1. Overview Classification of sustainable finance

Driven by societal, economic and regulatory factors, sustainability has evolved into a megatrend in recent years. Rising public awareness around climate change and social issues has ramped up pressure on companies to step up their commitment to sustainable practices. Increasingly, consumers, investors and employees expect companies to operate responsibly and sustainably. In addition, investors have come to recognize that companies with robust ESG strategies not only have a lower risk profile and are more resilient in economic downturns, but can also achieve higher long-term returns.

It is being further driven by regulatory initiatives. Governments and regulators worldwide are enforcing more stringent regulations to promote sustainability. The European Union's Sustainable Finance Disclosure Regulation (SFDR) requires financial institutions to disclose their sustainability criteria in decision-making processes. The Corporate Sustainability Reporting Directive (CSRD), which has been adopted by the EU Parliament, will significantly expand existing non-financial reporting rules and will affect an estimated 15,000 companies in Germany. By promoting transparency and accountability, these regulations are incentivizing companies to adopt more sustainable business practices.

Sustainability also entails transforming the economy and financing this transformation through specially developed sustainable financial instruments. That is why corporate sustainable finance is so important when it comes to actively supporting the transition to a more sustainable economy. Part of a comprehensive sustainability strategy is financing. For this reason, more and more companies are turning to sustainable finance. But what is sustainable finance? It takes into account ESG aspects, i.e. environmental, social and governance factors.

Recent years have seen German companies actively participating in the sustainable finance market, clearly demonstrating that sustainable finance is not a fringe phenomenon. The LBBW1 study “Sustainability and Green Finance - How companies are mastering the flood of data” shows that by 2024, more than half of the German CFOs and treasurers surveyed already view sustainable finance as the new standard and that 17 percent of those surveyed have already taken out loans that include sustainability components.

2. Advantages of sustainable finance

A number of good reasons speak in favor of sustainable corporate financing. The most obvious one is contributing to a greener environment. By investing in sustainable projects, you are supporting initiatives that benefit our environment and our climate. Sustainable financing can have a positive image/PR effect on your reputation. Companies that can show their stakeholders that they are serious about sustainability often see an improvement in their public image. Such positive external perception makes it possible for companies to build a broader customer base and also contributes to improving their attractiveness as an employer – in some cases, this even applies to the finance department within the company itself.

More and more, investors and lenders are paying attention to the sustainability of their portfolios. As a result, companies without a clear sustainability strategy are finding it increasingly difficult to obtain financing, while sustainable companies are gaining access to a broader and more diversified investor base.

Last but not least, the potential lower cost of financing is another argument in favor of more sustainability in financing.

Fig. 1: Advantages of sustainable finance

Source: KPMG AG

3. Important financing instruments for sustainable finance.

Companies seeking to take advantage of the benefits of sustainable finance have a wide range of options available to them. The most popular financing instruments, namely loans, bonds and promissory notes, are all available in “sustainable” versions. In the case of sustainable financing instruments, a distinction is made between ESG-linked/sustainability-linked and project-specific or “use of proceeds” financing instruments.

Fig. 2: Overview

Source: KPMG AG

ESG-linked or sustainability-linked financing

These include, among others, sustainability-linked loans, sustainability-linked bonds and sustainability-linked promissory notes. They can be used to finance or refinance general corporate purposes. What sets these financing instruments apart from their non-sustainable counterparts is that their terms include certain clauses that provide for a margin change if predefined sustainability indicators of the company change. The “Sustainability-linked Loan Principles”, the “Sustainability-linked Bond Principles” of the ICMA (The International Capital Market Association) and the EU Taxonomy are available as a standard or orientation for such financing instruments.

In most cases, a margin change can occur in both directions, which means that not only a reduction of the financing margin is possible, but also an increase. These sustainability-linked instruments are linked either to an external ESG rating/score of the company or to predefined KPIs/SPTs (sustainable performance targets). It is the chosen link that determines the change in margins. In recent years, markets have shown a preference for the KPI/SPT-based approach.

If the KPI approach is adopted, linking the financing to just one KPI is less and less common, with 2-5 KPIs often being preferred. A common question for companies is which KPIs are relevant for them. One advantage of the KPI approach is that each company can agree on the relevant KPIs with the financing parties, resulting in a customized solution. In doing so, it is important to ensure that the goals set are ambitious.

Where a company wishes to use an external ESG rating or score for the financing, the sustainability-linked instrument is linked to one or more ratings/scores. An improved rating results in a better margin. A decline in the ESG rating, on the other hand, increases the financing margin.

In many cases, companies have no experience with sustainable KPIs and no ESG rating, but still want to issue a sustainability-linked financing instrument. This is where the option of issuing an “ESG-ready” loan comes in.

ESG-ready loans combine a company's current financing needs with the will to incorporate sustainability into corporate financing in the future. This is done by including a clause in the loan agreement that allows the company to make the necessary decisions and submit the documentation within 12 months. The inclusion of such a “rendezvous clause” in the loan agreement does not create any pressure to act or any obligation: All that is agreed in the financing agreement is that the interest rate will be linked to ESG criteria in the future by means of a supplement.

Project-specific or “use of proceeds” financing

The project-specific financing instruments include “green”, social, and sustainable loans, bonds, and promissory notes. Structurally, the instruments are the same, with the label being the only difference. The so-called use of proceeds financing focuses on the financing of green, social or sustainable projects or a combination of these projects for the sustainable label. Unlike the previously mentioned sustainability-linked instruments, this type of financing is limited to projects that can be proven to be green, social or sustainable. A wide range of standards and guidelines have been established for this form of financing. These include the Green / Social Loan Principles, Green / Social Bond Principles, Sustainability Bond Guidelines, EU Taxonomy and the EU Green Bond Standard. Companies issuing these instruments must also publish a suitable framework, e.g. a green bond framework for a green bond.

4. Recent developments on the market for sustainable finance

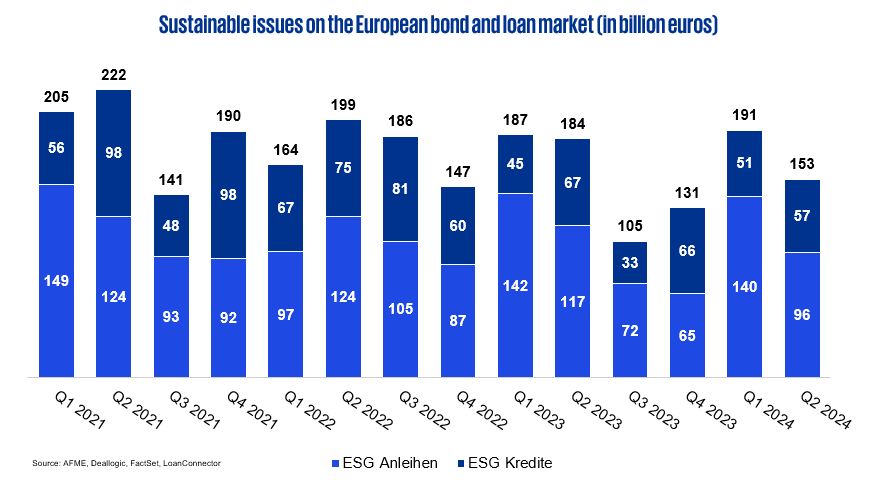

Measured by issuance volume, the European sustainable finance market grew strongly until 2021, peaked in 2021 and has since weakened in various areas, in line with the general economic sentiment in the last two years. The market got off to a strong start in 2024, with an issuance volume of around EUR 140 billion in sustainable bonds and EUR 51 billion in sustainable loans in Q1 2024. With a quarterly volume of EUR 191 billion, not only has the market got off to a strong start in 2024, but it has also seen a strong quarterly volume, which is on a par with 2021. This year's second quarter was weaker than Q1, with EUR 57 billion in sustainable loans and EUR 96 billion in sustainable bonds.

When it comes to the sustainable bond market, the “green” label has always been by far the most prevalent. In Q1 2024, around 68% of all sustainable bonds were green, around 17% social, 9% “sustainable” and only 5% bonds with the “sustainability-linked” label.2 Across the entire European bond market, the sustainable labels together accounted for a share of around 12% in Q1 2024.2 What is interesting here is that across all labels, the share of investment-grade companies is significantly higher and only for sustainability-linked bonds does the gap narrow. The volume of sustainability-linked bonds issued by investment-grade companies is almost double that of non-investment-grade companies.

For the purposes of this report, the sustainable loan market is split into green loans and sustainability-linked loans, as the other labels account for negligible volumes.

In Q1 2024, around 19% of all loans on the syndicated loan market in Europe are sustainable. For years, we have seen the share of sustainability-linked loans in the total amount of sustainable loans increase and it is now always above 90%. In Q1 2024, 86% of sustainable loans were taken out by investment-grade companies and 14% by non-investment-grade companies.2

Stabilizing interest rate margins and expectations of a stagnating or falling key interest rate for the second half of 2024 mean that market sentiment remains positive for sustainable financing.

Abb. 3: Sustainable issues on the European bond and loan market

Source: KPMG AG

5. Benefits of sustainable corporate financing

When it comes to sustainability-linked instruments, the financing advantage is negotiated in the margin grid. It is common practice to select 1-5 KPIs and structure the clauses in such a way that the margin is reduced by 1-2.5 basis points for each individual target achieved. Alternatively, the margin grid can be designed in such a way that a margin reduction only comes into effect if all targets are met. In both cases, interest margins may also increase (often by the same amount) if the company's performance in the selected KPIs deteriorates. This design can be transposed to a structure with ratings/scores instead of KPIs – even though linking to ratings/scores has become increasingly unpopular in recent years and linking to KPIs is becoming the standard.

While financing advantages are directly apparent in the case of sustainability-linked products, assuming that the defined targets are also achieved, the advantages in the interest margin are more difficult to identify in the case of “use of proceeds” financing. A margin advantage in this type of financing is often referred to as an ESG premium or “greenium”. Calculating a greenium requires a comparison of the margins for financing with the labels “green”, “social” or “sustainable” with their non-ESG counterparts. However, different data providers show diverging information and the ESG premium has fluctuated considerably in recent years. AFME (The Association for Financial Markets in Europe) most recently reported in the “ESG Finance Report - Q1 2024” that the ESG premium has been decreasing since 2021. By using the “Use of Proceeds” structure, issuers saved an average of around 1.4 basis points on corporate financing in the first quarter of 2024.2 This premium is only an average, and in most cases, investment-grade companies also see a low single-digit spread in the base points. By contrast, the spread savings for non-investment-grade issuers are usually significantly higher.

6. Conclusion

The importance of sustainability strategies and reporting is now at the top of the agenda for German corporate boards, which is driving increased attention to sustainable financing and its benefits. In this context, it is essential that financing strategies follow corporate strategy. So the first step towards issuing sustainable financing instruments is for companies to clearly define their sustainable orientation.

It is also crucial for companies to disclose credible targets, relevant KPIs and long-term plans to enhance their positive impact on ESG factors or mitigate negative ones. CSRD serves an important role in closing information gaps and, in doing so, integrating the implementation of sustainable financing into the existing financing mix for companies.

Integrating pertinent ESG metrics into financial contracts can strengthen relationships with stakeholders, increase the interest of financing parties and reduce financing costs. Given the growing calls for clear targets and commitments to sustainability and for reporting on them, we can expect these practices to become standard in the future. Organizations that do not rise to these challenges could increasingly face barriers to accessing the financing market.

Source: KPMG Corporate Treasury News, Edition 146, August 2024

Authors:

Till Karrer, Partner, Deal Advisory, KPMG AG

Börries Többens, Partner, Finance and Treasury Management, Corporate Treasury Advisory, KPMG AG

______________________________________________________________________________________________________

1 LBBW. (2024). Sustainability and Green Finance. How companies manage the flood of data.

2 AFME. (2024). ESG Finance Report Q1 2024.

Börries Többens

Partner, Financial Services, Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft