of tools such as credit insurance. Given the current market conditions and rising insolvency rates, it is worth reviewing and further developing your in-house credit management.

Also, don't miss our next newsletter (issue 154 in May 2025) featuring a guest article by experts from Professor Schumann GmbH. In it, we will discuss system-based solutions for operational credit management and how you can use them to take your credit management organization to the next level.

Source: KPMG Corporat Treasury News, Edition 153, April 2025

Authors:

Nils Bothe, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Lukas Kallup, Manager, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

________________________________________________________________________________________________

1 Creditreform (2024) Insolvencies in Germany in 2024. Available at: https://www.creditreform.de/fileadmin/user_upload/central_files/News/News_Wirtschaftsforschung/2024/Insolvenzen_in_Deutschland/2024-12-16_AY_OE_analyse_UE-2024.pdf (Accessed on: 31 March 2025)

2 Schmidt-Kasparek, U. (2023) ‘Jetzt in die Kreditversicherung einsteigen’ (Get started with credit insurance now), Versicherungsmagazin. Available at: https://www.versicherungsmagazin.de/rubriken/branche/jetzt-in-die-kreditversicherung-einsteigen-3430411.html (Accessed on: 31 March 2025)

Nils A. Bothe

Partner, Financial Services, Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft