These are pivotal times for industrial manufacturing. Manufacturers must navigate an unfamiliar environment shaped by advances in disruptive technology, economic turmoil, shifting customer expectations, uncertain labor and materials supply markets, and the world’s emergence from the COVID-19 pandemic.

Future-focused manufacturers can win by embracing digitally enabled service as the foundation of both their business and operating models.

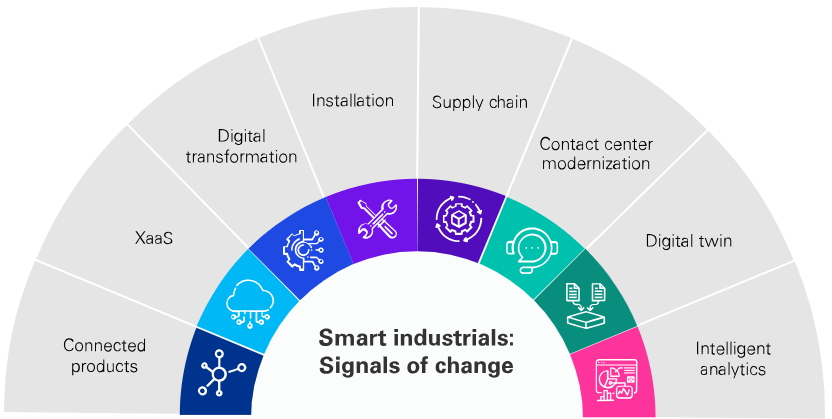

Everywhere you look, there are signals of change for aftermarket and field service in industrial manufacturing.