Were any OTC derivative contracts concluded in the past financial year?

With the end of the financial year on 31 December, the three-month mandate and nine-month implementation period for the independent review of the EMIR compliance system begins for companies whose financial year coincides with the calendar year.

Such an EMIR compliance system must be set up from the time over-the-counter (OTC) derivative contracts are concluded in the past financial year. This obligation is not restricted solely to financial companies (such as credit institutions), but also includes non-financial companies (such as industrial companies).

► The obligation to set up an EMIR compliance system is based on EU Regulation 648/2012 of 4 July 2012, which was adopted by the European Parliament and Council in response to the 2008 financial market crisis. This regulation aims to increase the transparency of the unregulated OTC derivatives market and limit potential default risks.

Using over-the-counter derivative contracts is by no means exotic in risk management, but serves to hedge interest rate and foreign currency risks as well as commodity price risks resulting from corporate activities. Where a company enters into an OTC derivatives transaction, an EMIR compliance system must always be implemented.

What does the EMIR compliance system involve?

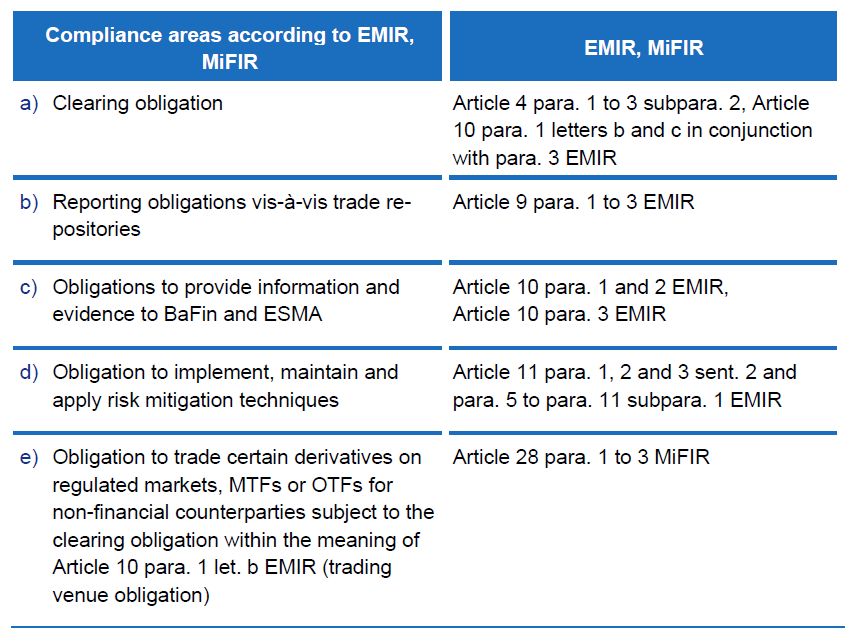

In principle, the EMIR compliance system consists of the following compliance areas specified by the EU regulation:

Figure 1: EMIR compliance system

Source: KPMG AG

The compulsory reporting of derivatives transactions to a trade repository in particular is intended to increase transparency on the derivatives market. Such a trade repository must be registered with the European Securities and Markets Authority (ESMA), which regularly publishes a list of registered trade repositories on its website. This list includes the following trade repositories as of 30 November 2024 on the ESMA website:

- Regis-TR

- DTCC Data Repository (Ireland) Plc

- Krajowy Depozyt Papierów Wartosciowych S.A. (KDPW)

- LSEG Regulatory Reporting B.V.

To the extent that derivative transactions are concluded with a financial counterparty domiciled in the EU, the obligation to report to a trade repository is transferred informally and unilaterally to the financial counterparty. This means that the financial counterparty must not only report its side of the derivative transaction, but also the non-financial counterparty's side of the same transaction. As a rule, the obligation to report derivative transactions is not limited to external derivative transactions. However, under certain conditions, it is possible to be exempted from reporting internal derivative transactions. Such an exemption must be reported to the national supervisory authorities and can be complex depending on the circumstances.

The necessary risk mitigation techniques must be contractually agreed before an OTC derivative transaction is entered into, irrespective of the financial counterparty's domicile. When drawing up the agreement, it is advisable to use the Master Agreement published by the International Swaps and Derivatives Association (ISDA) and the German Master Agreement (DRV) with the associated EMIR Annex.

Under what circumstances is the EMIR compliance system subject to statutory auditing?

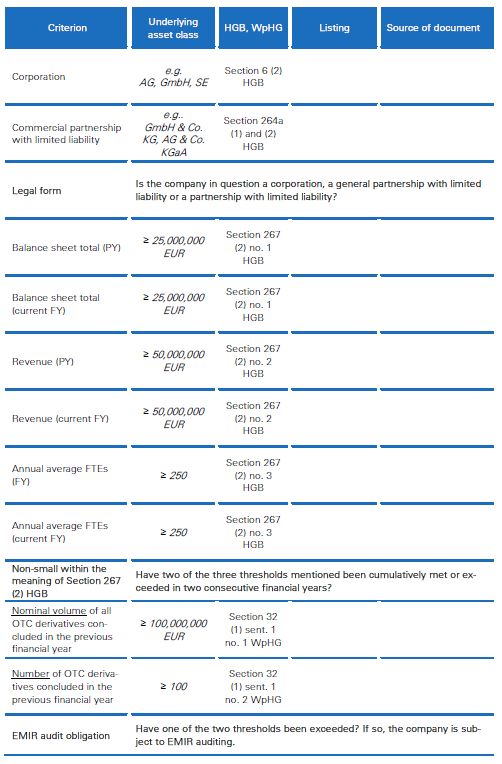

Unlike the obligation to implement an EMIR compliance system, the obligation to have it audited by an auditor follows the criteria set out in Section 32 (1) sentence 1 no. 1 and no. 2 WpHG for non-small corporations within the meaning of Section 267 (1) HGB, which can be found in the following EMIR audit obligation checklist:

Figure 2: EMIR audit obligation checklist

Source: KPMG AG

The checklist above can be used by corporate treasury to help determine the EMIR audit obligation. In this context, the legal definition of “OTC derivatives” within the meaning of EMIR is of particular importance. The classification of whether an EMIR compliance system must be set up on the one hand and whether such a system is subject to audit within the meaning of Section 32 WpHG on the other regularly gives rise to practical questions and thus an increased need for advice.

► The obligation to audit the EMIR compliance system applies to legal entities domiciled in the Federal Republic of Germany. Companies domiciled outside the Federal Republic of Germany are therefore not subject to a statutory audit in accordance with Section 32 WpHG.

In case you have established an EMIR audit obligation, the audit must be carried out by a suitable audi-tor. Pursuant to Section 32 (2) WpHG, only auditors and auditing firms qualify as such.

► The auditor must be appointed within three months of the reporting date in accordance with Section 32 (2) sent. 2 WpHG.

Although neither the requirements for an EMIR compliance system nor an EMIR audit obligation are new, the task of regularly monitoring compliance in the past financial year should not be underestimated for corporate treasury. Particularly in the case of derivatives transactions that are not carried out on a regular basis, such as interest rate hedging for borrowing, it can be easy to forget to determine the audit obligation. If you have any questions or need advice on the EMIR compliance system or an EMIR audit, please do not hesitate to contact us.

Source: KPMG Corporate Treasury News, Edition 150, December 2024

Authors:

Robert Abendroth, Partner, Finance and Treasury Management, Treasury Accounting & Commodity Trading, KPMG AG

Manuel Seick, Manager, Finance and Treasury Management, Treasury Accounting & Commodity Trading, KPMG AG

Robert A. Abendroth

Partner, Audit, Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft