For today's businesses, ensuring liquidity is a strategic necessity. Companies are contending with volatile markets, geopolitical tensions and unpredictable economic developments. In this environment, organizations are seeking innovative ways to efficiently manage their working capital while optimizing their financial strategies. An increasingly popular solution is dynamic discounting, which enables companies to pay their suppliers before the invoice date and to take advantage of flexible discounts.

While this tool has been around for several years, the economic situation and improved technical conditions have boosted its popularity.

Much more than a financial buffer: a strategic lever for working capital management

Your company's working capital plays a central role in its financial health and ability to function. Not only does it serve as a buffer to bridge liquidity shortages, it also builds the foundation for investments and the agility to respond to market changes. A solid working capital management strikes the appropriate balance between liquidity and profitability and helps to minimize financial risks. To be effective, working capital management should be deeply embedded in a company's strategic direction. Companies can efficiently plan their cash flow, reduce their capital costs and improve their competitive position by optimizing their management of liabilities.

Dynamic Discounting is a tool that supports this strategy by providing targeted management of current assets. It allows companies to actively manage their liabilities by encouraging early payments, thereby reducing their capital costs. This improved efficiency in working capital management leads to a more stable cash flow, which in turn gives companies more financial leeway for investments in innovation and expansion.

Particularly in times of economic uncertainty, maintaining a stable cash flow is crucial to avoiding financial bottlenecks and to reacting flexibly to challenges. Incorporating dynamic discounting into their financial planning helps companies to maintain their liquidity while ensuring long-term stability.

Early payments, flexible benefits

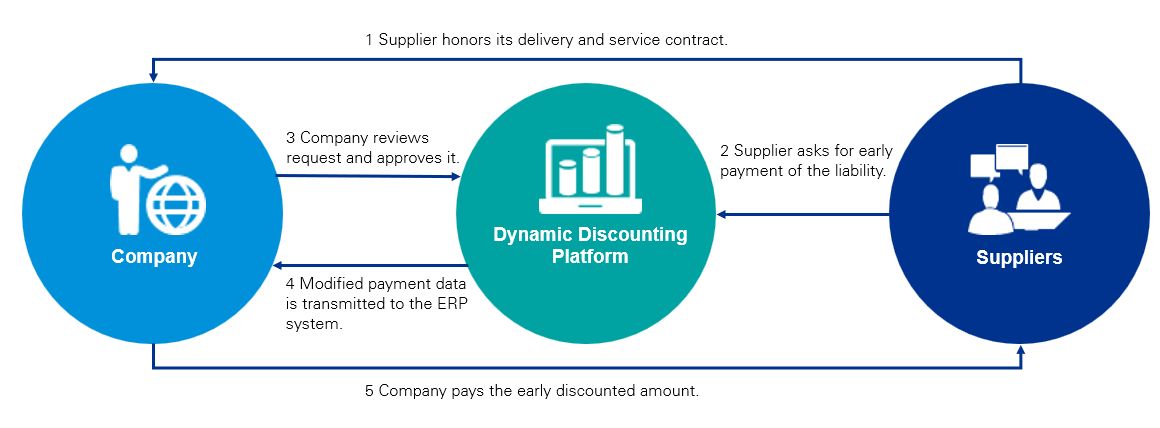

Dynamic discounting lets companies offer early payments to their vendors, discounted over the remaining term of the liability depending on the timing of payment. But unlike factoring, which typically involves a bank as a third-party provider, the financing is drawn entirely from the company's own funds. This gives companies more control over their liquidity and puts them in a position to strengthen direct relationships with their suppliers. The following chart illustrates the process of a model program:

Fig. 1: Discounting process

Source: KPMG AG

This solution not only lets companies benefit from cash discount advantages, but allows them to stabilize cash flow and optimize working capital. And suppliers who are paid early can respond flexibly to opportunities as they arise. Not only does this strengthen supplier relationships, but it also improves the company's financial leeway for its own investments.

Advantages of Dynamic Discounting

Doing so offers a number of benefits that go well beyond mere liquidity management:

- Improved cash flow: By paying suppliers early, an organization can actively manage its payables and optimize cash flow.

- Savings: Payments made early result in discounts on payables, significantly reducing the cost of capital.

- Stronger supplier relationships: As suppliers benefit from earlier payment, their financial stability increases and working relationships are strengthened.

- No need for an external financial partner: Financing is provided from the supplier's own resources, eliminating the need for a bank partner and avoiding additional costs and complexities.

- More flexible liquidity management: Organizations retain control over the timings and amounts of payments, enabling them to manage their liquidity as needed.

More precise liquidity management through digitalization

The market for dynamic discounting solutions is highly fragmented, with a large number of fintech providers offering solutions that can vary in design. Among the providers of these solutions are Taulia, C2FO and Kyriba, which specialize in the digitalization of working capital solutions. They rely on cloud-based platforms that can be seamlessly integrated into existing ERP systems. Such platforms let companies manage their liquidity in real time and flexibly decide what discounts to offer their suppliers. All of this adds up to a scalable solution that can be optimally adapted to a wide range of market conditions.

That said, implementing this solution in practice is no easy feat. The Treasury's Target Operating Model (TOM) must be aligned with the digital solution to ensure a smooth implementation and use. Adapting the TOM is the only way to optimally integrate dynamic discounting into the existing end-to-end processes, from purchasing to accounting and treasury. Seamless connection with ERP systems also ensures that all relevant data, such as invoices, payment terms and liquidity planning, are synchronized in real time, further automating the entire process.

An additional important aspect is the integration of suppliers. They too need to be tied into the platform and encouraged to actively participate. As with internal participants, the added value must be conveyed to external participants, since noticeable effects can only be achieved by reaching a critical mass level of participation. Companies usually start with their key suppliers. For a successful implementation, targeted communication strategies and training measures are needed to convincingly convey the added value of dynamic discounting.

Along with the integration into existing processes, care must be taken to account for the various payment formats and regions in which the company operates. The platform will need to be able to handle different currencies and country-specific requirements to accommodate global use.

What's more, digitalization makes it possible to automate the entire payment processing workflow. When companies use automated systems to create and accept offers, they not only reduce manual errors but also increase the efficiency of their processes. As for suppliers, they can view these offers in real time and flexibly decide when to accept payments.

Conclusion: A leading-edge tool for liquidity management and strategic financial planning

Not only can dynamic discounting improve liquidity, it also serves as a strategic tool for optimizing working capital. By actively managing payables and integrating digital solutions, organizations can improve their financial stability, pursue growth opportunities, and minimize risk – all without relying on external financial partners. As economic uncertainty continues unabated, dynamic discounting can be a crucial lever for an organization's long-term success.

Source: KPMG Corporate Treasury News, Edition 147, September 2024

Authors:

Börries Többens, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Daniel Lichtenberg, Manager, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

Börries Többens

Partner, Financial Services, Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft