Now in its 13th edition, the biannual KPMG Survey of Sustainability Reporting for 2024 analyzed data from 5,800 companies, reaffirming its status as the most comprehensive edition in the series, alongside the 2022 survey. The survey is based on research by KPMG professionals across 58 member firms, who analyzed the financial, integrated, and ESG/sustainability reports of the 100 largest companies in their respective jurisdictions. We hope this report brings you meaningful insights!

Key global findings

- For almost all G250 companies, reporting on ESG and sustainability has become part of business as usual

- Although sustainability reporting under the EU’s Corporate Sustainability Reporting Directive (CSRD) is not yet mandatory, some companies are already reporting material topics in line with the European Sustainability Reporting Standards (ESRS), and nearly half of European companies are disclosing information using the EU Taxonomy

- Double materiality is now used by half of the largest companies

- Voluntary guidelines and standards remain widely used, with three-quarters of G250 companies using them and nearly as many in the N100 groups

- Although growth has been slower in the last two years, around half of both the G250 and N100 groups now report on biodiversity

- Nearly three-quarters of G250 companies report climate risks in line with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations

Key findings for Belgium

Sustainability reporting trends

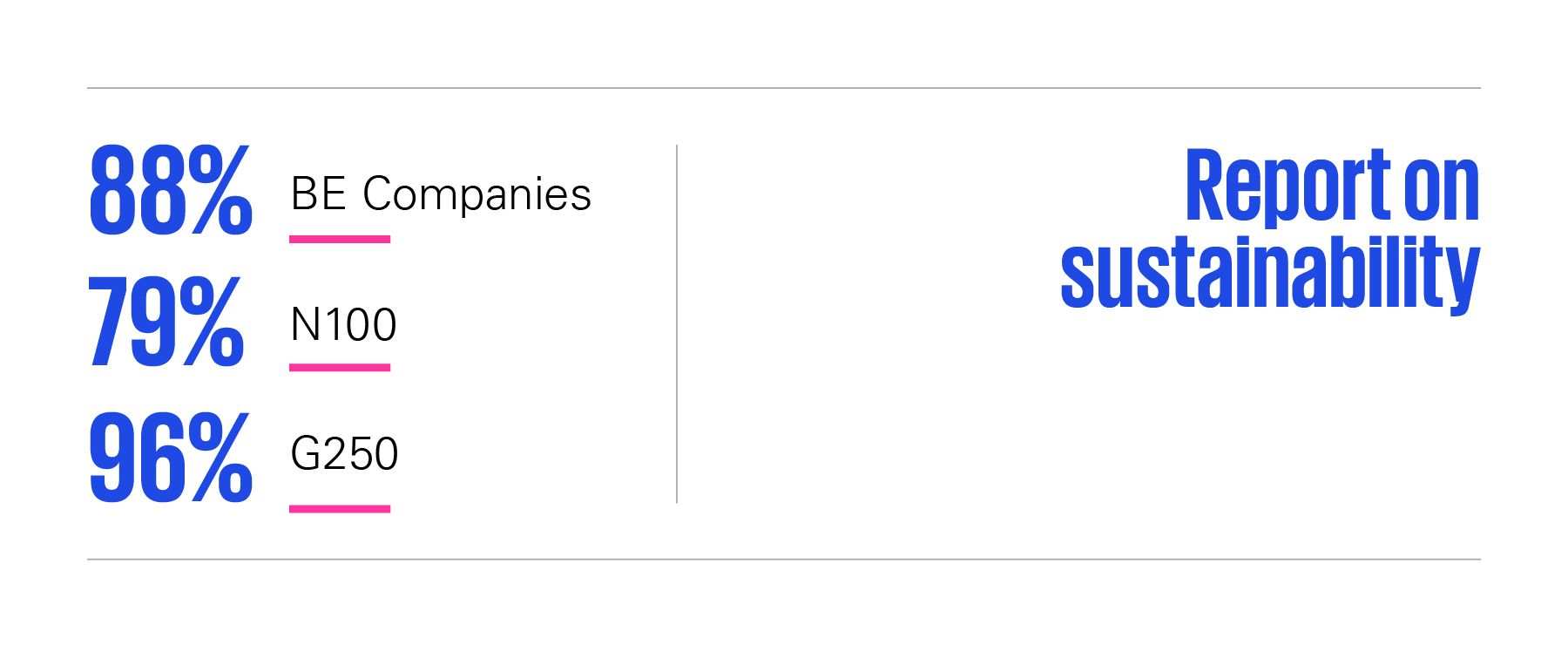

Sustainability reporting saw significant growth, with 88% of companies disclosing their performance in this area. This marks a 4% increase compared to the findings from the 2022 survey and exceeds the global N100 average of 79%, though it remains well below the G250 average of 96%.

A notable shift in reporting methods was observed, as 57% of companies published standalone sustainability reports, a decrease from 64% in the 2022 survey. This trend aligns with an increased integration of sustainability information into annual reports, now included by 71% of companies, up from 68%. Meanwhile, 14% of sustainability-reporting companies state that they follow the International Integrated Reporting Framework or guidance from the IIRC, a figure that has remained stable since the 2022 survey.

Adoption of guidelines and standards

Despite the upcoming adoption of the CSRD and ESRS in Belgium, a large portion of Belgian N100 companies still apply voluntary reporting frameworks. 38% of companies state in their reporting that they adhered to GRI Standards, marking a 6% increase since the 2022 survey. References to SASB Standards also rose by 4%, reaching 23%, while 2% cited stock exchange guidelines, a new development. These trends underscore ongoing efforts to enhance the rigor and comparability of sustainability reporting, though significant gaps remain. Notably, companies will need to comply with mandatory sustainability reporting standards (ESRS) in the coming years. Despite the CSRD not yet being applicable, some companies already referenced CSRD and ESRS in their 2023 reporting.

Assurance of sustainability information

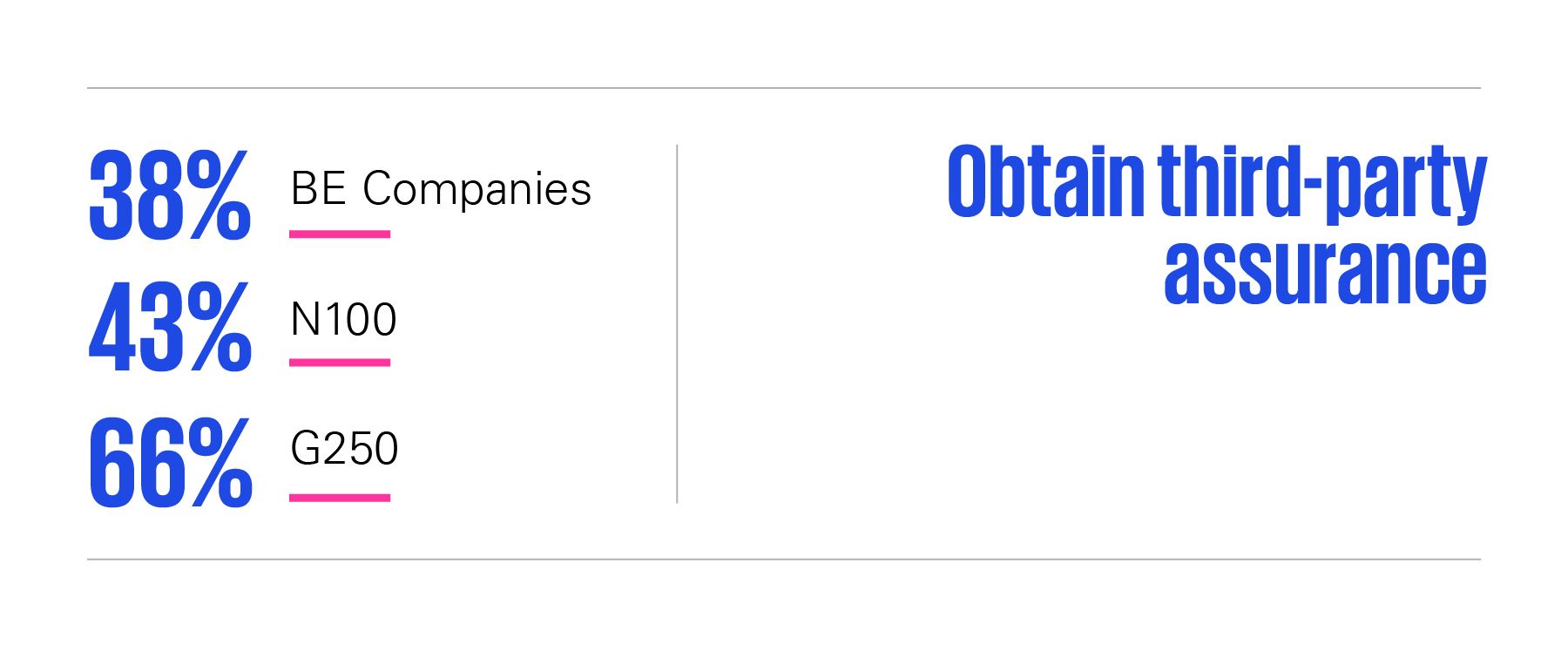

Formal assurance of sustainability information experienced a notable rise with 38% of companies obtaining third-party assurance, a 13% increase from the 2022 survey, with 22% focusing on specific indicators. 33% received limited assurance, and a mere 1% achieved reasonable assurance, while for 3% the level of assurance obtained was a combination of both reasonable and limited assurance. These rates still lag behind the N100 average of 43% and the G250 rate of 66%, highlighting room for improvement in the verification of sustainability information.

To meet the ever-growing request from stakeholders and investors for the availability of reliable, robust, and comparable sustainability information, assurance rates should further increase. Additionally, for companies in scope of the upcoming CSRD, mandatory assurance on the sustainability information reported will be applicable.

Materiality considerations in reporting

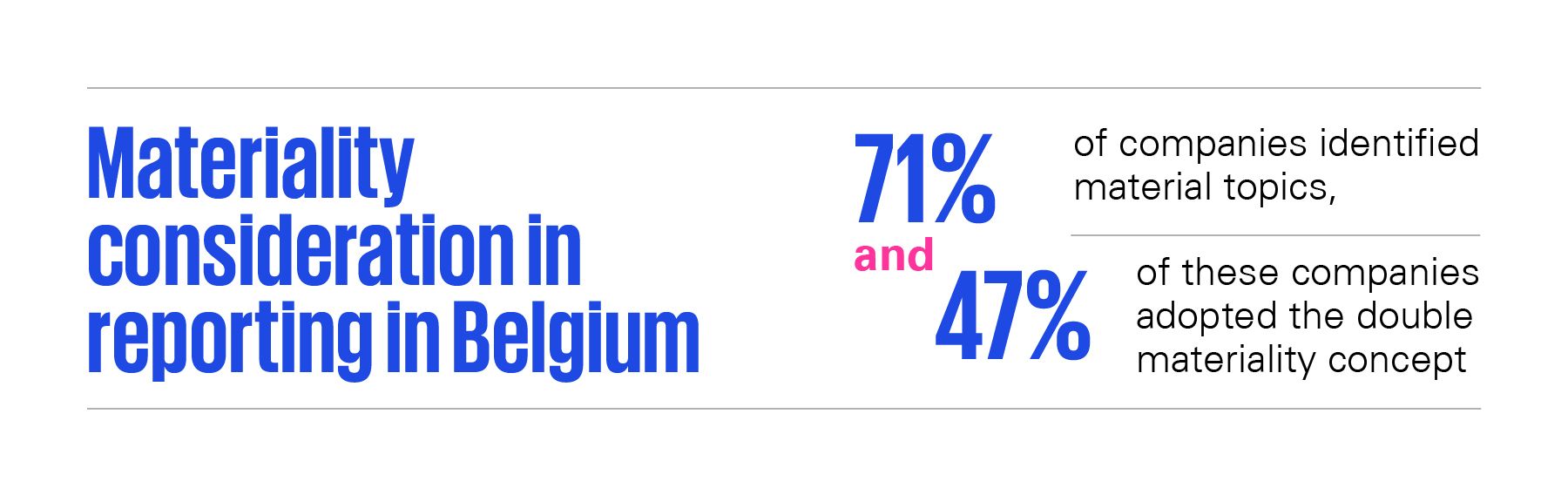

In defining its reporting scope and content, 71% of companies identified material topics, which is a significant 20% jump from 2022. Among them, 20% applied impact materiality, assessing the company's impacts on society and the environment, while 4% considered financial materiality, addressing how sustainability issues affect the company’s financial performance.

Notably, 47% of Belgian N100 companies already adopted the double materiality concept as introduced by the CSRD, combining both the impact and financial materiality perspective, reflecting a sophisticated and comprehensive approach to materiality assessment.

Sustainable Development Goals (SDGs)

Despite a slight decline, 64% of companies reported on specific SDGs, remaining above the global N100 average of 59% but below the G250 benchmark of 71%. A mere 12% provided insights on both positive and negative SDG impacts, while 20% identified relevant SDG targets, a 7% decrease from the 2022 survey. This indicates a need for greater alignment between corporate activities and global goals and targets, such as the SDGs.

Climate-related risks and targets

Recognition of climate change risks reached 62%, a 10% increase from the 2022 survey, with most companies offering narrative descriptions of potential impacts (56%). A smaller segment (6%) adopted scenario analysis and alignment with TCFD recommendations grew to 28%. Companies increasingly recognize that they have a role to play in climate change mitigation and achieving global climate goals. 81% of companies report on carbon reduction targets (up 17%), surpassing the global N100 average of 63%, though still trailing the G250 average of 91%. Furthermore, 53% have adopted or plan to adopt science-based targets, with 35% committing to SBTi net-zero targets, a sharp rise from 8% reported in the 2022 study.

Biodiversity and ESG risks

Biodiversity loss was recognized by 26% of companies as a risk to their business, slightly up from the 2022 study but below the global N100 and G250 averages. Regarding broader ESG risks, 62% of companies in Belgium identified climate change as a business risk, while 53% acknowledged social risks, and 39% addressed governance risks (lower than the N100 global average of 51% and significantly below the G250 percentage of 75%). Although there is a growing acknowledgement of ESG-related business and financial risks, integration of environmental, social and governance risks into companies’ risk management needs further attention. The CSRD and ESRS will require companies to assess their ESG risks and opportunities, and report on relevant disclosure requirements in their sustainability statement.

Governance and leadership in ESG

Sustainability governance is gaining increasing attention, with 53% of Belgian N100 companies now assigning a board or leadership team member to oversee sustainability matters—a notable 23% increase from the 2022 study. The Belgian percentage is higher than the global N100 average (45%) and at the same level as the G250 (54%). Additionally, 37% of companies indicate that sustainability-related performance is integrated into executive or board compensation and incentive schemes, surpassing the global N100 average of 29% but still just below the G250 percentage (40%). These developments highlight growing accountability and integration of ESG considerations into corporate leadership structures.Top of Form

Towards and beyond mandatory reporting

With mandatory reporting requirements just around the corner, Belgian companies are increasingly communicating on their sustainability strategy and performance. This is demonstrated by the rise in reporting rates, the increase in application of recognized reporting standards including materiality considerationsAs the CSRD and ESRS continue to unfold within Europe, introducing extensive reporting requirements and mandatory assurance, companies will still need to take significant steps in meeting these regulatory challenges and informational needs of their stakeholders. Investors and other stakeholders are expecting companies to reflect how their business is contributing to tackle global ESG challenges and how they are creating long-term value. Transparent, robust, and reliable sustainability information will soon be part of general-purpose corporate reporting, driving stakeholder decision-making. Companies who are taking this seriously and rise beyond compliance, will be able to demonstrate their added value to society ensuring their business remains future-proof and resilient to the environmental, societal and governance challenges the world is facing today.

Explore

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia