Assess your fund's sustainability performance

To allow you to measure the impact of your portfolio, KPMG and the Cambridge Institute of Sustainability Leadership (CISL) have developed a software-as-a-service (SaaS) tool – the Sustainable Investment Framework Navigator (SIFN). This online tool can assess investment portfolios based on a common impact standard and provide asset managers and investors with insight into real-world sustainability impacts of investment portfolios.

The ultimate goal of the co-operation between KPMG and CISL is to create a tool by which all investment portfolios can be assessed using a common impact standard so that asset managers and investors can make informed choices with their investments.

Request a demo of our Sustainable Investment Framework Navigator and learn more about how this plug & play tool can help you visualize the impact of your portfolios.

Understanding the non-financial impacts of our investment decisions is critical if we are to transition the wealth & asset management industry into a positive and sustainable force for good. Measurement of the social and environmental externalities of our investment choices is complex and fraught with challenge, but our SIFN tool can help.

Asset managers face increasing demand and challenge in impact reporting

Investors, regulators and other stakeholders are becoming increasingly aware of the impact that investment choices have on society. They are increasingly demanding that asset managers intensify their efforts to provide insight into their level of contribution to sustainable development. This results in spectacular growth in environmental, social and governance (ESG) integrated and responsible investment products.

A growing number of asset managers have begun reporting on the impact of their holdings. This commonly includes reporting on impacts associated with their investments, including carbon emissions and jobs created. However, many asset managers have found it difficult and time-consuming to report on the full impact of their investments due to the lack of a standardised methodology and limited availability of reliable data.

How can the SIFN help you

The Navigator offers financial institutions and investors a simple and transparent method of understanding their environmental and social impact. There is an ESG data library inside the Navigator provided by an external data provider which covers the data needed for the assessment of more than 10,000 listed companies.

The Navigator can be used for:

- Gaining insights into the current impact of an investment portfolio, and to track changes in its impact over time

- Reporting the impact of an investment portfolio to both internal and external stakeholders

- Assessing asset managers according to the impact of their investment portfolio, instead of strictly focusing on the more traditional approach

This framework clearly demonstrates the ILG's mandate to provide member-driven, solution-based outputs backed by world class academic expertise. In co-developing and piloting the framework, the Group's work will help the market navigate a key sustainable investment challenge: the ability to communicate to investors, social and environmental outcomes from investment portfolios.

Creating a standard together to assess fund performance

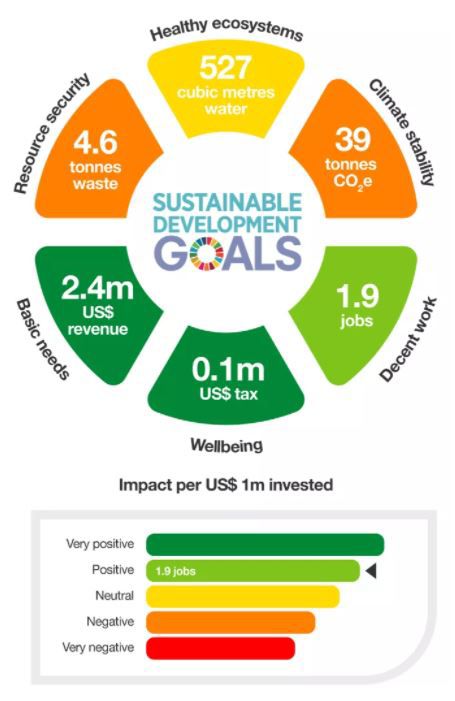

Based on data that is available from recognized data providers, the Framework assesses the absolute performance of a fund, as well as its relative performance in comparison to a benchmark. It comprises a set of six themes, which investors can use as proxies for the performance of their investments against the full suite of United Nations Sustainable Development Goals (SDGs).

CISL’s framework offers a solution to this problem in the form of six simple quantitative tests based on readily available data. Our collaboration with KPMG will help us advance the framework in the future as new data sources become available, including in the important area of social impact.

The Framework provides a dashboard that enables the asset manager or owner to understand and assess the performance of a fund, as well as compare it to others. The outcome highlights the relative performance of a fund portfolio in comparison to a specified benchmark.

In brief, the six key themes in the Framework look at the following criteria:

- Climate stability: the global effort to curb the Earth’s temperature rise, and an asset’s alignment with the Paris consensus to hold temperature rises ‘well below’ 2°C.

- Healthy ecosystems: the maintenance of ecologically sound landscapes and seas for people and nature.

- Resource security: the preservation of natural resources through efficient and circular use.

- Basic needs: the provision of critical services to all in society, including low-income people with the aim of helping them escape poverty.

- Wellbeing: enhanced health, education, justice and equality of opportunity for all.

- Decent work: the creation of secure, socially-inclusive jobs and working conditions for all.

The University of Cambridge Institute for Sustainability Leadership (CISL) is a globally influential Institute developing leadership and solutions for a sustainable economy. We believe the economy can be 'rewired', through focused collaboration between business, government and financial institutions, to deliver positive outcomes for people and the environment.

For over three decades we have built the leadership capacity and capabilities of individuals and organisations, and created industry-leading collaborations to catalyse change and accelerate the path to a sustainable economy. Our interdisciplinary research engagement builds the evidence base for practical action.

The Investment Leaders Group (ILG) is a global network of pension funds, insurers and asset managers committed to advancing the practice of responsible investment. It is a voluntary initiative, driven by its members, facilitated by the Cambridge Institute for Sustainability Leadership (CISL), and supported by academics from the University of Cambridge.

The ILG’s vision is an investment chain in which economic, social and environmental sustainability are delivered as an outcome of the investment process as investors go about generating robust, long-term returns.