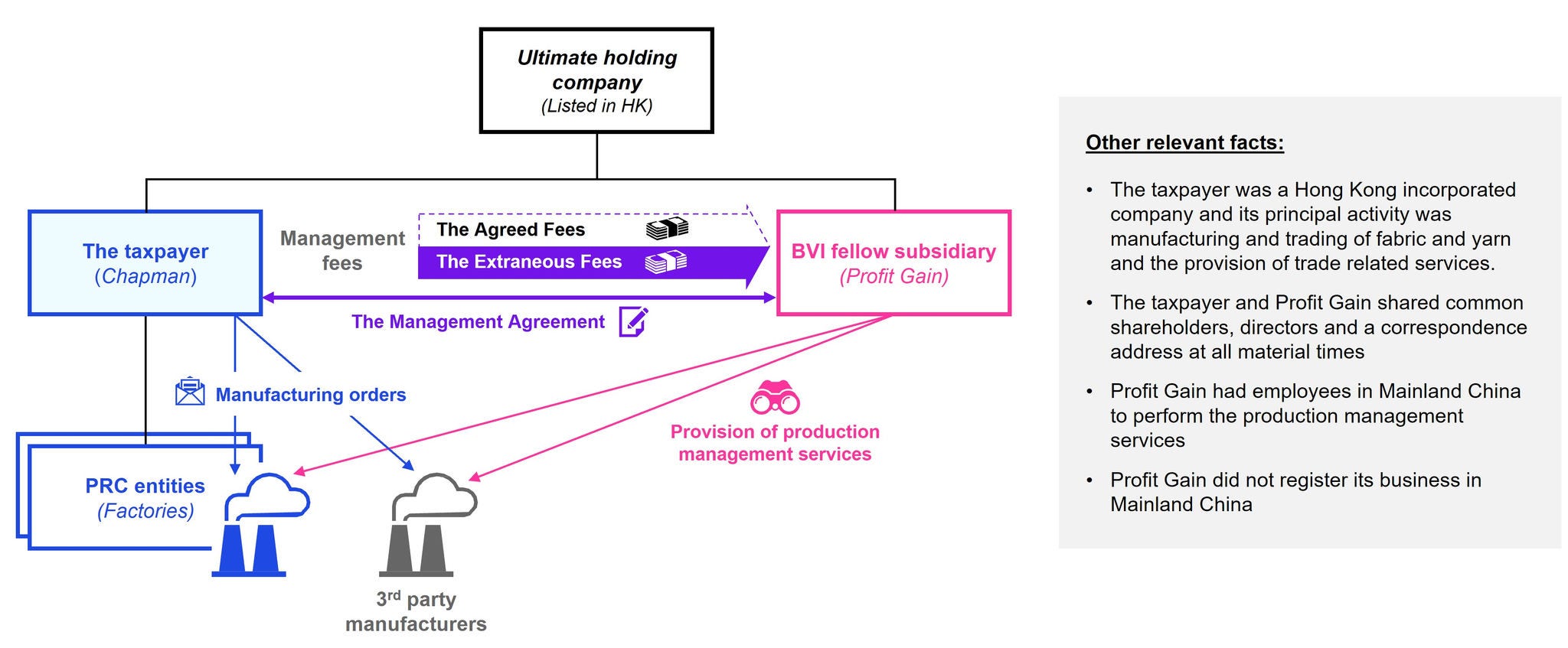

The Court of First Instance (CFI) recently held in a case that the management fees paid by a Hong Kong SAR company to its related company in the BVI are not deductible. The portion of the management fees paid in accordance with the contractual terms of a management agreement (the Agreed Fees) was held as non-deductible under the general anti-avoidance rule whereas the portion paid in excess of what was agreed (the Extraneous Fees) was held as non-deductible under the general expense deduction rule.

In this news alert, we summarise the court’s analysis and share our observations from the case.