The existing case law5 in Hong Kong and the Inland Revenue Department (IRD)’s assessing practice as stated in Departmental Interpretation and Practice Notes (DIPN) No. 226 regard the source of royalty income from licensing and sub-licensing of intangible assets as the place(s) where the licensing and sub-licensing agreements are effected.

However, the CA in this case considered that the post-grant activities performed in connection with the execution and maintenance of the Sub-licence Agreements (e.g. promotion and maintenance of the trademarks, provision of know-how and the day-to-day operation of the sub-licensing business) after the agreements were concluded are also the relevant profit-producing activities.

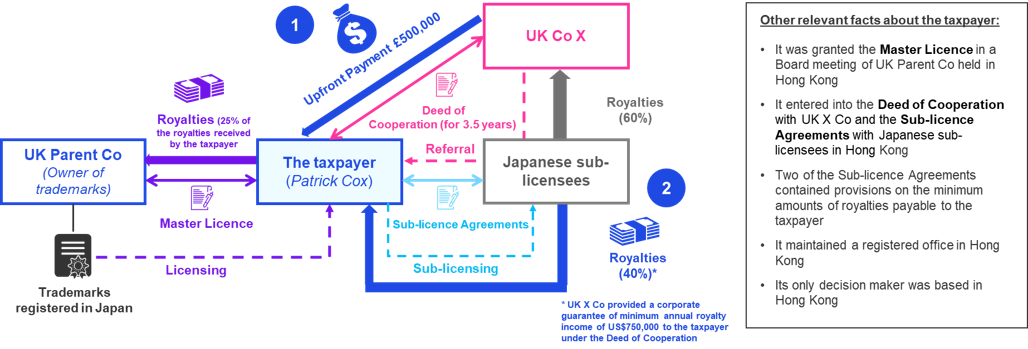

This could be due the specific fact pattern of this case where (1) the amount of royalties derived by the taxpayer would depend on the sub-licensees’ sales amounts (instead of being a fixed amount) and (2) the taxpayer (through UK X Co) provided various support to the sub-licensees on the design, manufacturing, promotion and sale of the products after the sub-licences were granted. Potentially, the Royalties Income derived by the taxpayer could be viewed as consisting of income from granting of the trademarks and income from provision of services to facilitate sales of the products in Japan.

The CA judgment also states that the Board erred by, among other things, failing to take into consideration that the royaltie s were payable not on the grant of the sub-licences but only on the exercise of the licensed rights in Japan as a percentage of the sub-licensees’ sales (subject to the point about guaranteed minimum royalties). This implies that the location of use of the intangible asset will carry more weight in determining the source of the royalty income in other cases when the licensor has a continuing financial interest in the subsequent exercise of the rights in exploiting the asset in that location.