Since the formation of the ISSB [1] at COP 26 in November 2021 [2], the ISSB has taken on the mantle of creating a global baseline for sustainability reporting, reducing the ‘alphabet soup’ of sustainability disclosure standards. Today, the ISSB has taken a giant step towards that goal by issuing the first two IFRS Sustainability Disclosures Standards – IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (‘general requirements standard’) and IFRS S2 Climate-related Disclosures (‘climate standard’) – moving towards equal prominence for sustainability and financial reporting. It will be crucial for HKEX [3] listed issuers to familiarise themselves with the requirements of the climate standard, assuming that the HKEX’s current public consultation [4] to adopt the climate standard progresses unchanged. The HKEX has proposed an effective date of 1 January 2024 [5] in alignment with the ISSB standards. Additionally, the HKEX has proposed a two-year transition period, which is an additional year for issuers to get prepare for the enhanced climate disclosures, compared to the ISSB’s one year transition period [6]. Read on for an overview of the finalised requirements and what key actions companies should take to tackle the upcoming changes. Some areas where the HKEX climate proposals are not fully aligned with the ISSB climate standards have also been highlighted.

Highlights of the ISSB standards

Material information

Similar to the preparation of financial statements, the reporting entity is the same for sustainability reporting. Sustainability reporting also reflects information about broader resources and relationships that the reporting entity depends on across its value chain. Understanding these resources and relationships enables companies to identify and report on all sustainability-related risks and opportunities – i.e. the key factors that will influence the prospects of the business in the short, medium, and long term. Information is considered material to disclose if it would affect investors’ decisions by influencing their assessment of the reporting entity’s prospects. The ISSB’s definition of materiality is aligned with IFRS® Accounting Standards, focusing on the needs of investors and creditors.

Framework of disclosures over the four pillars – aligned with TCFD

The general requirements standard sets out the following framework under four pillars:

- Governance: Processes, controls and procedures that a company uses to monitor sustainability-related risks and opportunities.

- Strategy: Sustainability-related matters that could enhance the business model and strategy over the short, medium and long term.

- Risk management: How sustainability-related risks are identified, assessed and managed.

- Metrics and targets: Information to explain the company’s performance on sustainability-related matters over time.

The climate standard and other future topics or industry-specific standards will build on this framework and include additional specific requirements.

Scalable and proportionate requirements – responding to stakeholders’ feedback

The ISSB have incorporated mechanisms and additional guidance in the final standards to respond to concerns of stakeholders in a less mature phase of sustainability reporting, to support the application of the standards.

Climate scenario analysis

Using the climate scenario analysis requirements as the first example. The ISSB requires companies to use scenario analysis to assess their climate resilience. In making this analysis, companies would:

- have the option of applying temporary transition relief from providing comparative information in the first year of application;

- be given relevant guidance materials; and

- consider all reasonable and supportable information available without undue cost or effort and take an appropriate approach depending on their specific circumstances.

In this area, the HKEX has aligned its proposals to the ISSB’s requirements.

Scope 3 GHG emissions

Although GHG emissions disclosures are a fundamental part of sustainability reporting, the accounting for Scope 3 emissions in a company’s value chain can be a real challenge in terms of data quality and availability. Despite the challenges, the ISSB agreed that Scope 3 emissions disclosures are required because of their importance to investor understanding of transition risk.

Companies would follow guidance in the GHG Protocol Standards to disclose material categories of Scope 3 emissions. Financial institutions would be required to give specific disclosures on financed emissions.

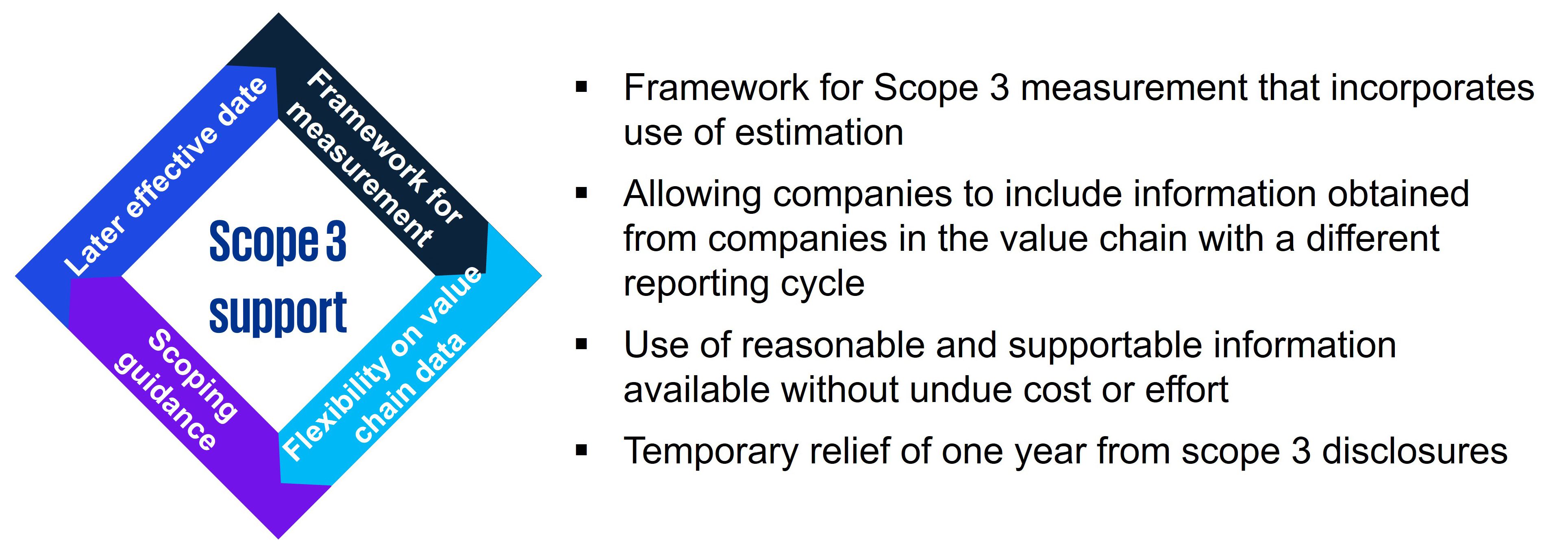

However, in an acknowledgement of companies’ practical concerns, the ISSB agreed the following ways to support better data quality and availability:

Current and anticipated financial effects of sustainability-related risks and opportunities

Users need to understand how sustainability-related risks and opportunities and the strategies that management implements to manage these risks and opportunities may impact the financial statements. This is relevant for both the current period (i.e. financial impacts already occurred) and future periods (i.e. anticipated financial impacts). Users also need to understand the potential financial exposures arising from the company’s business model – e.g. by gaining a greater understanding of the supply chain or other resources and relationships upon which the company relies.

The ISSB requires companies to explain how sustainability-related risks and opportunities impact financial position (e.g. assets, liabilities), financial performance (e.g. revenue, expenses) and cash flows. This information needs to describe the effects identified at the reporting date and those anticipated over the short, medium and long term, and explain how the identified risks and opportunities impact financial planning. When providing information about the current and anticipated financial effects of a sustainability-related risk or opportunity, companies are required to disclose both qualitative and quantitative information.

During the finalisation of the standards, the ISSB considered feedback received and incorporated an alternative disclosure framework for situations where a company is unable to provide quantitative information on individual sustainability-related risks and opportunities. For example, where there is a high level of measurement uncertainty associated with the financial effects impacting usefulness of information. In such situations, a company may provide an alternative qualitative information on the individual sustainability-related risk or opportunity and quantitative information on the combined or aggregated effect of sustainability-related risks and opportunities and other factors.

The HKEX has proposed to only require issuers to describe in qualitative terms the anticipated financial effects of climate-related risks and, if an issuer chooses to, climate-related opportunities information. During the transition period where an issuer has yet to provide disclosures on the anticipated effects of climate-related risks (and climate-related opportunities if disclosed), it should disclose: (i) information, to the extent reasonably available, enabling investors to understand the aspects of the financial statements that are most affected; and (ii) the work plan, progress and timetable for making the required disclosure. The HKEX has provided a relief from quantification of anticipated financial effects and allow issuers to choose whether to disclose climate-related opportunities, due to concerns from stakeholders regarding accuracy and reliability of forward looking information.

Metrics and targets

The objective of metrics and targets disclosures is to help users understand how a company measures, monitors and manages its sustainability-related risks and opportunities. The standards require companies to provide detailed descriptions of the sustainability-related targets it has set, linked to the metrics it uses to measure and monitor them. It also needs to disclose targets that it is required to meet, for example under local regulations. Clear connectivity of disclosures between strategy and the related metrics and targets is important.

The HKEX proposals for metrics and targets are largely aligned with the ISSB’s climate standard except that issuers are encouraged to consider SASB industry metrics, whereas ISSB’s climate standard incorporates the SASB industry metrics as illustrative guidance and under the general requirements, SASB industry standards have to be considered in identifying material information.

Action plan for companies

Determine the impacts for your company

- Identify the differences between the standards you are in scope of, for HKEX listed companies, that will be the requirements of the climate standard, and your existing reported context and create an action plan to fill in the gap. For those which are also listed or have significant operations elsewhere, the applicable standards may go beyond the climate or ISSB standards.

- Understand the processes and resources required to provide detailed information reliably and on time.

Get ready for rapid implementation

- Educate the board, management and those involved in reporting about the company’s exposure to sustainability-related risks and opportunities. Ensure that the company’s strategy for addressing those risks is clear and understood across the organisation.

- The standards support greater transparency around the board’s strategy, including how it is dealing with its most material sustainability-related matters. Ensure that the board are supported by an effective cross-functional collaboration across internal departments.

- Understand your value chain - identify where in the value chain your sustainability-related risks and opportunities arise to understand where you will need to source your data from.

- Engage with current process owners and understand how information is being defined, captured and reported, and where there are control gaps.

- Explore your options to create efficiencies and move certain aspects of the data collections and calculation process into systems, processes and controls that are already related to financial or sustainability reporting.

1 International Sustainability Standards Board

2 2021 United Nations Climate Change Conference, commonly referred to as COP26, was the 26th United Nations Climate Change conference

3 Hong Kong Stock Exchanges and Clearing Limited

4 HKEX Consultation Paper: Enhancement of Current Climate-related Disclosures under the Environmental, Social and Governance Framework

5 The HKEX has proposed an interim provision period of two years, giving HK listed issuers an extra year to apply the climate disclosure requirements compared to the ISSB’s one-year transition relief.

6 The ISSB has provided a ‘climate-first’ option to allow ISSB-adopters to adopt the climate standard first in their first year of adoption of ISSB standards. There are additional transitional reliefs in both the ISSB standards and HKEX proposals which are not discussed in this article. Refer to Proportionality - KPMG Global for more details.