Basic conditions for non-taxation

Under the proposed scheme, onshore equity disposal gains derived by an investor entity would be regarded as non-taxable without the need to conduct the “badges of trade” analysis if the following condition is met:

“The investor entity has held at least 15% of the total equity interest in the investee entity for a continuous period of at least 24 months ending on the date immediately prior to the date of disposal of such interest”.

The scheme offers an alternative option for taxpayers to make a non-taxable claim for their onshore equity disposal gains. Failing to meet the above mentioned conditions under the scheme, taxpayers could still make a capital claim on the disposal gains based on the principles established by case law to ascertain whether income is capital or revenue in nature. For investment funds, an additional alternative option for enjoying non-taxation of their onshore equity disposal gains is the tax exemption under the unified fund exemption regime, provided that the specified conditions under the regime are met.

Eligible investor entities

Eligible investor entities (1) include a legal person (other than a natural person) and an arrangement that prepares separate financial accounts such as a partnership and a trust, and (2) can be a Hong Kong or non-Hong Kong resident.

Eligible equity interests

The scheme is applicable to onshore gains from disposal of different forms of equity interests (e.g. ordinary shares, preference shares3, partnership interests), subject to the exclusions discussed below. The investee entity can be incorporated or established in or outside Hong Kong.

Exclusions from the scheme

The following are the proposed exclusions from the scheme:

- Excluded investor entities – insurers are not an eligible investor entity and gains on disposal of equity interests by an insurance business will not be covered by the scheme.

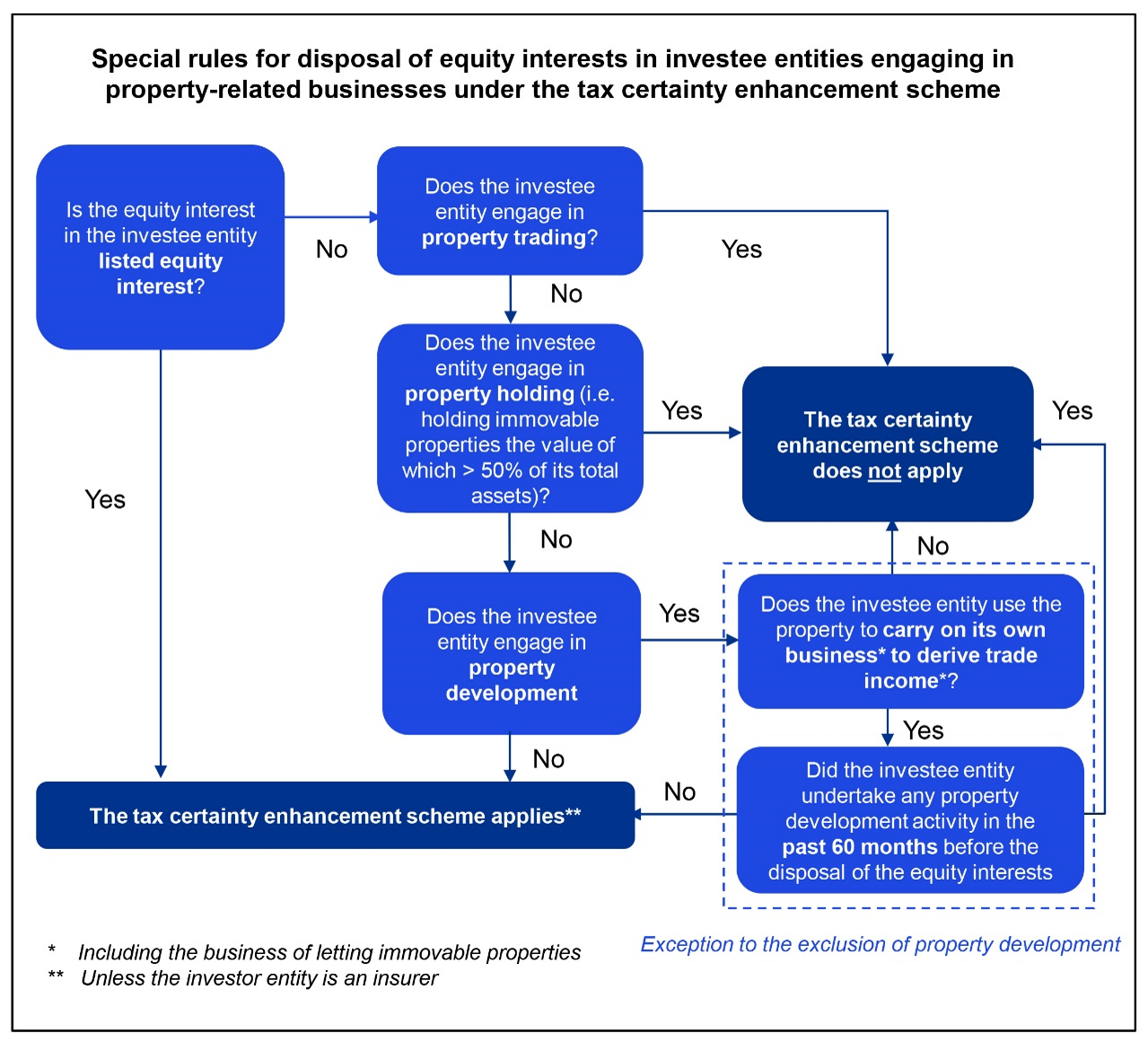

- Excluded equity interests – special rules apply to exclude gains from disposal of equity interests in certain investee entities engaged in property trading, property development and property holding from the scheme. Please refer to the diagram below for details.