There is a strategic partnership between a corporate treasury organization and its core or partner banks that goes far beyond the processing of pure payment transactions. Companies not only depend on their banks to be reliable and economically stable, but also to offer cost-efficient services. At a time of constant change in the banking landscape, be it changing financing conditions or possible bank mergers, the trusting and successful cooperation between Corporate Treasury and its banking partners is even more important than ever.

This edition of our newsletter focuses on internal bank ranking within a treasury department. The goal is to optimize cooperation with banking partners and strengthen the company's financial strategy.

Factors for successful cooperation

There are several ways in which treasury departments can ensure a systematic evaluation of banking relationships. We recommend regularly carrying out a bank analysis or bank ranking in order to implement this in a structured manner that is comprehensible to third parties.

The term “bank ranking” refers to the – usually public – evaluation or classification of banks and their services. However, in the context of a corporate treasury organization, we understand it in a narrower sense as a comprehensive analysis of banking partners that aims to systematically evaluate and compare their performance and stability. This should help Treasury to make informed decisions and select the best banking partners for the company's specific needs.

Treasury has a central overview of all relevant topics that should be covered by the partner banks. It covers both product-specific and geographical service coverage, which Treasury can assess best and compare corresponding bank offers. In doing so, it is important to compile, weight and then evaluate all current and expected future relevant requirements.

Typically, Treasury's internal bank ranking process comprises several steps:

- Establishing relevant criteria: The treasury department defines the required evaluation criteria.

The following factors may be of interest:

a. Bank fees: cost management as a key parameter

A crucial factor when evaluating banks is how transparent their fees are and the way they are structured. Apart from the general account management fees, this also includes the base fees for payment transactions, any individual transaction execution costs and the costs for confirmations in the payment process, for example in pain.002 format. The fees for account statements can also vary considerably from bank to bank depending on the format and number.

Companies drawing on guarantee credit lines are also affected by the costs for guarantee lines and the issuing fee for each guarantee, including a minimum fee. Unused guarantee volumes, which are often subject to a commitment fee, can result in additional costs.

With respect to loans, the relevant costs include the fees for taking out and managing loans, the commitment fee for unused credit lines and the interest rate for drawn loans.

b. Service and product range: bank performance in an international context

Aside from the costs, the scope and quality of the services offered are decisive for the evaluation of a bank. This includes technical support both during the initial setup and during ongoing operations. A bank's technical infrastructure plays an essential role, as different forms of connection such as host-to-host, SWIFT or EBICS offer different levels of security and automation standards and every company has different requirements.

What's more, the service coverage in different countries is a key factor, especially for companies with an international presence. Ideally, a bank should be in a position to offer the required products (e.g. bank accounts or available guarantee lines in the countries required by the company) in the relevant markets to meet all Treasury requirements for ongoing operations. Whether a bank is represented by its own branches or only by partner banks in the respective countries might also be relevant. Depending on this, processing times for transactions and pricing conditions can differ significantly.

Another aspect that should not be neglected is the banks' KYC process. The more standardized and structured it is, the easier it is for Corporate Treasury to provide the requested documents. Another significant advantage when it comes to making adjustments to the banking or account landscape is efficient processing with short response times.

c. Financial stability:

A bank's financial stability is another decisive criterion used by Corporate Treasury in its assessment. Solid financial stability makes sure that the bank is in a position to meet its obligations in the future and thus minimizes the risk of default. One key criterion for this is the bank's capitalization, in particular the equity ratio.

To this end, the classifications of renowned rating agencies such as Moody's and Standard & Poor's (S&P) provide an objective assessment of a bank's creditworthiness and financial stability. The higher the rating, the lower the probability of default and an important indicator of a bank's long-term reliability. Economic and political stability in the country in which the bank is headquartered provides companies with security first and foremost - in terms of deposits, but also in terms of the bank's ability to meet contractual obligations, such as credit lines granted. Also, with regard to derivatives concluded to hedge e.g. forex or interest rate risks, companies are dependent on stable and economically stable banking partners in order to minimize their own risks.

d. E(nvironmental), S(ocial), G(overnance) criteria:

A company's fulfillment of ESG criteria is playing an increasingly important role in the evaluation of banking partners. Banks often evaluate ESG aspects through bonus-malus regulations that, for instance, provide more favorable financing conditions for sustainable projects. When analyzing these criteria, it is up to the treasury department to check what data the company needs to provide, in what form and who defines the required data points. For example, will the published annual financial statements suffice or does a separate sustainability report need to be provided? Likewise, the timeline for provision must be coordinated in order to ensure that the ESG data is up-to-date and relevant. In addition, it is important to consider whether a bank excludes certain sectors, products or countries due to its ESG strategy, or would like to exclude them in the future.

Financial institutions also provide quantitative or qualitative ESG data to demonstrate their own sustainable and responsible business practices. Such data can be obtained from company reports and other disclosures. Here, too, it is essential to analyze whether a bank fits in with the company's ESG goals and to what extent the relevant data points are available. - Weighting of the criteria: The individual aspects are weighted and knock-out criteria are defined based on the importance of these for a company's banking strategy.

- Data collection: There are several ways to collect the data in a structured manner. On the one hand, the data can be requested from the banking partners using a query form. On the other hand, the data can be obtained from various trustworthy sources, such as data from official market data providers, annual reports, etc.

- Assessment: Banking partners' responses to a query form are critically evaluated and scored in each of the specified categories.

- Analysis & comparison: An in-depth and targeted analysis or ranking emerges by adding the pre-defined weighting.

- Reporting: Preparing a report that presents the ranking methodology, results and conclusions in a way that is comprehensible to a third party.

Sample analysis

A company currently works with three different banking partners (Bank A; Bank B and Bank C). It would particularly like to intensify its cooperation with the bank that offers favorable conditions for guarantees. It also aims to ensure that the banking partner pursues sustainable and responsible business practices. It also wishes to convert payment transactions from host-to-host to EBICS, which is why both the technical offering and service quality (availability of customer service, regional coverage and fees for the conversion) are relevant.

Approach as outlined above:

- Establishing relevant criteria: Specifically, the core criteria arise from the focus areas outlined above, including favorable conditions for guarantees, sustainable business practices (ESG factors) and service quality, particularly with regard to the transition from host-to-host to EBICS. Other common measurable criteria are also included.

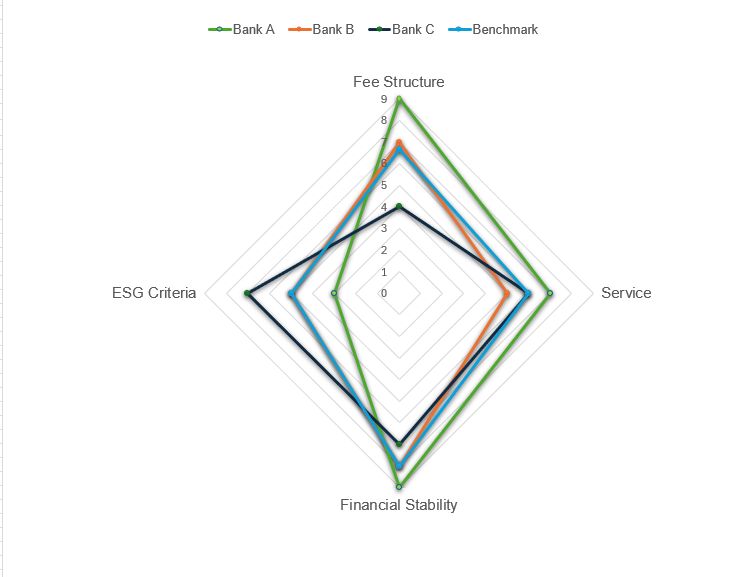

- Weighting of the criteria: The company decides on a weighting of the criteria of, for example: 30% fee structure, 20% service quality, 30% financial stability, 20% ESG. This high weighting of the fee structure and financial stability ensures that cost-efficient and secure banking partners are selected. In parallel, the banking partners' service quality and sustainability are appropriately considered to ensure a holistic assessment and selection of the best banking partners.

- Data collection: Gathering any relevant data is a fundamental step in the bank ranking process. Its purpose is to create an assessment of banking partners based on sound and up-to-date information.

Data on the fee structure can be obtained using a central survey of fees or through direct inquiries to the banking partners. Service quality is assessed based on internal experience during the EBICS switchover. Key information on financial stability and ESG compliance can be obtained by reviewing the banks' annual reports. - Assessment: Once detailed data has been collected, the three banks are rated on a scale of 1 (very poor) to 10 (very good).

- Analysis & comparison: The scores are summarized in a table to allow a direct comparison of the banking partners.

In this example, the analysis shows that Bank A achieves the highest overall rating, followed by Bank B and then Bank C. Bank A is particularly impressive due to its financial stability and favorable fee structure, while Bank B scores points for its excellent ESG performance. Bank C has average ratings in all categories and performs worst overall. - Reporting: The findings of the analysis are summarized in a report that outlines the methodology, the evaluation criteria and the results of the ranking. For a clear presentation of the results, the company opts for a network diagram.

Figure 1: Sample evaluation of a bank ranking

Source: KPMG AG

Conclusion

Picking the right banking partner requires analyzing various criteria in detail. A methodical approach reduces the effort involved and ensures that the results are precise, reliable and verifiable. Not all criteria have the same priority, so it goes without saying that not all criteria are knock-out criteria.

In addition to transparent fee structures, we have found that technical connectivity, service quality, financial stability and ESG criteria usually play an increasingly important role.

Treasury should regularly carry out such an analysis of both potential new banking partners and existing banking partners to achieve efficient and targeted bank coverage at all times.

Source: KPMG Corporate Treasury News, Edition 152, March 2025

Authors:

Nils Bothe, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Maximilian Gschoßmann, Manager, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Nils A. Bothe

Partner, Financial Services, Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft