The global economy was shaped by several key trends in 2024. The U.S. demonstrated resilience as inflation eased and the U.S. Federal Reserve cut interest rates, while China’s uneven post-reopening recovery continued to support regional trade flows. Hong Kong’s economy grew by 2.5%1, down from 3.2% in 2023, as trade tailwinds counterbalanced subdued domestic demand.

A rebound in exports fuelled economic momentum, as shipments to the Chinese Mainland, the U.S. and ASEAN markets recovered. Exports from the services sector remained resilient, particularly in finance, business services and transportation. These positive trade developments helped offset weakening consumer spending, as purchasing patterns continued to shift.

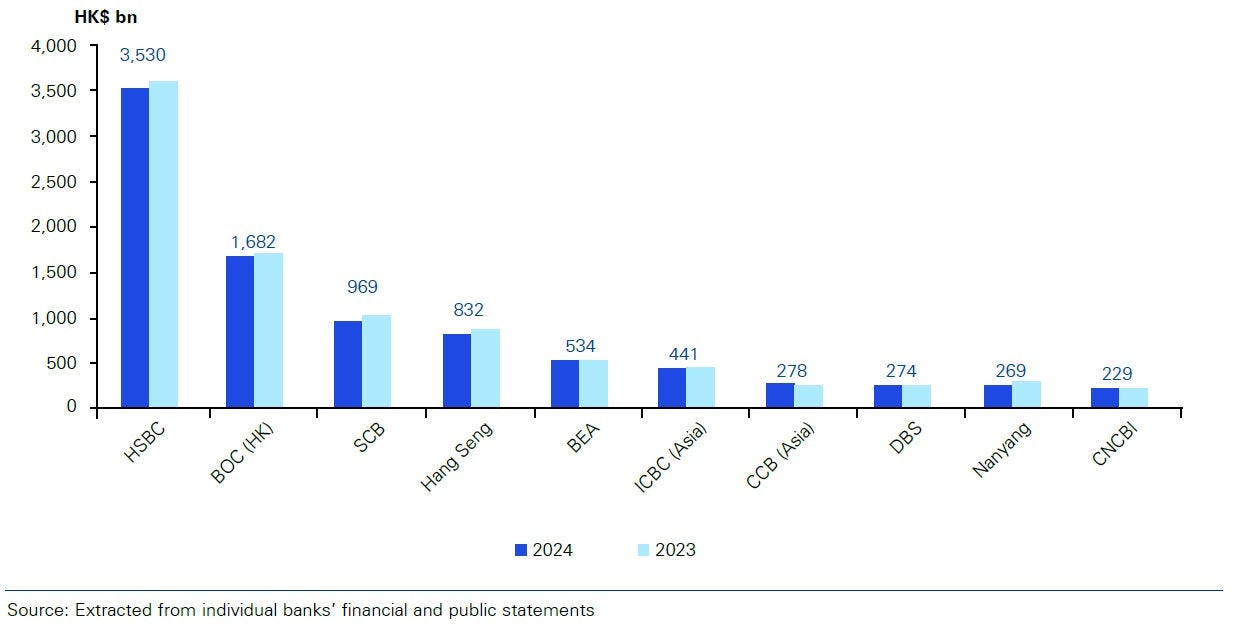

Within this environment, Hong Kong’s banking sector achieved moderate overall balance sheet growth in 2024. The total assets of all licensed banks rose by 4.5% to HK$24 trillion. Although total loans and advances declined by 2.3%, total customer deposits increased by 4.1%.

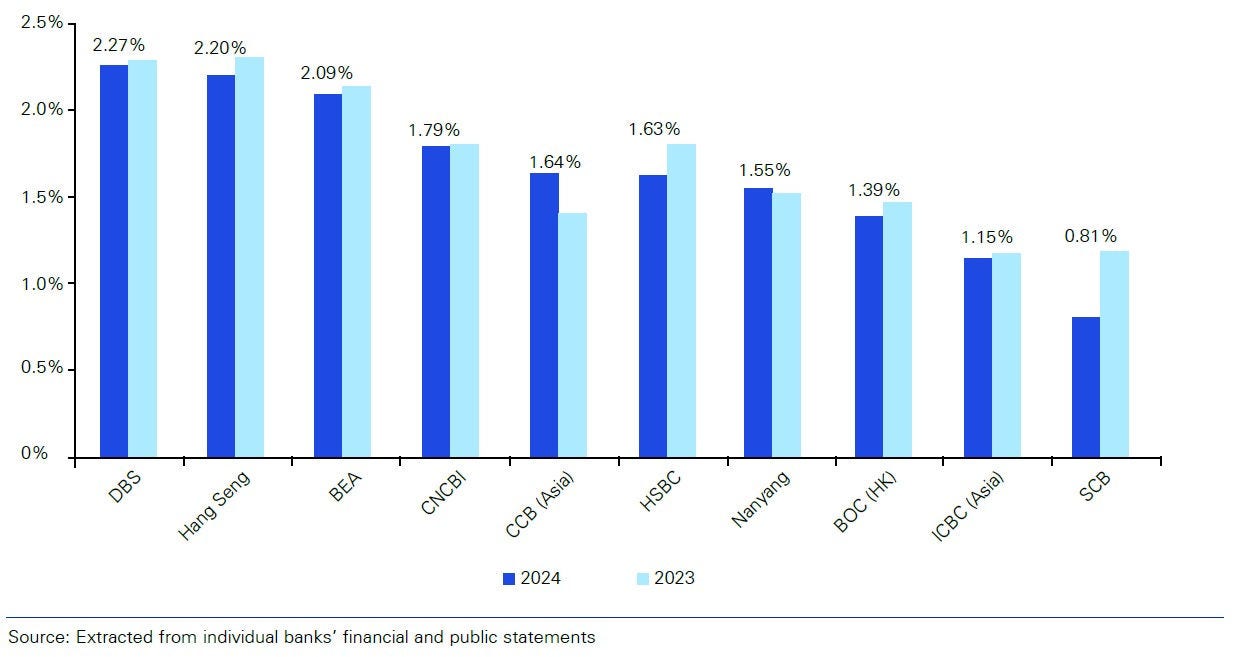

In line with our prediction in the 2024 Hong Kong Banking Report, the sector continued to face a challenging environment marked by uncertain U.S. monetary policy, geopolitical tensions, and economic headwinds in the Chinese Mainland. These factors kept net interest margins (NIM) stable, with an average year-onyear decline of 1 basis point.

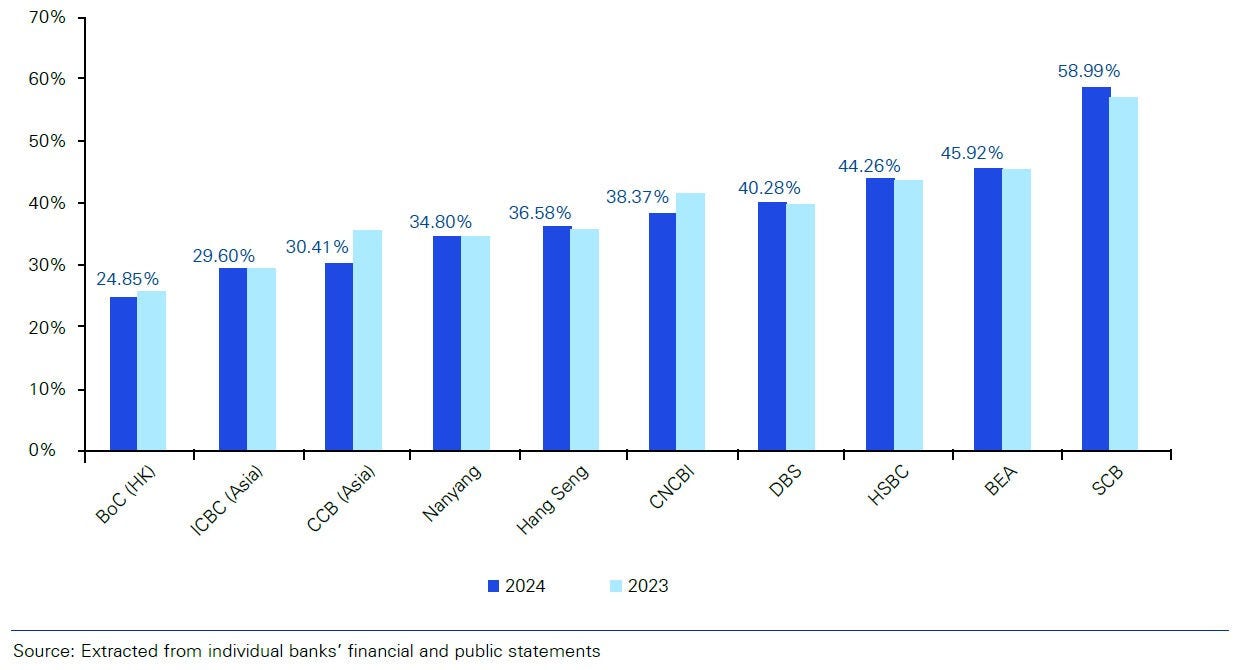

Despite these challenges, Hong Kong banks grew their operating profit before impairment charges to HK$318 billion in 2024, up 7.8% from the previous year. This performance was mainly driven by strict cost control and improved operational efficiency, which helped offset revenue headwinds.

The U.S. Federal Reserve reduced the federal funds rate by a total of 100 basis points in 2024 and has maintained the rate at 4.5% since December. Following this, the HKMA followed suit by lowering the base rate from 5.75% to 4.75%. This caused the Hong Kong Interbank Offered Rate (HIBOR) to drop from 5.15% in December 2023 to 4.37%2 (three-month HIBOR) in December 2024. The composite interest rate, which is a measure of the average cost of funds for banks, fell by 70 basis points from 2.94% in December 2023 to 2.24% in December 20243.

The Hong Kong (SAR) Government forecasts the economy will grow by 2% to 3% in 2025, after recording 2.5% growth in 2024. Consumer price inflation is expected to reach 1.5% in 2025, up from 1.1% in 20241. Hong Kong’s economy remained resilient in the first quarter of 20254, supported by strong exports to the Chinese Mainland despite rising global trade tensions.

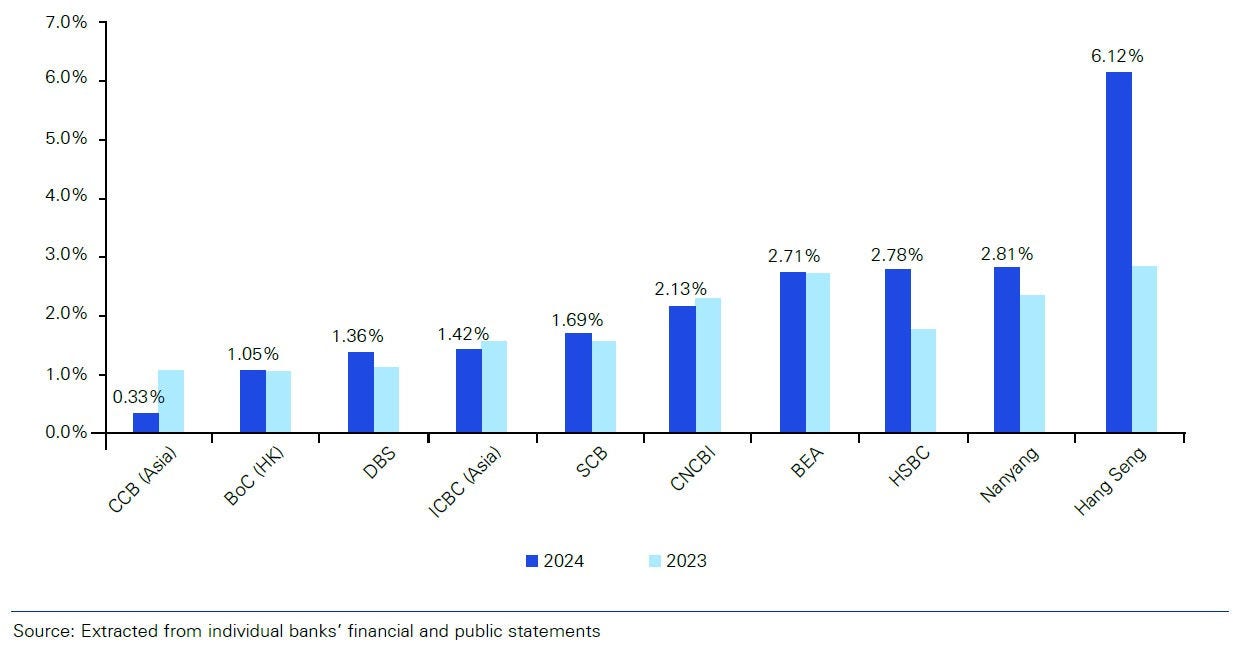

However, since April 2025, the sudden escalation of reciprocal tariffs between the U.S. and China has heightened downside risks for Hong Kong’s trade-oriented economy and clouded its economic outlook. The property market, particularly commercial real estate, remains vulnerable to weak sentiment, which could prolong price declines and put pressure on collateral values. Additionally, Hong Kong’s interest rates will continue to be closely linked to movements in U.S. Federal Reserve rates, adding another layer of uncertainty.

For the remainder of 2025, Hong Kong’s banking sector may see subdued demand for trade financing and increased pressure on credit quality, especially in tariff-exposed industries. Banks’ profitability will depend on effective risk management, quick adaptation to geopolitical shifts, and the ability to respond to changes in trade and monetary policy.

In this article, we analyse5 key metrics for the top ten locally incorporated licensed banks6 in Hong Kong. While some banks operate a dual entity structure in Hong Kong (e.g. a branch and an incorporated authorised institution), we have not combined their results. The analysis is conducted on a reporting entity basis.