To compensate for the potential loss of information resulting from the mandatory deferred tax accounting relief, companies are required to provide new disclosures in their financial statements from 31 December 2023.

For an illustration of the disclosures in the annual financial statements, see Note 14 in our Illustrative disclosures – Guide to annual financial statements. For more detail about the disclosures in the interim financial statements, see Interim reporting.

Mandatory deferred tax accounting relief

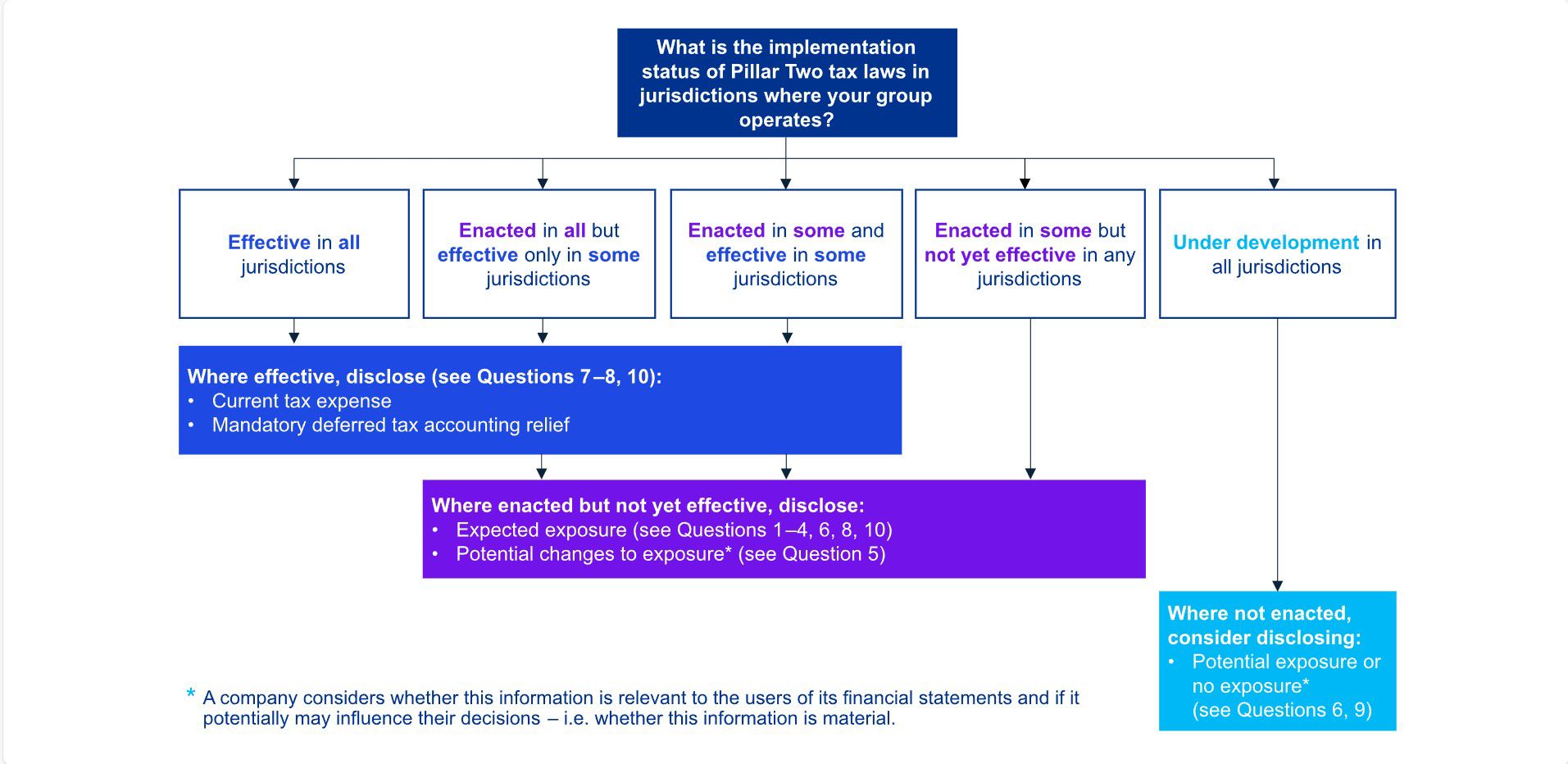

Once the tax law is enacted in at least one jurisdiction in which the group operates, a company discloses that it has applied the mandatory deferred tax accounting relief.

Exposure to top-up tax

A company discloses known information (or information it can reasonably estimate) that will help users of its financial statements understand its exposure to Pillar Two taxes at the reporting date.

This information does not need to reflect all of the specific requirements in the legislation – companies can provide an indicative range. Disclosures may include the following.

- Qualitative information: How the company is affected by Pillar Two taxes and in which jurisdictions the exposure arises – e.g. where the top-up tax is triggered and where it will need to be paid.

- Quantitative information: The proportion of profits that may be subject to Pillar Two taxes and the average effective tax rate applicable to those profits, or how the average effective tax rate would have changed if Pillar Two legislation had been effective.

If information is not known or cannot be reasonably estimated at the reporting date, then a company discloses a statement to that effect and information about its progress in assessing the Pillar Two tax exposure.

For an illustration of these disclosures, see Note 14(J) in our Illustrative disclosures – Guide to annual financial statements.

No – a company can provide qualitative disclosures (see Question 1 for more detail).

If information is not known or cannot be reasonably estimated at the reporting date, then a company discloses a statement to that effect and information about its progress in assessing its Pillar Two tax exposure.

It depends – companies need to engage with tax specialists to determine if the impact of adjustments for GloBE2 tax rules may be material, considering their specific facts and circumstances.

The objective of the disclosure is to help users of a company’s financial statements understand the company’s exposure to Pillar Two taxes at the reporting date.

IAS 12 Income Taxes does not specify how a company determines its potential exposure to top-up tax – i.e. whether to apply GloBE tax rules or use unadjusted IFRS financial statements. However, it notes that information about a company’s exposure does not need to reflect all of the specific requirements in the legislation.

A company may need to consider whether adjustments for GloBE tax rules may have a material impact in its specific circumstances – i.e. whether the resulting information may potentially influence the decisions of the users of its financial statements.

2023 data – actual, estimated or a combination of both.

Before the new tax rules become effective, a company is required to disclose information about its potential exposure to Pillar Two taxes at the reporting date. This means that it provides disclosure on what its hypothetical exposure would be if the new tax laws were effective at 31 December 2023 and its 2023 profits were subject to top-up tax.

If a company performs the impact assessment before 31 December 2023, then it may use some estimated 2023 figures. For example, if a company performs its assessment in November 2023, then it can use actual Q3 2023 and estimated Q4 2023 figures in determining its disclosures.

Yes – if that additional information is relevant to users of the company’s financial statements. Possible expected changes include the following.

Transition to Pillar Two taxes

Different countries may be at different stages in implementing the new tax laws – e.g. the laws may become effective for some countries in 2024, and in 2025 or later for others. For example, if the new tax laws become effective in the ultimate parent’s jurisdiction in 2025 and in the intermediate parent’s jurisdiction in 2024, then the intermediate parent company may be liable for the top-up tax in 2024 but not in 2025 or going forward.

Different Pillar Two tax mechanisms – IIR3 , UTPR4 and QDMTT5 – may also become effective at different dates. As a result, different companies in the group may be liable for the top-up tax during the transition period.

For example, UTPR may be enacted at 31 December 2023 in one of the jurisdictions which the group operates with an effective date of 2025. However, one of the low-tax jurisdictions in which the group operates plans to introduce its own local top-up tax – QDMTT – in 2024 with an effective date of 2025 as well. In this example, the group company that is potentially liable for the UTPR based on the tax laws at 31 December 2023 will not need to pay it in 2025. This additional information may be relevant to users of the group’s financial statements.

Changes in tax strategies

Some companies may be considering changing their tax strategies – e.g. to forgo tax deductions that reduce their effective tax rate below 15 percent. As a result, they will not trigger the top-up tax in the future.

As discussed in Question 4, in its 2023 financial statements a company needs to disclose its potential exposure to top-up tax using 2023 data. However, it may want to disclose additional information about potential changes to its tax strategy if it considers this relevant to users of its financial statements.

It depends – it is not only a quantitative but also a qualitative assessment.

Materiality is assessed from the perspective of the users of the financial statements – i.e. whether the information could influence their decisions.

A company may need to engage with its investors to determine what information is relevant for their analysis.

Only two disclosures are required once the new tax rules are effective in all jurisdictions in which the group operates:

- mandatory deferred tax accounting relief; and

- current tax expense related to top-up tax.

However, during the transition period (see Question 5) a company may need to provide some additional disclosures.

In short – the company’s own exposure.

In our view, in determining which disclosures to provide, a company should consider the information relevant to the users of a specific set of financial statements so that they understand the company’s potential exposure arising from the new tax laws.

For example, information about an individual company’s exposure may be relevant if it expects to be liable for, or to trigger, top-up tax (either during the transition period or when the new rules are ‘business as usual’ around the world).

Conversely, if a group company expects to be neither liable for nor trigger top-up tax, then disclosures on other group companies’ exposure to Pillar Two taxes in its separate financial statements may obscure the relevant information.

Likely – as investors need relevant information even before the new tax rules are finalised.

IAS 12 requires disclosures only when the new tax laws are enacted. However, companies still need to consider whether to provide disclosures on their exposure to top-up tax before they are enacted because investors might expect companies to assess the potential impacts. [IAS 1.17(c)]

No – if there is no exposure to disclose.

The disclosures are intended to help users of a company’s financial statements understand its exposure to the top-up tax.

A company’s assessment of its exposure to top-up tax may be complex and tax specialists may need to be involved. If a group company expects neither to be liable for top-up tax nor to trigger it either during the transition period or when the new rules are ‘business as usual’ around the world, then it has no exposure to disclose.

1 The requirements in the accounting standard apply to tax laws that are enacted or substantively enacted. For the ease of reference in this digital guide, ‘enacted’ is intended to refer to both ‘enacted’ and ‘substantively enacted’.

2 GloBE – global anti-base erosion.

3 Income Inclusion Rule.

4 Undertaxed Payment Rule.

5 Qualifying Domestic Minimum Top-up Tax.

Explore

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

© 2026 KPMG IFRG Limited, a UK company, limited by guarantee. All rights reserved.