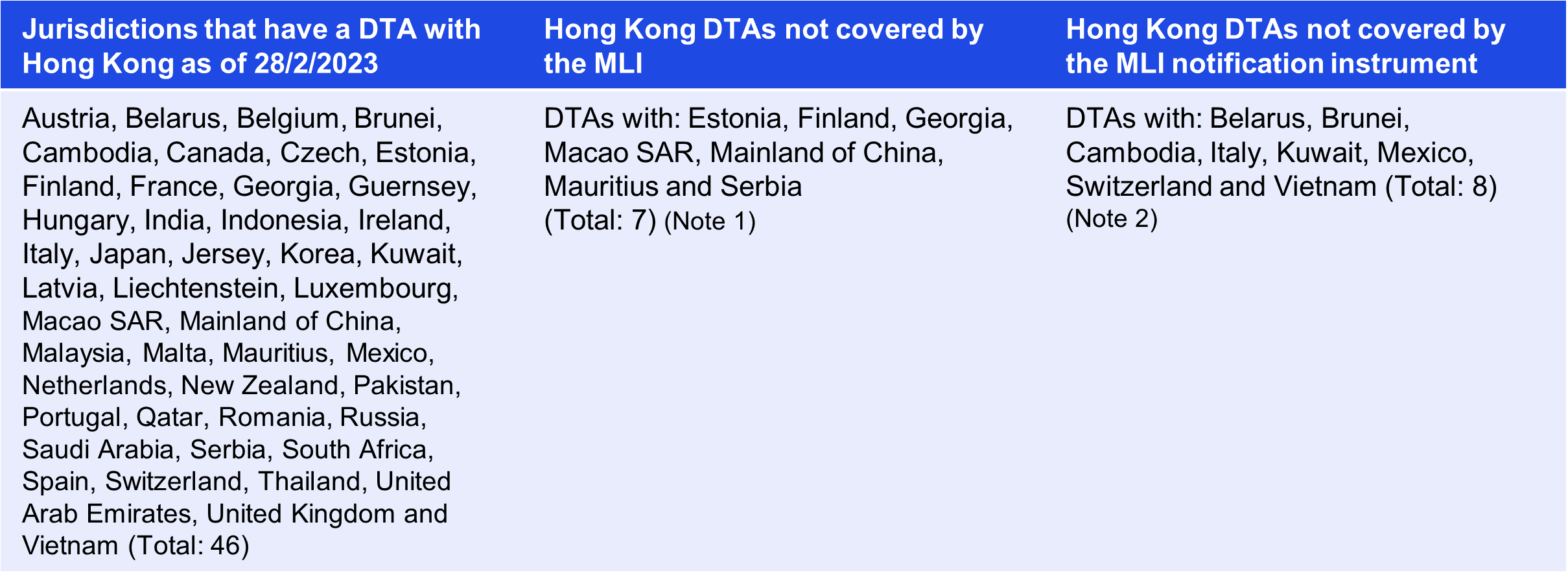

The People’s Republic of China (China) recently deposited a notification with the OECD on behalf of the Hong Kong SAR (Hong Kong), confirming that Hong Kong has completed its internal procedures for bringing into effect the applicable provisions of the Multilateral Convention to Implement Tax Treaty-Related Measures to Prevent BEPS (Multilateral Instrument or MLI) with respect to 31 out of 39 covered Double Tax Agreements (DTAs) of Hong Kong.

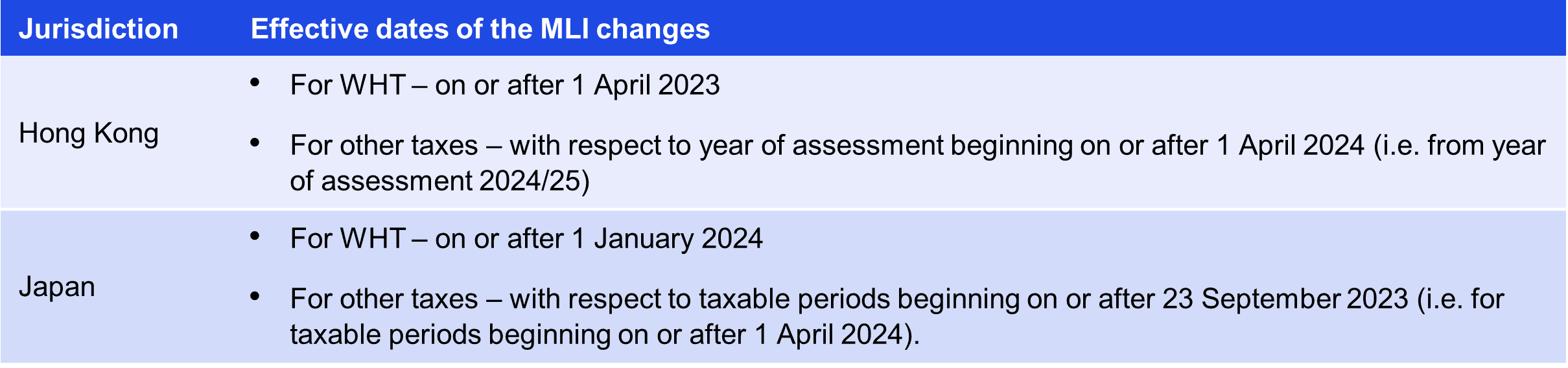

This means that the principal purpose test (PPT) for anti-treaty abuse and other MLI provisions that Hong Kong has chosen to apply will become effective in respect of some of the Hong Kong DTAs from 1 April 2023 (for withholding taxes (WHT)) and year of assessment 2024/25 (for other taxes) in Hong Kong.