The draft legislation (Bill) on the enhancements of the existing aircraft leasing preferential tax regime in the Hong Kong SAR (Hong Kong) was gazetted on 17 November 2023. Upon the passage of the Bill, the legislative amendments will take retrospective effect from the year of assessment beginning on 1 April 2023.

Summary

Background

Hong Kong's positioning as an international aviation hub is supported by the Central People's Government in the 14th Five-Year Plan and the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area. Establishing Hong Kong as an aircraft leasing and services hub is a pivotal to Hong Kong’s international aviation hub. The development of the OECD’s BEPS 2.0 initiative, specifically Pillar 2, will see the imposition of a 15% minimum corporate tax rate most likely commencing on 1 January 2025 for the largest taxpayer groups. It will diminish the competitiveness of the existing Hong Kong aircraft leasing tax regime. There is an imminent need for the Hong Kong government to enhance the prevailing regime to ensure it remains competitive.

The draft legislation (“Bill”) on the enhancements of the existing Hong Kong aircraft leasing preferential tax regime was gazetted on 17 November 2023. Upon the passage of the Bill, the legislative amendments will take retrospective effect from the year of assessment beginning on 1 April 2023 to allow the early implementation of the enhancement measures.

Enhancement Measures via Legislative Amendments

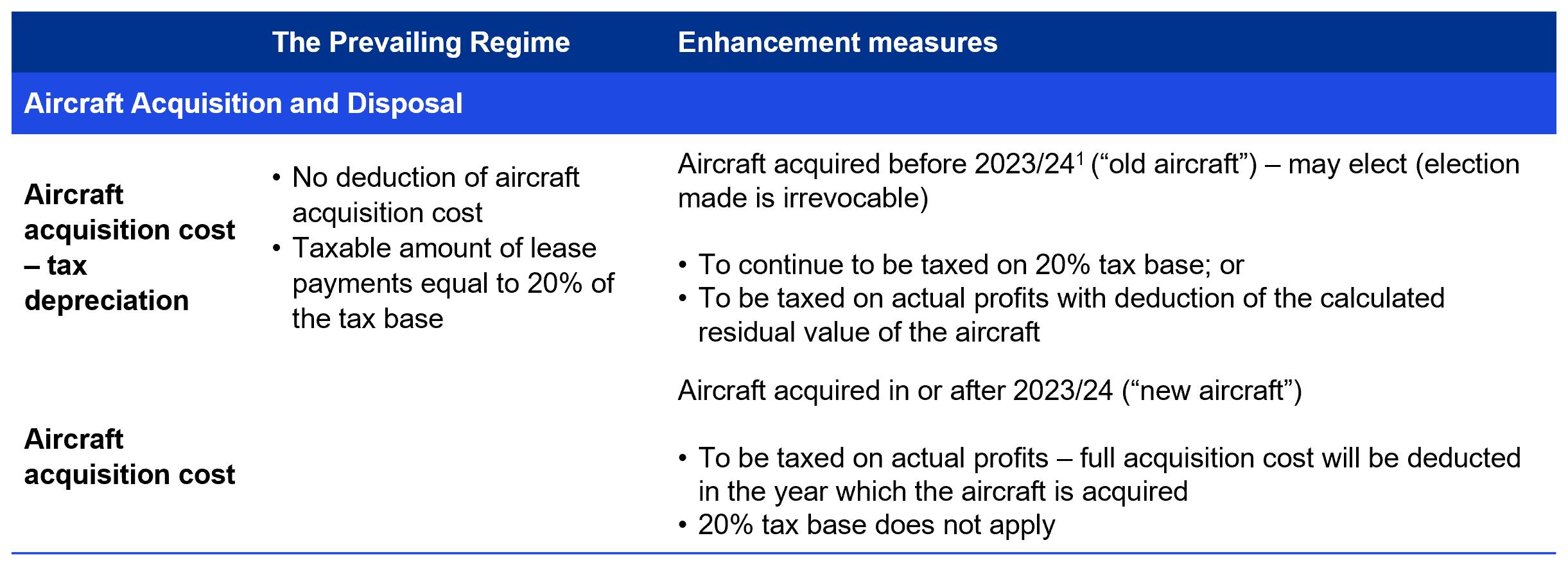

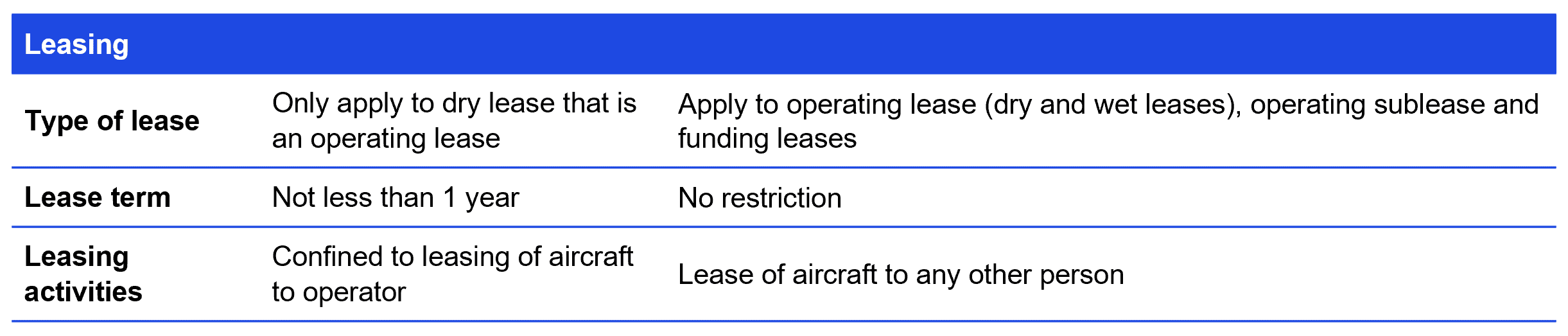

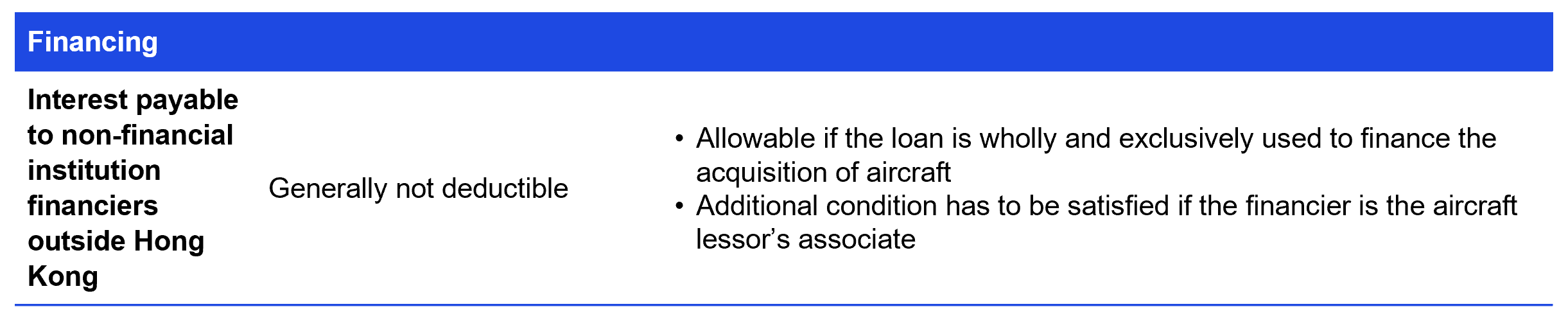

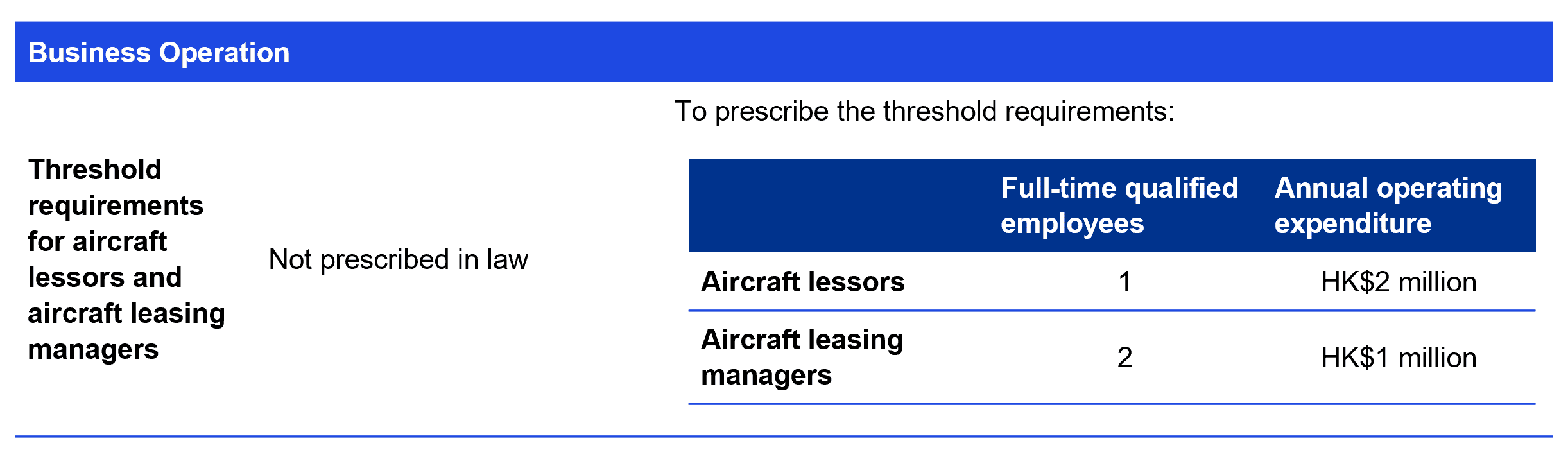

We summarise below a comparison of the prevailing regime with the enhancement measures based on the aircraft leasing transaction life cycle.

KPMG observations

With the implementation of BEPS 2.0 global minimum tax, the prevailing “cash-based tax” regime is less competitive than the tax regimes in other major international aircraft leasing hubs such as Ireland and Singapore where accelerated tax depreciation policies are available to aircraft lessors. Introducing the mechanism to allow the full tax deduction of the acquisition cost of the aircraft, on one hand reduces the impact of BEPS 2.0 global minimum tax, on the other hand allows Hong Kong aircraft lessors to defer the cash tax payment over the lease term till the future disposal of the aircraft (the deduction of aircraft acquisition cost allowed will be clawed back at the time of disposal).

The Bill updates the existing anti-avoidance provisions to disallow a “double-dip” situation where tax deprecation is double claimed for the same aircraft. The measure provides clarity for the tax treatments to facilitate cross-border aircraft trading and sale and leaseback transactions.

Old aircraft using the prevailing 20% tax base concession has the option either to continue to use the 20% tax base concession or to claim the tax deduction of the residual value of the aircraft which is calculated based on the notional tax allowances has been granted to the old aircraft.

KPMG observations

While it is still to be tested in the market, we anticipate these measures provide wider business applications for aircraft leased through Hong Kong platform. For instance,

- the removal of Hong Kong lessor’s ownership requirement allows Hong Kong platform to structure operating sublease and funding lease transactions, whether Hong Kong platform has the potential to be an international sub-lessor by connecting with other major aircraft leasing hubs (e.g. Ireland, Chinese Mainland, Singapore, etc.)

- funding leases are often used in private jet financing

- will traditional aviation financiers (e.g. banks) or risk-averse new investors tap into the market by using Hong Kong as a funding leasing platform

- whether the inclusion of wet lease in scope and the removal of lease term restriction attract operators with excess capacity to carry out Aircraft, Crew, Maintenance and Insurance (“ACMI”) leasing via Hong Kong platform

KPMG observations

The current stringent interest deduction rules have been a significant issue to existing leasing companies. Generally speaking, interest payable on money borrowed wholly and exclusively to finance the acquisition of an aircraft used by a qualifying aircraft lessor for producing qualifying profits should be deductible for Hong Kong profits tax purposes. If the lender is an associate of the Hong Kong lessor, additional conditions summarised below also need to be satisfied.

- The associate is, in respect of the interest, subject to a similar tax in a territory outside Hong Kong at a rate that is not lower than the reference rate (i.e. 8.25%). The implementation of this measure will need careful consideration as a similar rule in the CTC regime is required cash tax to be paid.

- The associate’s right to use and enjoy that interest is not constrained by a contractual or legal obligation to pass that interest to any other person, unless the obligation arises as a result of a transaction between the associate and a person other than the borrower dealing with each other at arm’s length.

KPMG observations

To comply with the OECD requirements, all the preferential tax regimes of Hong Kong are subject to substantial activities threshold requirement in terms of number of qualified persons employed and annual operating expenditure incurred. The proposed threshold requirement in the Bill is lower than the thresholds required in the prevailing Hong Kong ship leasing preferential tax regime. In addition, the annual operating expenditure requirement for aircraft leasing manager has been reduced from the proposed HKD10 million in the Trade Consultation Paper2 to the current HKD1 million. We believe this is welcomed by the industry, especially for new market entrants, small and medium-size lessors and lessors specialising in mid-life aircraft leasing.

According to the Department Interpretation and Practice Notes No.54 – Taxation of Aircraft Leasing Activities (“DIPN 54”), all the relevant facts and circumstances of each lessor should be considered when determining whether the substantial activity requirements are satisfied. The Inland Revenue Department ("IRD”) also acknowledge the fact that the industry operates on SPV lessor basis and whether an SPV lessor has sufficient connection or nexus with the active conduct of aircraft leasing activity in Hong Kong, including the engagement of an aircraft leasing manager carrying on business in Hong Kong should be considered. Seeking Commissioner’s opinion through advance ruling application is always helpful to obtain tax certainty.

Enhancement Measures via Administrative Means

Other enhancement measures were implemented via administrative means in the first half of 2023. Specifically,

Recognition of the Irish Stock Exchange – The interest payable on the notes listed on the Irish Stock Exchange was not allowed for tax deduction. To facilitate the financing of aircraft lessors, starting from 1 April 2023, the Irish Stock Exchange (trading as Euronext Dublin) has been recognised by the Commissioner of the IRD for tax deduction purpose.

Specification of leasing model involving bare trust – There has been an increase in the use of bare trustee which holds the legal ownership of an aircraft while the lessor acts as the beneficial owner of the aircraft. DIPN 54 has provided further clarification and guidance that leasing model involving bare trust is eligible for the tax concession regime.

Summary

A low tax and simple tax regime has long been a cornerstone of Hong Kong’s success as an international financial centre. To extend the success to aviation finance sector is not easy, especially in the current evolving international tax environment. The proposed changes made a significant step is putting Hong Kong on an equal standing with other leasing hubs, although the absence of a tax group consolidation regime will remain a barrier for Hong Kong companies, We also share the view with the industry that other factors such as broad and quality tax treaty network, pool of talent, knowledge and experience are critical to contribute to a successful international aviation financing centre.

12023/24 refers to the year of assessment beginning on 1 April 2023.

2Enhancing the Aircraft Leasing Preferential Tax Regime Trade Consultation Paper (November 2022)

Enhanced Hong Kong aircraft leasing preferential tax regime

Hong Kong SAR Tax Alert - Issue 25, December 2023