With the People’s Republic of China (China) depositing its instrument of approval for the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent BEPS (Multilateral Instrument or MLI) with the OECD in May 2022, the Hong Kong Special Administrative Region (Hong Kong) is one step closer to implementing the MLI in Hong Kong.

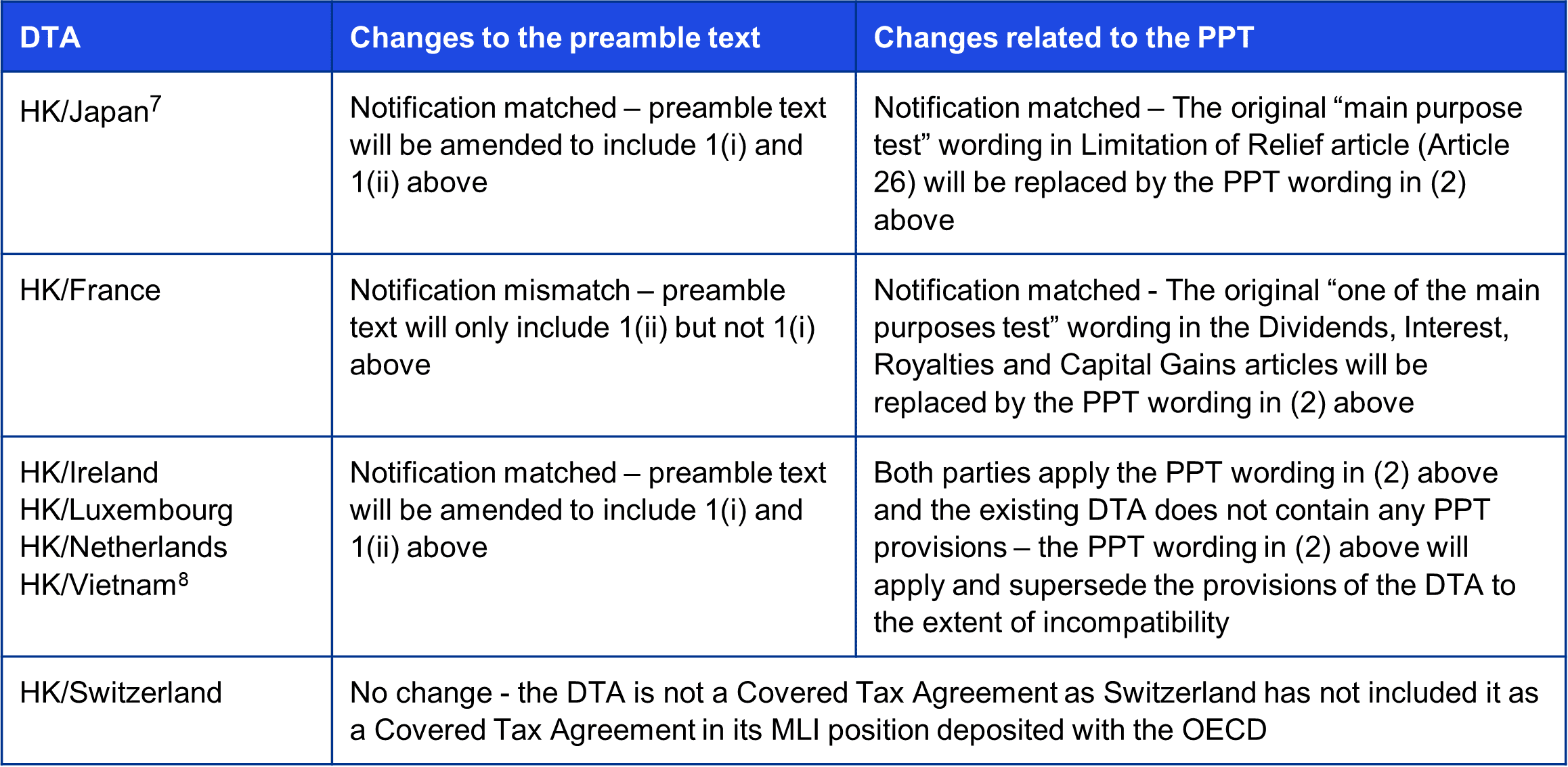

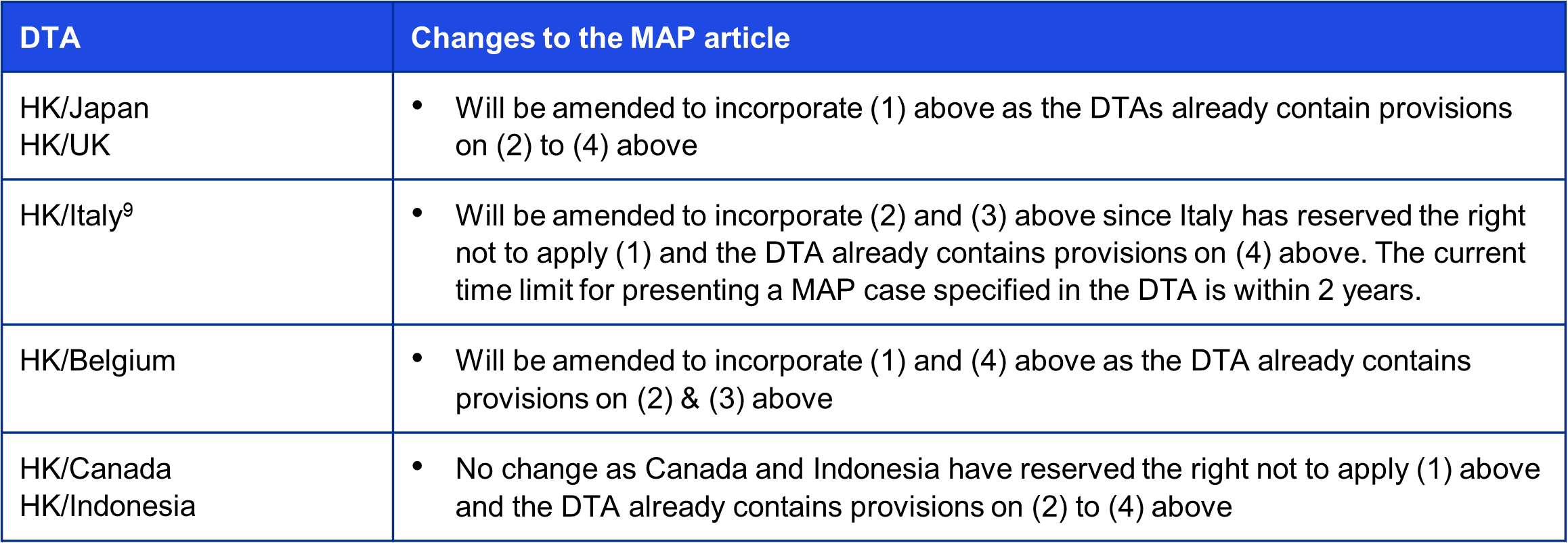

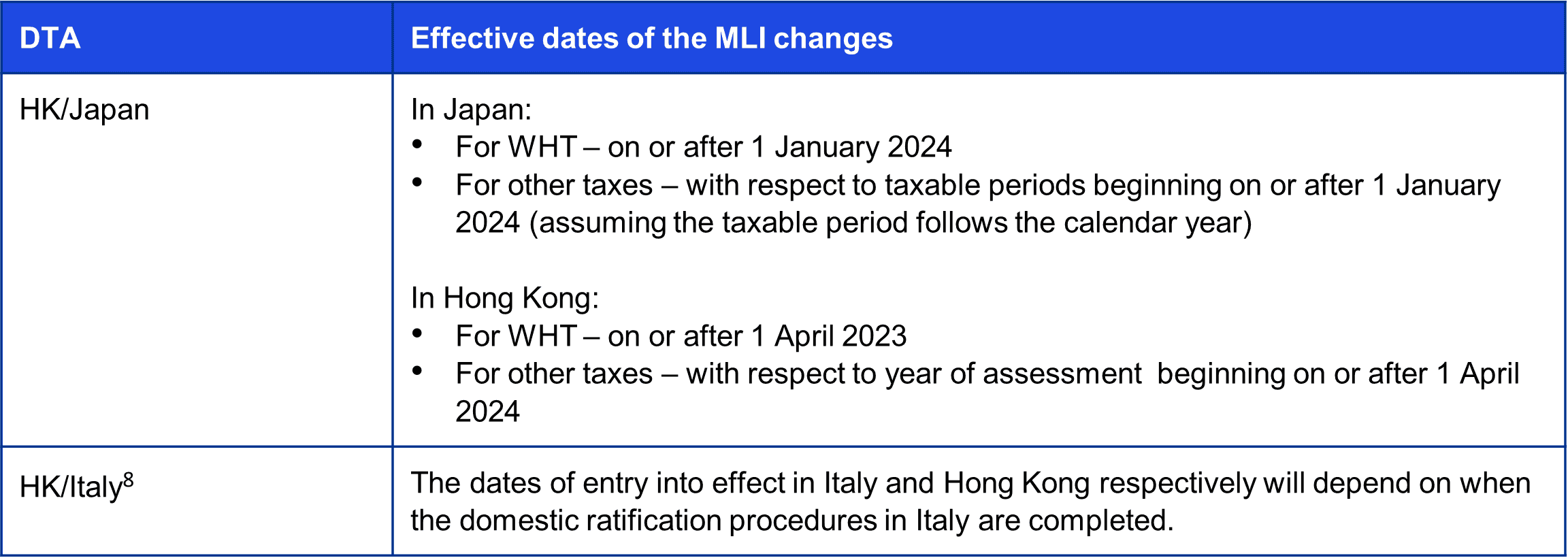

When the MLI enters into effect in Hong Kong, a number of existing Double Tax Agreements (DTAs) of Hong Kong will be modified by the MLI to incorporate the tax treaty related BEPS measures recommended by the OECD under BEPS Action 6 (preventing tax treaty abuse) and Action 14 (making dispute resolution more effective). Both Actions 6 and 14 are a minimum standard under the BEPS 1.0 Action Plan.

In this news alert, we summarise the changes that will be brought by the MLI to Hong Kong’s existing DTAs, the potential impact on Hong Kong businesses and how they should prepare for the changes.