The OECD Inclusive Framework on BEPS (IF) recently published a document with questions and answers (Q&A document) on the qualified status under the Global Minimum Tax1. The Q&A document set out a transitional qualification mechanism that adopts a simplified approach to temporarily establish and recognize the qualified status of Pillar 2 legislations of the implementing jurisdictions.

The rule order under BEPS Pillar 2

Under BEPS Pillar 2, top-up tax on the low-taxed excess profits in a jurisdiction will be charged based on the following rule order (not taking into account the Subject-to-Tax Rule):

- first via the Qualified Domestic Minimum Top-up Tax (QDMTT)2 in the source jurisdiction;

- then via the Qualified Income Inclusion Rule (IIR) in the parent jurisdiction(s); and

- then via the Undertaxed Profits Rule (UTPR) in the jurisdictions where the Constituent Entities (CEs) of the MNE group are located.

The OECD’s peer review process

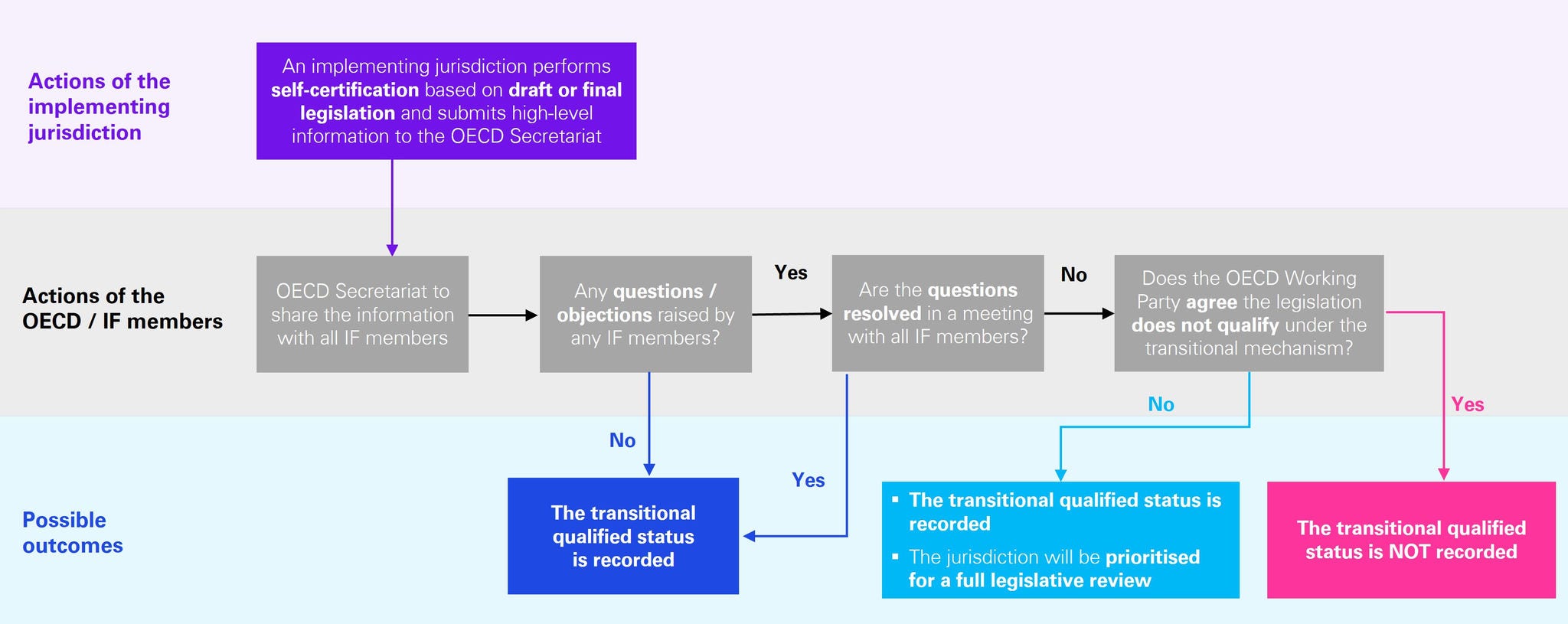

To apply the above agreed rule order, a consistent and coordinated mechanism for identifying the qualified status of the Pillar 2 legislation of each implementing jurisdiction is necessary. This will be achieved through the OECD’s common peer review process summarised as follows:

- the review will provide for a common assessment of (1) the qualified status of the IIR, UTPR, and DMTT and (2) the eligibility for the QDMTT safe harbour2 in each implementing jurisdiction;

- the process consists of a full legislative review and an ongoing monitoring by the IF;

- the full legislative review assesses whether the Pillar 2 legislation achieves consistent outcomes with the GloBE Rules;

- the ongoing monitoring assesses whether the legislation is in practice applied and administered consistently with the GloBE Rules; and

- the process will also assess whether an implementing jurisdiction provides benefits that are related to the Pillar 2 rules (which would prevent its Pillar 2 legislation from being considered as qualified).

As it takes time for the OECD to conduct and finalise a full legislative review for all the implementing jurisdictions that have implemented the IIR and/or DMTT legislation effective from 2024, the IF has developed a transitional qualification mechanism (the Mechanism) as a transitional measure to allow the swift recognition of the qualified status of implementing jurisdictions’ Pillar 2 legislation on a temporary basis.

The transitional qualification mechanism

Overview of the Mechanism

The Mechanism is based on a self-certification made by an implementing jurisdiction that its Pillar 2 legislation achieves consistent outcomes with the key provisions of GloBE Rules. The implementing jurisdiction could rely on the final or draft legislation for the self-certification purposes, provided that the draft legislation is close to final (i.e. ready to be introduced to the domestic legislative body) or publicly available.

We summarise below the key features of the Mechanism.

- The process of the Mechanism:

- Upon submission of the self-certification, the transitional qualified status is expected to be established within 12 months after the effective date of the legislation.

- The implementing jurisdiction is expected to initiate a full legislative review with the OECD no later than two years after the effective date of the legislation.

- The OECD's website will regularly record and update each implementing jurisdiction’s qualified status together with the effective date of the status.

- The transitional qualified status could be revoked in certain circumstances - e.g. the full legislative review is not initiated within the agreed timeframe or the legislation is not considered as qualified under the full legislative review.

What’s next for Hong Kong businesses

The IF will continue to develop the full legislative review and ongoing monitoring process for the peer review exercise.

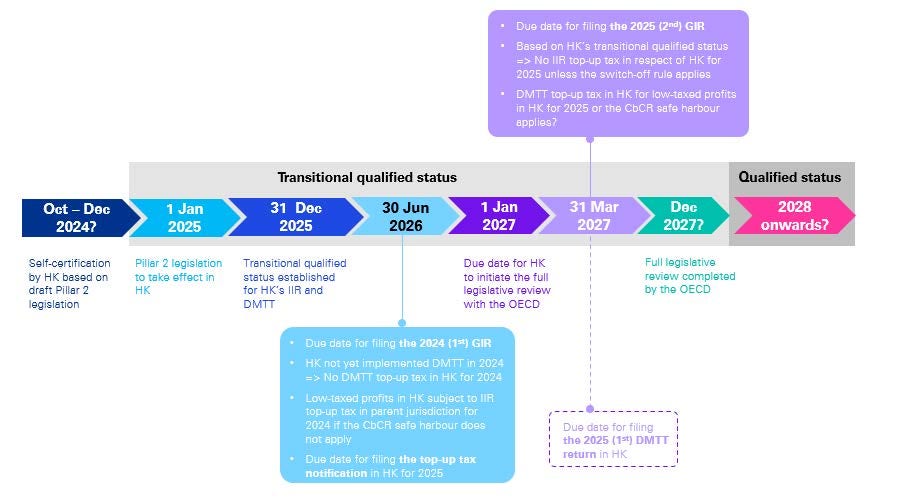

As far as the Hong Kong SAR (Hong Kong) is concerned, the HKSAR Government plans to develop the Pillar 2 legislative proposal for submission to the Legislative Council in the second half of 2024. When Hong Kong could start the self-certification process under the Mechanism will depend on when the draft Pillar 2 legislation is ready.

Separately, Singapore released the draft legislation to introduce a multinational top-up tax (MTT) and a DMTT in Singapore on 10 June 2024 for public consultation3. The draft legislation mainly contains the definitions of the terms used in the legislation, the operative provisions of the MTT and DMTT, and the related administrative provisions (e.g. registration requirement, filing of top-up tax returns, payment of top-up taxes, assessments, objections and appeals, penalties for non-compliance, etc.). The detailed rules on the determination of the GloBE Income/Losses and the Adjusted Covered Taxes will be contained in the subsidiary legislation to be issued at a later date.

We set out below an illustrative timeline with the key dates for the Pillar 2 compliance process for an in-scope MNE group with a December fiscal year-end. The timeline is applicable to an MNE group parented in a foreign jurisdiction that has implemented the IIR in 2024 (e.g. the UK and some EU countries) and with CE(s) located in Hong Kong.

Although Hong Kong would only implement the Pillar 2 legislation from 2025, Hong Kong CEs of a foreign-headquartered MNE group that needs to file its first GloBE Information Return (GIR) for 2024 by 30 June 2026 in the parent jurisdiction should take note of the above timeline and be prepared to provide the necessary data and information to the head office. This could include data for computing the effective tax rate in Hong Kong and assessing whether the transitional Country-by-Country Report (CbCR) safe harbour is applicable to Hong Kong.

1 The Q&A document can be accessed via this link: https://www.oecd.org/content/dam/oecd/en/topics/policy-sub-issues/global-minimum-tax/qualified-status-under-the-global-minimum-tax-questions-and-answers.pdf

2 For more details about QDMTT and QDMTT safe harbour, please refer to our previous BEPS publication issued in July 2023 in this link.

3 For details of the consultation and the draft legislation in Singapore, please refer to https://www.mof.gov.sg/news-publications/press-releases/public-consultation-on-proposed-multinational-enterprise-(minimum-tax)-bill-and-income-tax-(amendment)-bill-2024

The OECD’s transitional qualification mechanism for Pillar 2 legislation

Inclusive Framework BEPS Agreement