Hedging strategies and drivers

Commodities such as metals, agricultural goods, energy and energy sources are of vital importance to the global economy. Prices are highly volatile due to factors such as changes in supply and demand, geopolitical events, currency fluctuations and changes in economic policy (Fig. 1). Such volatility increases the unpredictability of production costs, complicates financial planning and liquidity management and negatively influences long-term investment decisions, making companies more cautious in uncertain markets. Companies need to carefully analyze their exposure to the commodity and energy markets and develop effective hedging strategies to achieve the necessary planning certainty. To minimize financial risks and ensure stability, these strategies must be adjusted on a regular basis, taking into account geopolitical events, market volatility and regulatory changes. Inflation also affects the purchasing power of currencies and, in turn, the price level of all commodities.

Given these challenges, companies in commodity- and energy-intensive industries need to not only continuously adapt their hedging strategies, but also regularly review their risk management strategy. These reviews make sure that the strategy is aligned with corporate objectives and that all relevant risks are adequately addressed. On top of that, risk metrics need to be evaluated for their reliability in terms of corporate performance.

When assessing exposure, the volume and timing of commodity risk must be determined as precisely as possible. In doing so, account must be taken of the various types of transaction and possible time lags in the transfer of risk. Furthermore, the risk-bearing capacity needs to be defined with a view to establishing the acceptable level of risk and the methods to be used for measuring risk.

Equally important is a clear hedging strategy that is regularly tested for effectiveness. Besides including methods for measuring success, this strategy also needs to be flexible enough to respond to changes in the market.

And finally, a company needs to establish a clear governance structure that defines the framework and responsibilities for commodity trading. Having such a structure in place helps ensure that the risk strategy is implemented effectively and continuously improved.

Fig. 1: External and internal factors driving hedging strategies

Source: KPMG AG

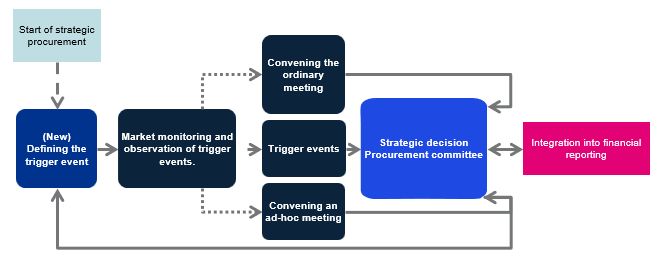

Depending on the type of risk, risks arising from changes in market prices can be managed in a number of different ways. Regardless of whether it is a purchase or sales contract, the risk can be mitigated by closing out a financial position that offsets the position defined in the underlying transaction. Where no financial instruments are available, other measures can be taken, such as organizational changes or the closure of positions in the physical commodity market. By way of example, an organizational change could be the establishment of a risk committee in which an event-driven decision-making process (trigger) initiates a series of measures with the aim of minimizing risk (Fig. 2).

Fig. 2: Example of a risk committee process

Source: KPMG AG

Analyzing and managing price risks in resource- and energy-intensive industries

Most commodity-intensive companies and commodity traders struggle with the challenge of accurately determining their exposure from open positions in procurement and sales. For example, companies that buy commodities and process them to sell a more complex product (e.g., oil and diesel, wheat and flour, etc.) will have contracts related to the purchase of commodities and the sale of the end products at different points in time. Changing market prices create exposure because either sales are agreed at a floating price and purchases at a fixed price, or the other way around. Below, we will explain how this risk can be analyzed and how hedging instruments can be selected to reduce the risk.

The first step in analyzing the risk from fixed-price contracts for various commodities is to collect various types of input data and to perform a systematic calculation of the exposure. This requires recording the contract details, such as duration, fixed prices, quantities, and delivery dates. Current and historical prices of the relevant commodities from commodity exchanges or market data providers must also be collected. Additionally, the production and procurement quantities of the commodities should be determined and the historical price volatility of the products analyzed so as to determine the potential price risk.

Measuring the exposure starts with determining the quantities per (exposure) unit from the contract details of all inventory contracts or from quantity expectations via price lists, e.g. measured in metric tons, barrels or from energy use in MWh. Then, each of these quantities is multiplied by a potential price change to determine the total financial risk. On top of this, historical or option-implied price volatility is used to estimate potential future risk, which can be done by applying risk models such as Value at Risk (VaR) or simulation techniques such as Monte Carlo simulations. Where applicable, currency risk may also need to be assessed by analyzing the potential volatility of exchange rates and their impact on contract values and risk metrics.

Last but not least, regular risk reports should be created for the exposure and risk position, which, based on the analysis results, are used to develop risk management strategies such as hedging or adjusting the contractual conditions. Such systematic analysis allows for effective management of the risks from commodity fixed-price contracts and, based on that, for well-founded operational decisions.

Once the exposure has been determined for the first time, strategies must be selected to effectively manage said exposure. When doing so, it is necessary to factor in the degree of freedom in the operational implementation of market timing or strategic positions. Methods for measuring the success of the hedging strategy must be defined and regularly implemented (e.g. using various benchmarking methods). Steps should be taken to ascertain whether the effectiveness of the hedging relationships, taking into account the current market situation, is still given in economic and accounting terms (e.g. effectiveness of proxy hedges).

Within the scope of a feasibility study, our experts use our standardized and industry-specific methods to calculate exposure based on the approach described. Using this, they then conduct specific analyses and demonstrate the potential benefits of new or adapted hedging strategies based on KPIs defined together with our clients. Taking this as a starting point, we then join forces with our clients to define the necessary adjustments to the target operating model and a roadmap for operational implementation, and we assist them with implementing the hedging strategy at the operational level.

Source: KPMG Corporate Treasury News, Edition 146, August 2024

Authors:

Ralph Schilling, CFA, Partner, Head of Finance and Treasury Management, Treasury Accounting & Commodity Trading, KPMG AG

Bardia Nadjmabadi, Senior Manager, Finance and Treasury Management, Treasury Accounting & Commodity Trading, KPMG AG

Ralph Schilling

Partner, Audit, Head of Finance and Treasury Management

KPMG AG Wirtschaftsprüfungsgesellschaft