15 notable issues addressed in the December 2023 AG

1. Further Guidance on the Transitional CbCR Safe Harbour (CbCR SH)

Q.1 If an MNE group has both CEs and a Joint Venture (JV) / JV Group in the same jurisdiction, is the JV / JV Group being treated as in a separate Tested Jurisdiction than that of the CEs?

- Yes, the CbCR SH tests should be applied by treating all the CEs as located in one Tested Jurisdiction and the JV / JV group as located in another separate Tested Jurisdiction.

Q.2 Can an MNE group use different sources of Qualified Financial Statements (QFS) for (i) the same entity / permanent establishment (PE) and (ii) different entities within the same Tested Jurisdiction?

- No, the data of an entity or a PE used in the CbCR SH computations must come from the same QFS (i.e. the CE’s financial statements used to prepare the ultimate parent entity (UPE)’s consolidated financial statements (CFS) or the separate financial statements of the CE prepared based on acceptable or authorized accounting standards). For example, a group could not use one set of financial statements to determine the Profit/Loss Before Tax (PBT) of a CE and another set of financial statements to determine such CE’s Simplified Covered Taxes.

- Similarly, a consistent source of data must be used for all entities located in the same Tested Jurisdiction, with exceptions for NMCEs and PEs.

Q.3 Can a CbC Report be considered a Qualified CbC Report if it is based on data from QFS for some but not all Tested Jurisdictions?

- Yes, as Qualified CbC Report determination is made on a Tested Jurisdiction-by-Tested Jurisdiction basis. A CbC Report can be considered a Qualified CbC Report for those Tested Jurisdictions of which the data in the report are drawn from QFS and not a Qualified CbC Report for those Tested Jurisdictions of which the data in the report are not drawn from QFS (e.g. internal management accounts).

Q.4 Can a CbC Report be considered a Qualified CbC Report if it is based on data from the UPE’s CFS for some jurisdictions and data from local GAAP accounts for other jurisdictions?

- Yes, an MNE Group may use different QFS as the source of data for different Tested Jurisdictions in a Qualified CbC Report.

Q.5 What constitutes a QFS for a PE?

- The PE’s own QFS (if available) or the separate financial statements prepared by the Main Entity for the PE for regulatory / tax reporting or internal management control purposes can be used to determine the amounts used in the CbCR SH tests. If a loss arising from a PE is allocated to the PE, a corresponding adjustment must be made to the PBT of the Main Entity to prevent double counting of the loss.

Q.6 Under what circumstance should dividends be included in the Revenue and PBT of the recipient entity for the CbCR SH purpose?

- Although the guidance on CbC Reporting states that an intra-group payment that is treated as dividend for tax purpose in the payer’s jurisdiction should be excluded from the Revenue and PBT of the recipient, such dividend should be included in the Revenue and PBT of the recipient for the purpose of the CbCR SH tests if it is treated as income in the QFS of the recipient and expense in the QFS of the payer, irrespective of the tax treatment of the amount in the recipient’s or payer’s jurisdiction and the treatment of the amount in the CbC Report.

- An example is where certain preferred shares are treated as debt and the payments arising from them are treated as interest income/expenses for accounting purpose but the preference shares are treated as equity for tax purpose.

Q.7 Can an MNE Group that is within the scope of the GloBE Rules but is not required to prepare and file CbC Report qualify for the CbCR SH?

- Yes, an MNE Group that is not required to file a CbC Report (e.g. because it does not meet the EUR 750 million revenue threshold in the immediately preceding fiscal year) can still apply the CbCR SH if it completes the relevant section of the GloBE Information Return using data from QFSs.

Q.8 Is the tax paid in the PE jurisdiction on the PE’s income included in the Covered Taxes of the PE or the Main Entity in the Simplified ETR test?

- Income tax expense in the PE jurisdiction on the PE’s income must be allocated exclusively to the PE’s jurisdiction and can only be included in the Simplified ETR computation for the PE’s jurisdiction.

Q.9 Should 5% or the transitional rates in Article 9.2 of the GloBE Rules be used for computing the Substance-based Income Exclusion (SBIE) amount for a Tested Jurisdiction for the routine profits test under the CbCR SH?

- The SBIE amount shall be computed using the transitional rates for 2024, 2025 and 2026 for the payroll and tangible asset carve-outs that are specified in Article 9.2 of the GloBE Rules.

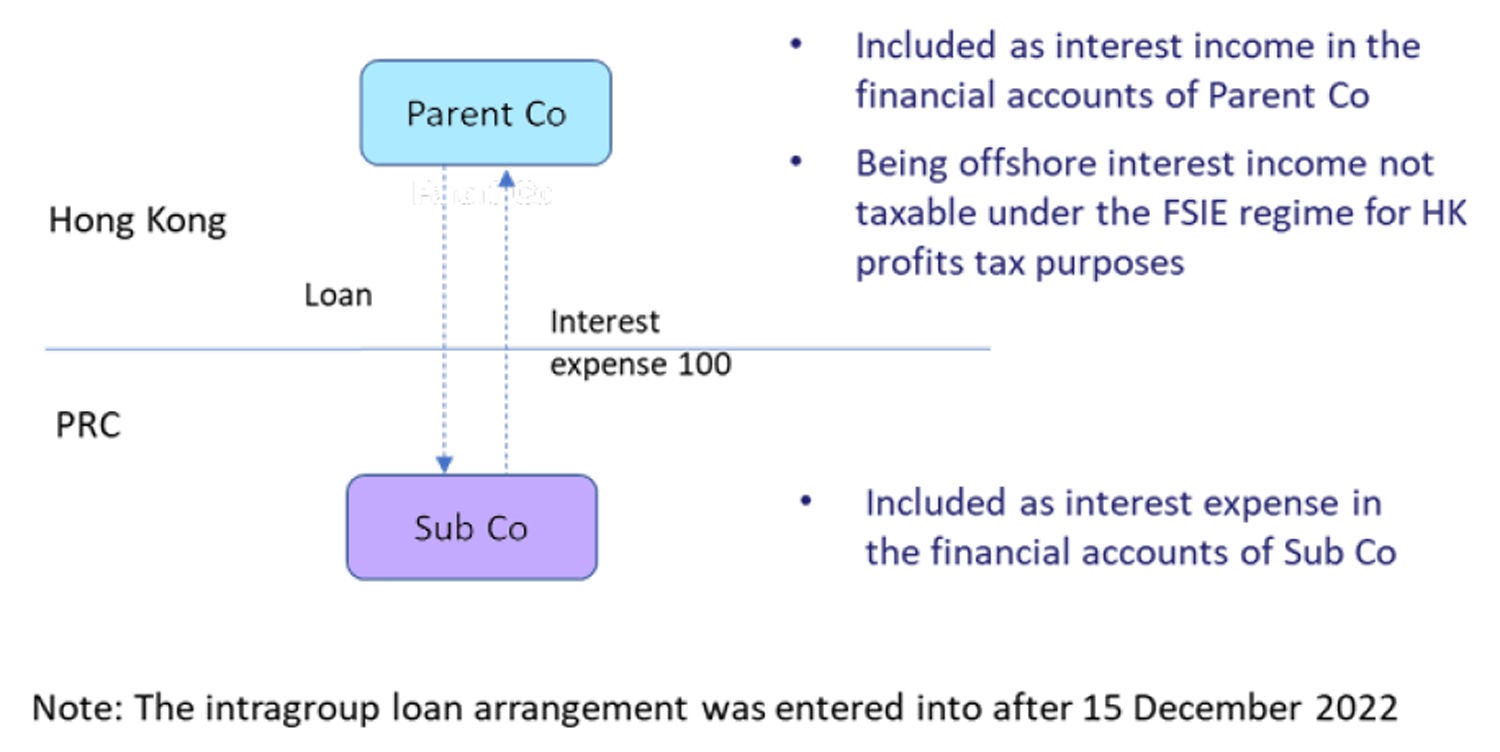

Q.10 How may the new anti-avoidance rules on hybrid arbitrage arrangements affect an MNE group’s eligibility to the CbCR SH?

- In determining whether a Tested Jurisdiction qualifies for the CbCR SH, the following adjustments to the PBT or income tax expense must be made in the CbCR SH calculations of a Tested Jurisdiction with respect to any hybrid arbitrage arrangements1 entered into after 15 December 2022 (i.e. the publication date of the OECD guidance on safe harbours and penalty relief)2:

- excluding any expense or loss arising from a deduction / non-inclusion arrangement or duplicate loss arrangement from the Tested Jurisdiction’s PBT; and

- excluding any income tax expense arising from a duplicate tax recognition arrangement from the Tested Jurisdiction’s income tax expense.