The global economy showed resilience in 2023, highlighted by improved levels of growth despite a higher interest rate environment and heightened geopolitical tensions. Notwithstanding the challenges in the Mainland Chinese economy, the Hong Kong economy expanded by 3.2% in 20231 compared to a 3.5% contraction in 2022, driven by the gradual recovery of inbound tourism and improved private consumption expenditure.

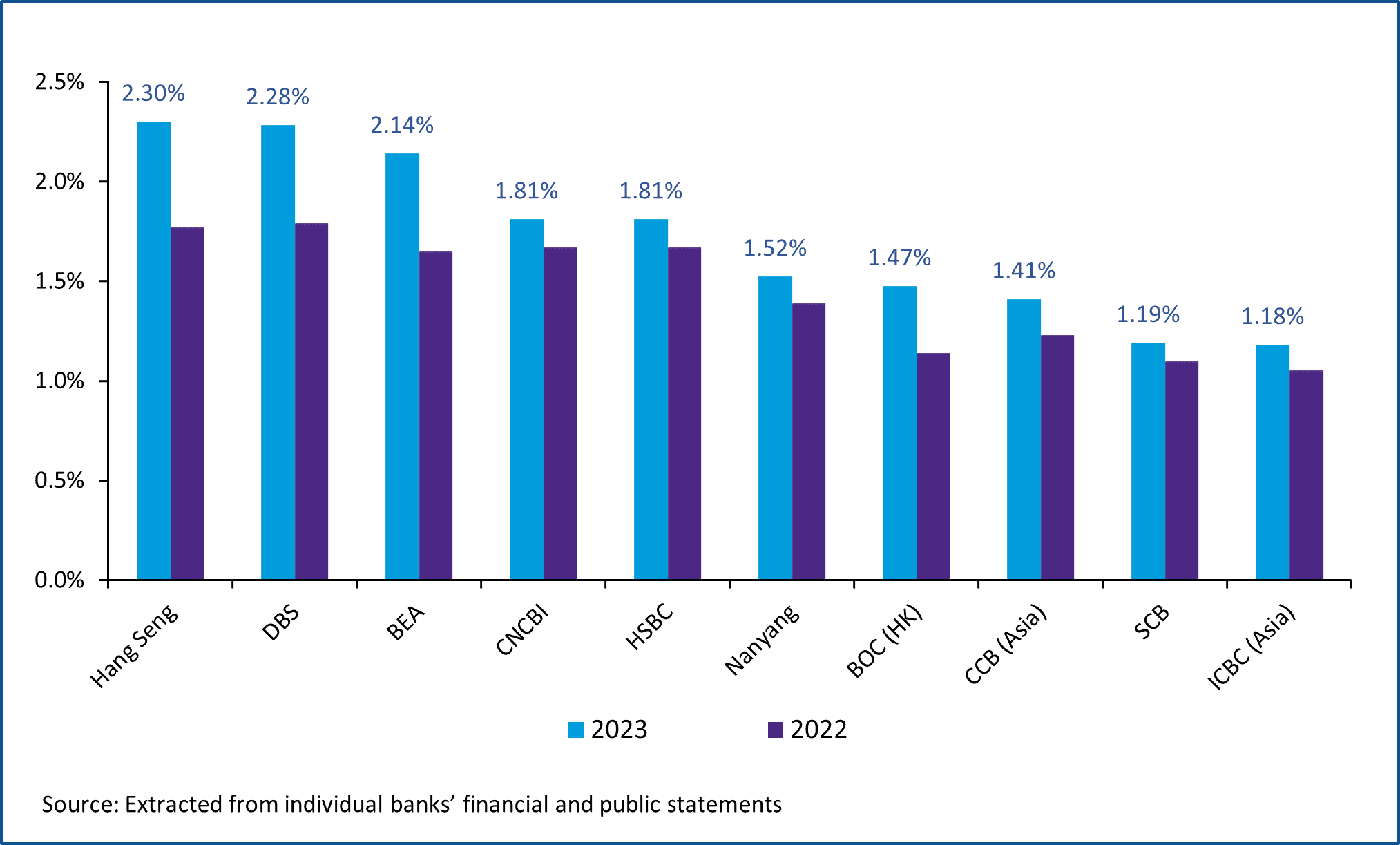

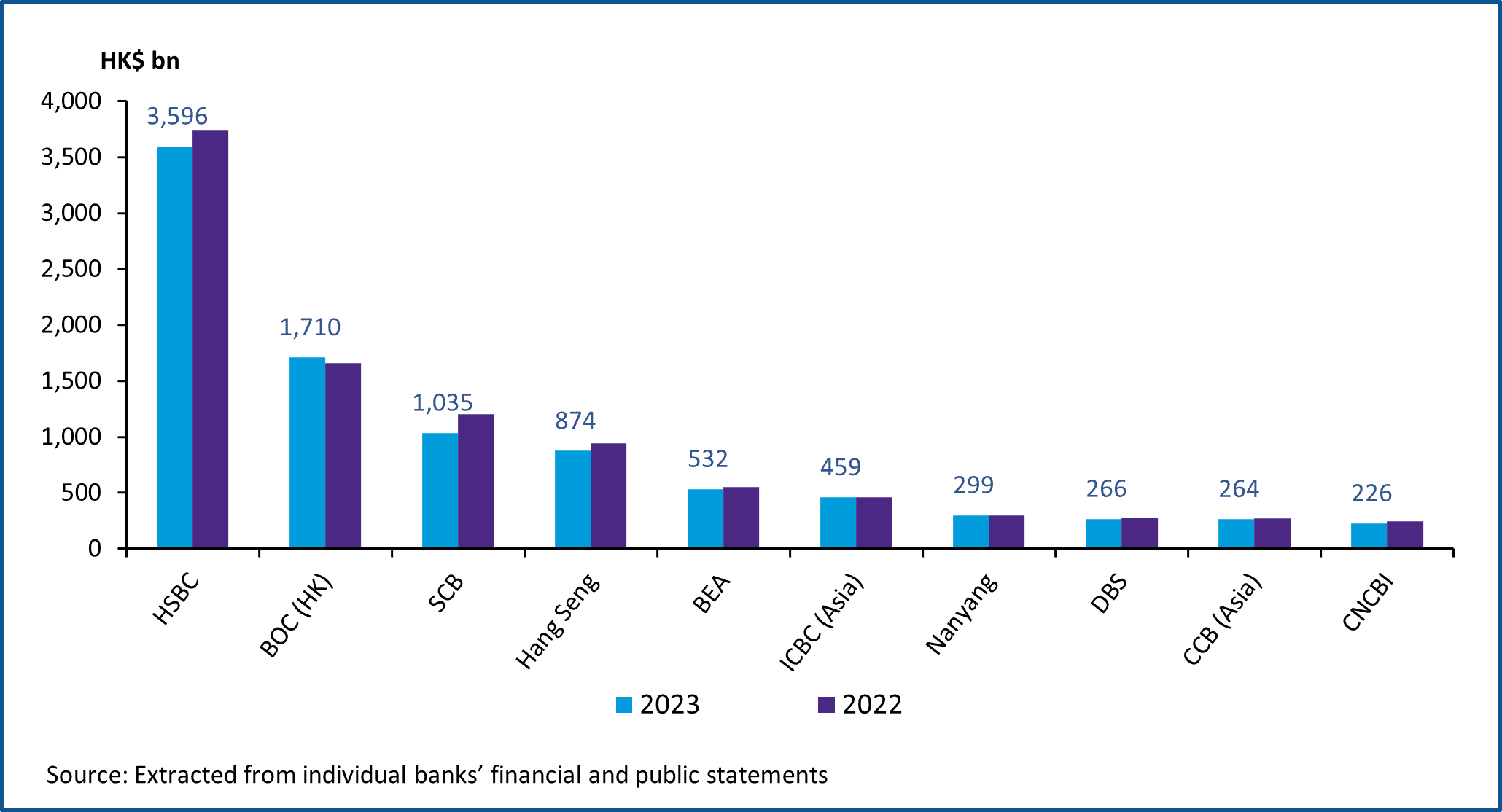

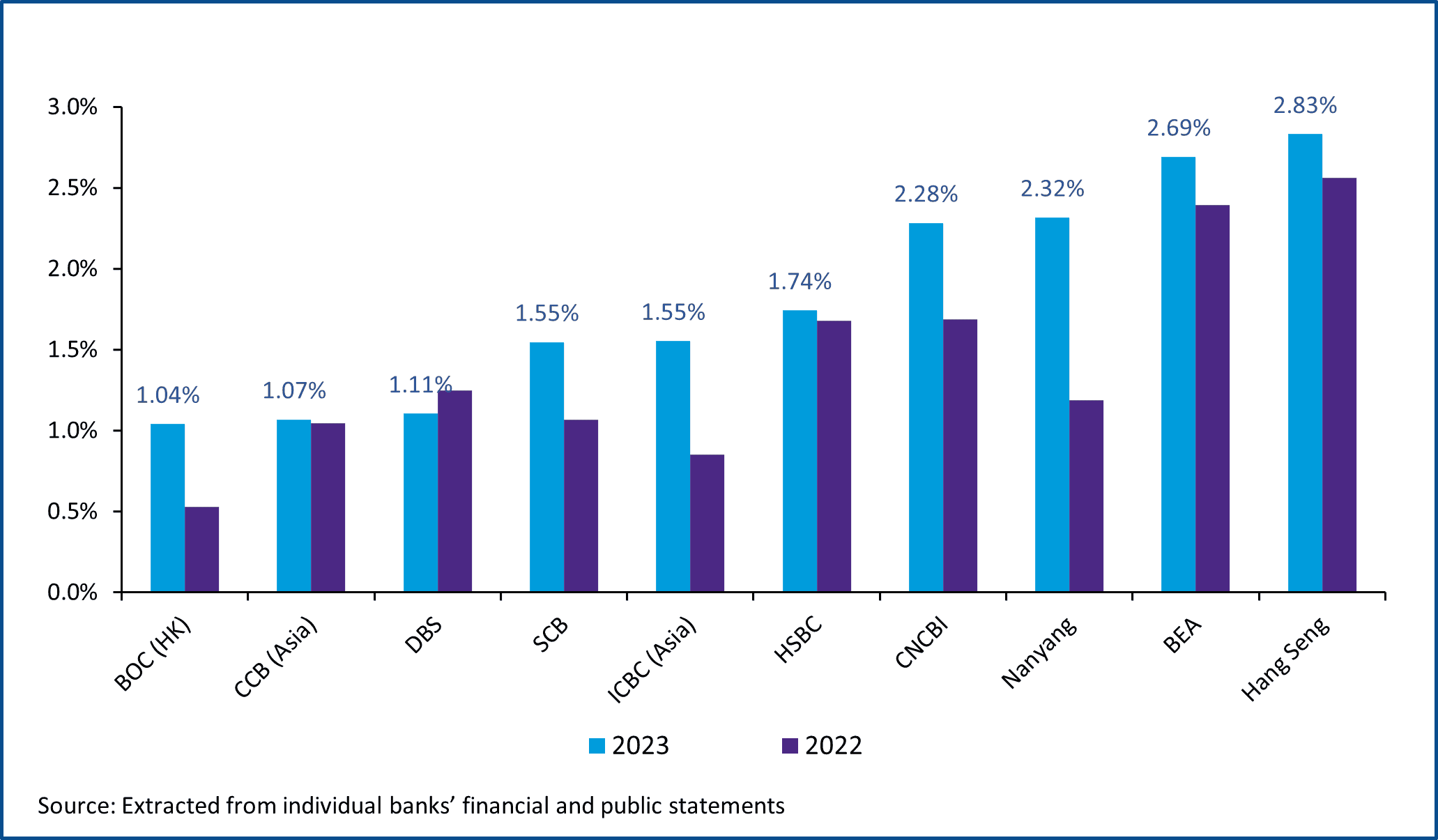

Against this backdrop, Hong Kong’s banking sector recorded moderate growth in its overall balance sheet in 2023. The total assets of all licensed banks expanded by 2.7% to HK$23 trillion. There was a decrease of 3.1% in loans and advances while customer deposits increased by 3.5%. In line with our prediction in our 2023 Hong Kong Banking Report, the higher interest rate environment continued to benefit banks in improving profitability with a notable increase in net interest margins (NIM). The NIM for all licensed banks increased by 30 basis points in 2023 to 1.84%. Operating profit before impairment charges for all licensed banks increased by 34.7% to HK$295 billion in 2023.

The US Federal Reserve raised the Federal Funds Rate by a total of 100 basis points in 2023 and has maintained the rate at 5.5% since July 2023. Following the increase in Federal Funds Rate, the HKMA raised the base rate from 4.75% to 5.75%. This led to an increase in the Hong Kong Interbank Offered Rate (HIBOR) in 2023 from 4.35% in December 2022 to 5.27%2 (for one-month HIBOR) in July 2023. The composite interest rate, which is a measure of the average cost of funds of banks, increased by 83 basis points from 2.11% in December 2022 to 2.94% in December 20233.

The Hong Kong (SAR) Government forecasts that the Hong Kong economy will grow by 2.5 to 3.5% in 2024, after a 3.2% growth in 2023. The consumer price inflation is forecast to be 1.7% in 2024, similar to 2023. Looking ahead, while interest rate levels have somewhat stabilised, most expect interest rates to remain elevated and anticipate a gradual decrease, which will depend on decreasing US inflation. While this will continue to improve profitability, banks need to be vigilant in managing the credit risk in their loan portfolios as their customers may face difficulties from rising funding costs, potentially weakening their debt-servicing ability, and uncertainty in economic recovery both in Hong Kong and the Chinese Mainland.

The performance of the Hong Kong banking sector in 2024 will continue to be affected by uncertainties associated with US monetary policy, the global growth outlook and geopolitical tensions. It will also be closely linked with the health of the Chinese Mainland economy, which remains challenged by subdued consumer and business confidence and a weak real estate sector.

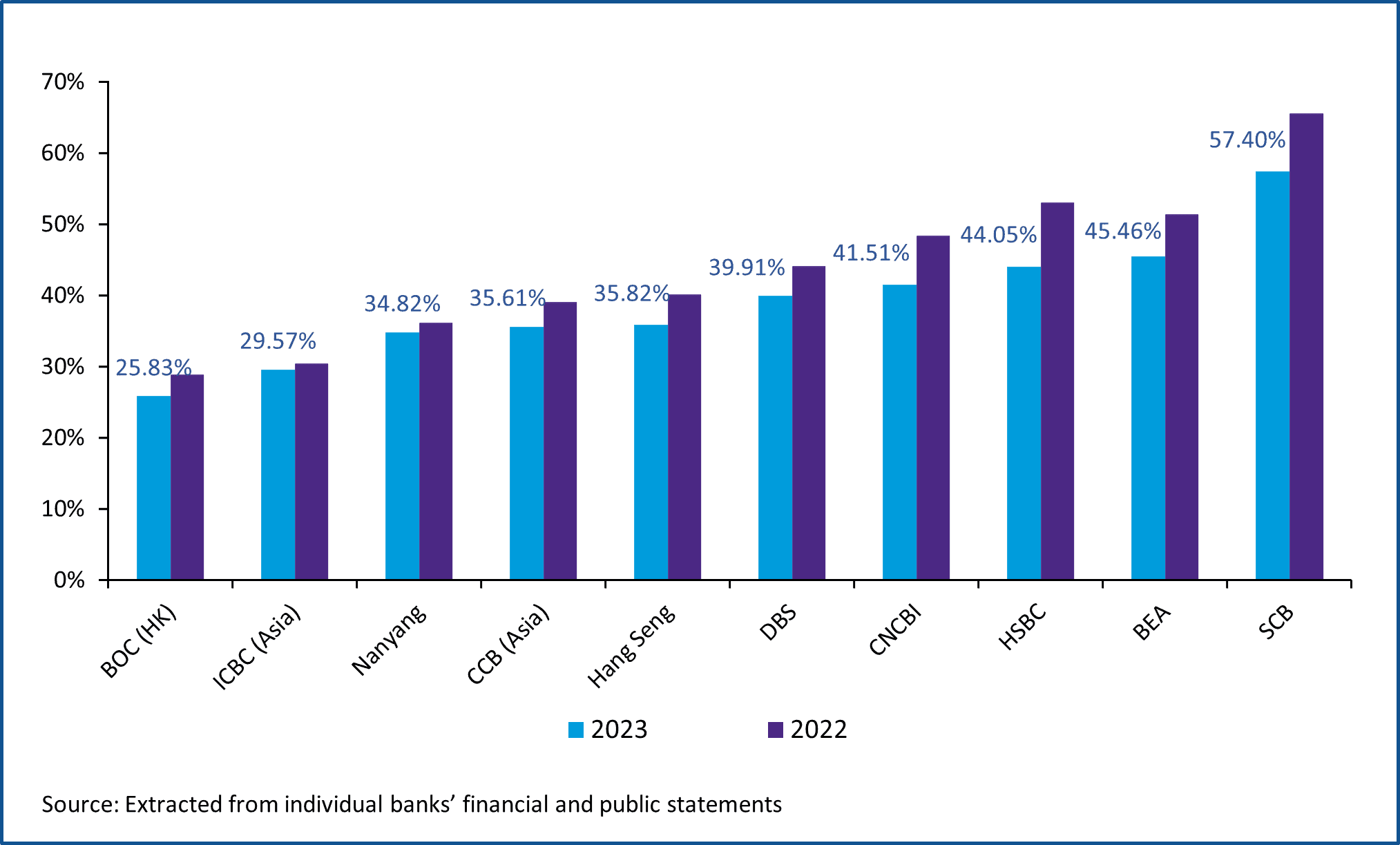

In this article, we present an analysis4 of key metrics for the top 10 locally incorporated licensed banks5 in Hong Kong. While some banks have a dual entity structure in Hong Kong (eg a branch and an incorporated authorised institution), we have not combined their results. The analysis is performed on a reporting entity basis.