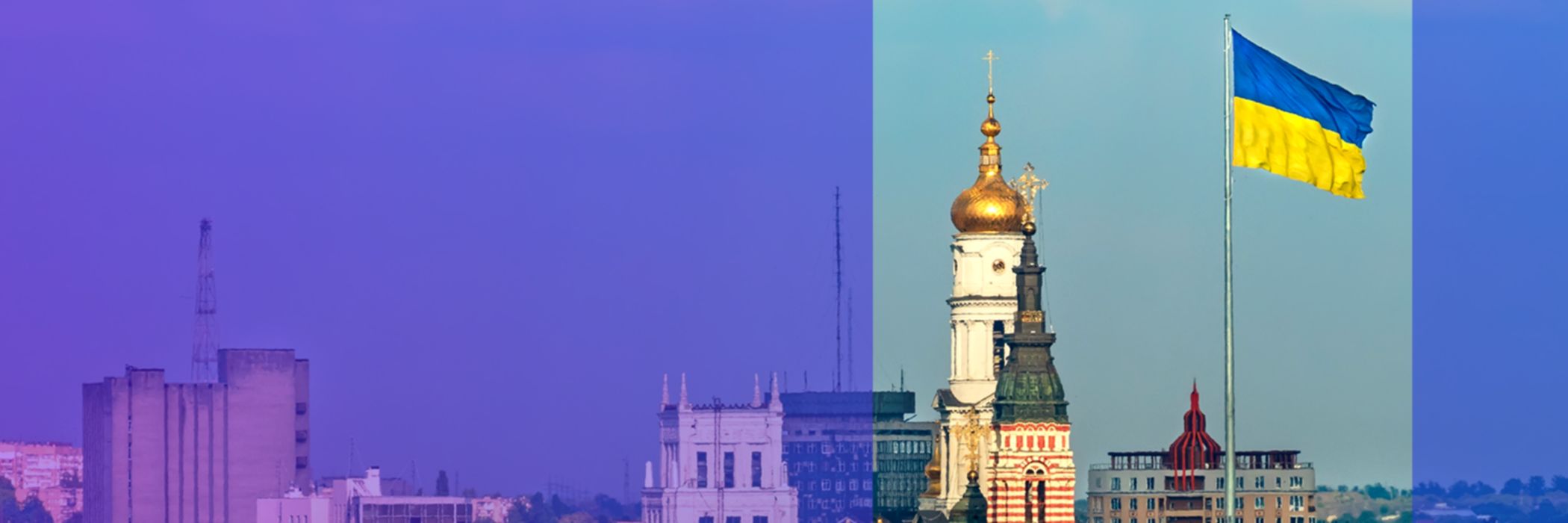

Few markets worldwide currently require such a complex approach as Ukraine. The Russian war of aggression is shaping the country and dominating international headlines; the situation is complex and volatile. This makes the ongoing resilience of Ukrainians and the local economy all the more impressive. Companies in the German-Ukrainian economic corridor are confident in view of Ukraine's great potential - this is one of several remarkable findings of the English-language German-Ukrainian Business Outlook 2024, which we compiled together with the German-Ukrainian Chamber of Industry and Commerce (AHK).

With the help of a business climate survey, our experts examined how a total of 142 managers whose companies are already active in the German-Ukrainian economic corridor or are planning to become involved assess the status quo, including growth opportunities and obstacles in Ukraine. What are the success factors? What makes Ukraine attractive? And what details dampen optimism? Against the backdrop of various reconstruction initiatives, the assessments and insights of the survey participants provide a comprehensive picture of the situation for the first time - and thus practical impetus.

Ukraine as a business location: Current developments

According to the International Monetary Fund, Ukraine's economy is growing despite the Russian war of aggression. While gross domestic product shrank by 29% in the first year of the war in 2022, Ukraine is expected to achieve a growth rate of 3.2% in 2023. Further growth of 6.5 percent is forecast for 2024. The war economy, i.e. the production of weapons and ammunition, as well as the maintenance and reconstruction of infrastructure destroyed by Russia, will play a major role in this.

Andreas Glunz

Managing Partner International Business

KPMG AG Wirtschaftsprüfungsgesellschaft

Nicolai Kiskalt

Partner

KPMG AG Wirtschaftsprüfungsgesellschaft

Facts and figures

- 43% of the German companies surveyed are planning new investments in Ukraine - despite the ongoing war. Only eight percent intend to disinvest.

- Key prerequisites for expanding business activities are political and economic stability (61% and 51% respectively) as well as the availability of public funding and guarantees (28%).

- 42% expect the economic situation in Ukraine to improve in the next twelve months. 48 percent expect no change, ten percent a deterioration.

- 48% see access to the Ukrainian market as the greatest opportunity, 39% the availability of qualified workers and 36% participation in programs to rebuild the country.

- More than half cite access to local business networks (59%) and access to market information (54%) as key business requirements.

- For 53%, the ongoing war is the biggest hurdle or challenge, for 38% it is security risks for their own employees and for 31% it is local corruption.

- Germany and the EU have launched funding programs worth billions. However, 35% of companies believe that the funds are unsuitable for their purposes. 20 percent are not even aware of the programs.

One thing is clear: German investments can make a significant contribution to strengthening the Ukrainian economy. As a large industrial nation, Ukraine offers German companies enormous potential for this, particularly in the areas of production, energy, pharmaceuticals, IT and outsourcing.

Nicolai Kiskalt, Partner and Head of Country Practice Central and Eastern Europe,

KPMG AG Wirtschaftsprüfungsgesellschaft

Focus on three core findings

1. Investments and growth opportunities

The financing required to maintain and rebuild Ukraine's infrastructure is immense. According to estimates by the World Bank, the costs for this will amount to 486 billion US dollars within the next decade and will require both public and private funds. The fact that more than four out of ten German companies surveyed are already planning new investments in Ukraine in the next twelve months shows that they also want to make a significant contribution to this.

2. Requirements and support for companies in the German-Ukrainian corridor

For more than half of the German companies surveyed, political and economic stability are the key prerequisites for expanding their activities in Ukraine - with 28% also focusing on the availability of public funding and guarantees. Germany is by far the second largest donor country in Ukraine after the USA with EUR 23.1 billion, far ahead of the UK (EUR 16.4 billion) in third place. However, only a tenth of the companies surveyed have used the programs from Germany and the EU to date. A quarter are planning to use them in the future, but one in five companies have never heard of the programs - and 35% assume that the programs are unsuitable for their purposes.

These results underline the need for more extensive communication about the existing funding opportunities and, if necessary, their adjustment. The support programs for the reconstruction of Ukraine open up business opportunities for German companies in particular. Key sectors for private investors are energy and public infrastructure in the broadest sense. However, there is also demand in various industries and in the agricultural sector.

Andreas Glunz, Managing Partner International Business, KPMG AG Wirtschaftsprüfungsgesellschaft

3. Hurdles and obstacles

The ongoing war in Ukraine remains the biggest challenge for long-term, sustainable investments for more than half of those surveyed. There is a particular focus on the risks to the safety of their own employees. The most important success factors for companies looking to expand their business in Ukraine are strong connections to local companies and networks as well as comprehensive and reliable market information.

However, the search for qualified personnel also remains a complex task for companies during the war: the mobilization law, which was passed after the end of the German-Ukrainian Business Outlook 2024 survey and has now come into force, will further limit the availability of workers.

Business climate survey: the methodology

KPMG AG Wirtschaftsprüfungsgesellschaft and AHK Ukraine surveyed 142 companies with current or future business activities in Ukraine for the business climate survey. The implementation period was between April 23 and May 12, 2024.