1 Currently, foreign investment funds in form of a corporate entity or a limited partnership can re-domicile to Hong Kong as an Open-Ended Fund Company or a Limited Partnership Fund respectively.

2 The 2023/24 Budget can be accessed via this link: https://www.budget.gov.hk/2023/eng/index.html

3 The public consultation document can be accessed via this link: https://www.fstb.gov.hk/fsb/en/publication/consult/doc/Public consultation paper (e)_for issue.pdf; and our Hong Kong tax news alert on the document can be accessed via this link.

4 The consultation conclusion and the revised legislative proposals can be accessed via this link: https://www.fstb.gov.hk/en/blog/blog030724.html

5 The Bill can be accessed via this link: https://www.gld.gov.hk/egazette/english/gazette/file.php?year=2024&vol=28&no=51&extra=0&type=3&number=32; and the Legislative Council brief can be accessed via this link: https://www.legco.gov.hk/yr2024/english/brief/co23c_20241219-e.pdf

6 Companies limited by guarantee without a share capital and other company types not specified by the CO are not covered by the regime.

7 The passed resolution is only required where neither the law of the original domicile nor the constitutional document of the applicant requires members’ consent to the proposed re-domiciliation.

8 The financial statements are required to be audited only if it is so required under the law of its original domicile or the rules of relevant stock exchange or similar regulatory bodies.

9 Other information and documents required include particulars of the applicant, a certified copy of certificate of incorporation issued by the original domicile, information about the re-domiciled company’s directors and company secretary, copy of the proposed articles of association of the re-domiciled company, etc. Please refer to the newly added Schedules 6A to 6C of the CO for more details.

10 The Registrar may on application extend the 120-day period, subject to imposition of any appropriate conditions.

11 For a re-domiciled company with the first accounting reference period longer than 12 months, the annual financial statements will need to be ready by (1) 6 or 9 months after the first anniversary of the re-domiciliation date (depending on the company type) or (2) 3 months after the end of the accounting reference period, whichever is the later.

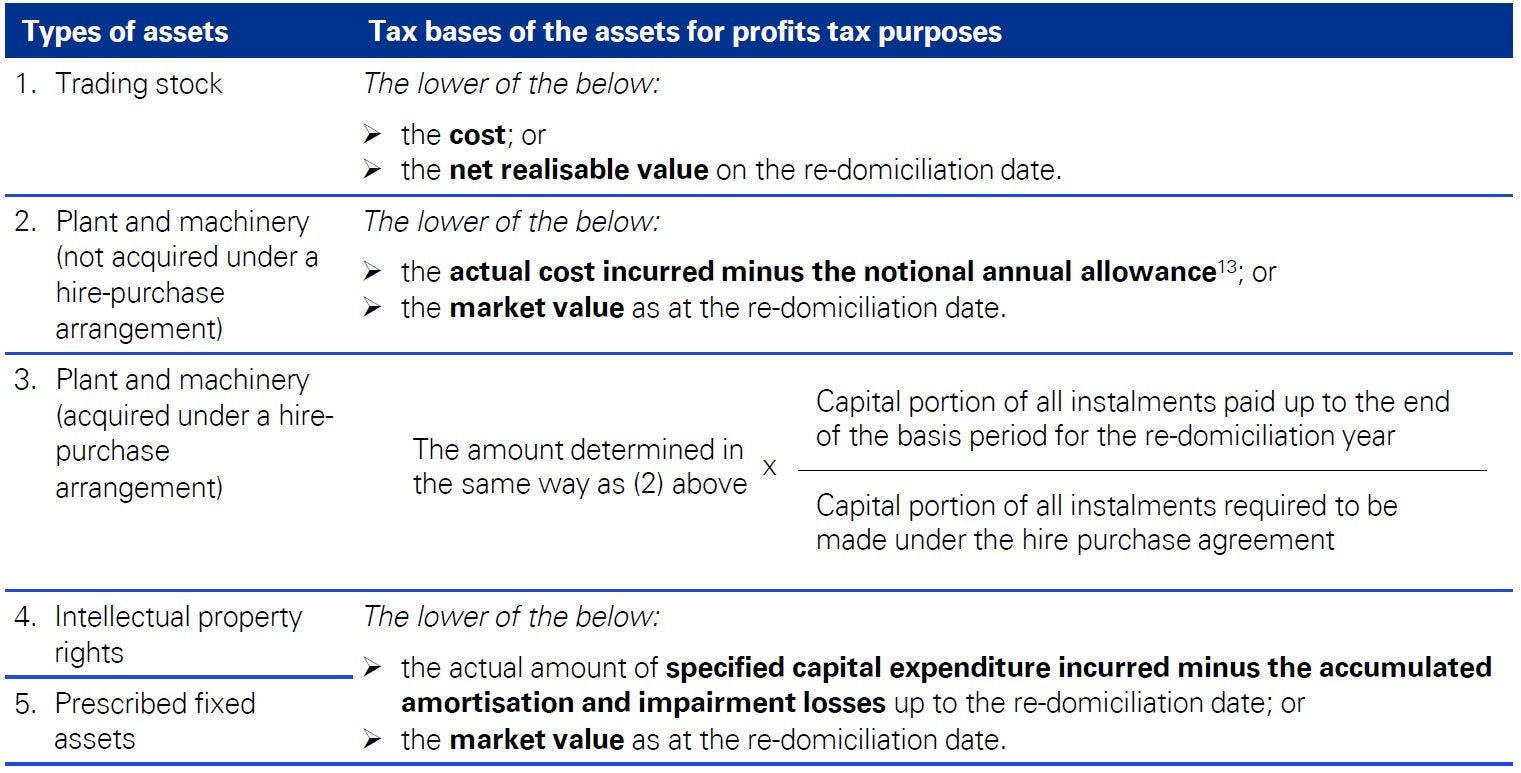

12 In general, the conditions are (i) the asset has been acquired before the re-domiciliation date for a trade or business carried on outside Hong Kong, (ii) the asset has not been used for any trade or business carried on in Hong Kong before the re-domiciliation date and (iii) the asset is used for a trade or business in Hong Kong on or after the re-domiciliation date.

13 Notional annual allowance means the annual allowance that would have been granted if the assets had been used for producing profits chargeable to Hong Kong profits tax after its acquisition.

14 The stamp duty rate for transfer of Hong Kong stock is 0.2% (in total) of the higher of (1) the market value of the stock transferred or (2) the consideration for the transfer of the stock.

15 For more details about the re-domiciliation regime implemented in Singapore, please refer to this link.

16 The HKSAR Government has proposed to introduce a definition of “Hong Kong tax resident” (which includes a company incorporated in Hong Kong) for the general purposes of the IRO in the paper on the BEPS Pillar 2 consultation outcome. For more details, please refer to our previous Hong Kong tax news alert in this link.