The Administrative Guidance on the GloBE Rules

Notable issues addressed in the Administrative Guidance

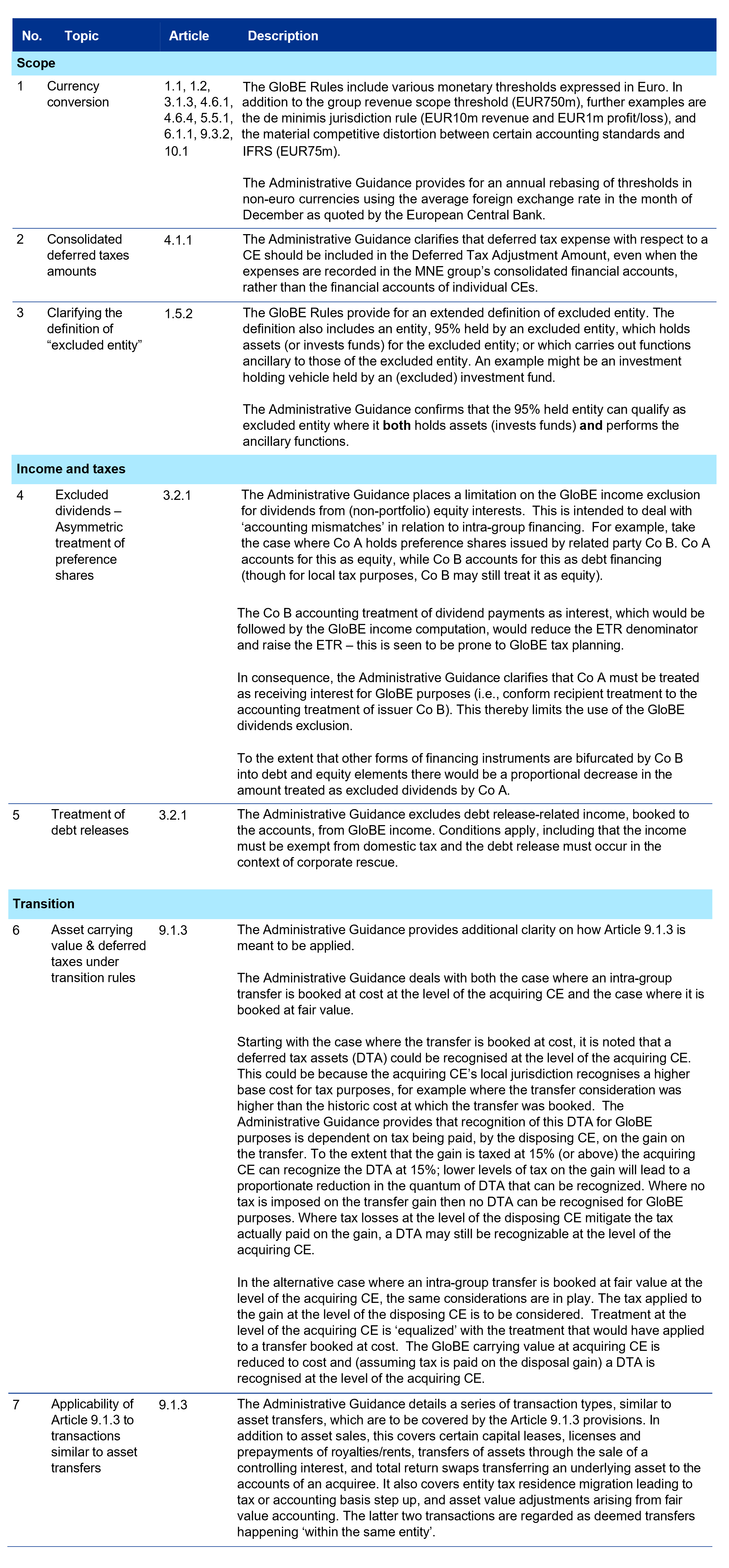

Some of the most notable issues addressed in the Administrative Guidance are:

1. Deemed consolidation rule (Articles 1.2.2 and 10.1)

The GloBE Rules do not only apply to MNE groups which have prepared consolidated financial statements with annual group revenue of EUR750 million or more but also to a collection of entities (related through ownership or control) which would meet the above revenue threshold if they had been treated as a group and required to prepare a set of consolidated financial statements. A question of particular concern to the investment fund industry is whether investment funds, their investees and investment managers would be caught by this deemed consolidation rule, given the nature of their control relationships, and treated as a composite group for GloBE purposes.

The Administrative Guidance clarifies that the deemed consolidated rule will not require the preparation of consolidated financial statements in a case where the Authorized Financial Accounting Standard explicitly permits non-consolidation. For example, the consolidation exemption for investment funds under HKFRS 10 will be respected and the deemed consolidation rule does not apply. However, unconsolidated investment arrangements used by say, wealthy families to invest in various businesses could be caught by the deemed consolidation rule. The two illustrative examples in the Administrative Guidance set out the cases in which the deemed consolidation rule does not apply (i.e. where an investment entity is covered by IFRS 10) and would apply (i.e. where a privately held investment holding company is not covered by IFRS 10).

2. Excess Negative Tax Carry-forward (Articles 4.1.5 and 5.2.1)

The GloBE Rules contain a provision, in Article 4.1.5, which could lead to the imposition of GloBE top-up tax in a year in which a GloBE loss arises. The Administrative Guidance now adapts the application of Article 4.1.5. Rather than imposing top-up tax in a GloBE loss year, an Excess Negative Tax Expense amount is calculated and carried forward. This would then reduce the effective tax rate (ETR) of a subsequent profitable year, potentially leading to the payment of further top-up tax at that time.

The same mechanism is used to avoid the possibility of top-up tax rates higher than 15% by modifying the application of Article 5.2.1. In a year where the GloBE ETR is determined to be negative in a jurisdiction, an Excess Negative Tax amount is calculated and carried forward. This would reduce the ETR in a later year.

3. Equity gain or loss inclusion election (Article 4.1.3(a))

Under the GloBE Rules, profits or losses accounted for under the equity method of accounting are excluded from the ETR denominator and current tax expense on such profits is excluded from the ETR numerator. However, the GloBE Rules do not explicitly provide for the exclusion of any current tax benefit arising from losses (as such losses reduce taxable income in the owner’s jurisdiction but not its GloBE income) accounted for under the equity method.

In this regard, the Administrative Guidance provides an election to remedy the distortive effects of a loss that is accounted for under the equity method (and therefore removed from the denominator of the ETR calculation) but nevertheless reduces Adjusted Covered Taxes because the loss is deductible for local tax purposes. More specifically, in-scope entities can make a 5-year election to include gains, profits and losses earned via equity method accounted investments (and other Ownership Interests) in GloBE income, subject to certain exclusions for items not subject to tax. Where this election is made, all associated current and deferred tax expenses and benefits are included in Adjusted Covered Taxes.

4. Excluded equity gain or loss and hedges of foreign equity investments (Article 3.2.1)

The GloBE rules provide that gains/losses on the disposal of (non-portfolio) equity interests will be excluded from GloBE income. The exclusion also extends to fair value gains/losses on such equity interests, and profit/loss from ownership interests which are subject to equity method accounting. To the extent that such equity interests are denominated in a currency different from the functional currency of the holding entity, the MNE group may choose to use hedging instruments. The Administrative Guidance provides a 5-year election to treat gains/losses on the hedging instruments themselves as also being excluded gains/losses.

5. Simplification for short-term portfolio shareholdings (Article 3.2.1)

The GloBE Rules provide a GloBE income exclusion for dividend income from equity interests that are not short-term portfolio holdings (i.e. less than 10% ownership interests and holding for less than one year). This then places a burden on in-scope MNEs to prove equity holding periods. As a simplification, the Administrative Guidance now provides a 5-year election to include all dividends in GloBE income. The election is open to all MNE groups but it is expected that it will largely be used by insurance companies.

6. Design of the Qualified Domestic Minimum Top-up Taxes (QDMTT) (Article 10.1)

The Administrative Guidance reiterates that in order for a jurisdiction’s minimum tax to qualify as a QDMTT, it must provide for outcomes consistent with the GloBE Rules, which generally requires that any variations in the QDMTT should not produce a lower tax liability when compared with the GloBE Rules. In addition, the Administrative Guidance identifies elements of a QDMTT that would need to be identical with the GloBE Rules and certain other elements that may vary.

For example, variations from the GloBE Rules may be permissible where particular GloBE provisions would be ‘redundant’ in light of the jurisdiction’s tax system (e.g. where a country’s Corporate Income Tax (CIT) rules do not provide a tax deferral for reorganizations, the corresponding Chapter 6 GloBE Rules can be omitted from that jurisdiction’s QDMTT). In addition, certain variances from the GloBE Rules which would systematically increase the tax liability under the QDMTT can be acceptable, (e.g. lowering or dropping the Substance-based Income Exclusion (SBIE) provided for under the GloBE Rules).

The Peer Review process will undertake a detailed and case-by-case evaluation of the QDMTT rules proposed by a jurisdiction, considering such alongside the domestic CIT rules, to see if omission/adaptation of any GloBE provisions is acceptable.

There are also some notable clarifications on the overall operation of the QDMTT:

- The Administrative Guidance reinforces that a QDMTT can be based on an accounting standard that differs from the one used in the consolidated financial statements of the Ultimate Parent Entity (UPE), assuming the accounting standard is of an “Acceptable” or “Authorised” nature.

- The Administrative Guidance clarifies that the QDMTT ETR numerator for the relevant jurisdiction would not include taxes paid by a shareholder of an entity located in such jurisdiction under a controlled foreign corporation (CFC) regime that would otherwise be allocable to such subsidiary under the GloBE Rules. Such rule would also apply in respect of any taxes paid by an owner of a permanent establishment located in such jurisdiction. Instead, the relevant CFC regime may give a credit for a QDMTT imposed on the CFC. As such, this would give the QDMTT imposing jurisdiction priority taxing rights over all others. Where CFC rule applying jurisdictions land in practice on this crediting point will be an area of intense interest going forward.

- The QDMTT developed by a jurisdiction needs to include the safe harbours developed by the OECD. Otherwise, an MNE would be forced to perform complex calculations for purposes of calculating tax liability under the QDMTT, which they are excused from if the GloBE Rules applied.

- A qualified QDMTT must be imposed on 100% of the tax-up tax calculated for local constituent entities (CEs). It cannot be limited to the ownership percentage of the UPE in those CEs. As such, QDMTT could lead to more top-up taxes than if the IIR at the UPE level applied in such jurisdiction.

- Elections under the GloBE Rules generally need to be provided for under a QDMTT, with certain exceptions (e.g. where the elections are irrelevant in the context of the local CIT law). An MNE group would need to make the same elections for QDMTT and GloBE rule purposes.

- A QDMTT must apply the same transition rules provided for under the GloBE Rules or otherwise the QDMTT will not reliably provide for outcomes consistent with the GloBE Rules.

The members of the Inclusive Framework on BEPS have not yet agreed on a QDMTT safe harbour and work will continue on its development. In its absence, QDMTT reduces the amount of top-up tax that arises under the GloBE Rules (i.e. a credit mechanism) while a safe harbour would switch this to an exemption mechanism. Practically, in the absence of a QDMTT safe harbour, MNEs may be required to compute the ETR for a given jurisdiction twice: first for purposes of the QDMTT (potentially using the local accounting standard) and again for purposes of the IIR/UTPR (using the consolidated financial accounting standard of the UPE).