Companies and organizations in all business lines, industries and geographies, are witnessing the rapidly rising importance of generating measurable economic benefits from available data sources (‘data monetization’). Nowadays, larger amounts of data are being generated, captured and analyzed than ever before. Together with technological advancements like robotics, artificial intelligence (AI) and machine learning, this data is analyzed mainly for two purposes: to increase efficiency and/or effectiveness of operational processes (i.e. operational analytics), or to gain a better understanding of customers’ behavior and preferences (i.e. customer analytics).

The use of advanced data analytics & technology has been much less apparent in the area of fraud risk management and compliance, where the main objective is to identify abnormalities that could be indicative of fraud and/or compliance infringements. At the same time, we see that technological innovations and growing regulatory demands create new uncertainties. As a result, those charged with preventing, detecting and investigating fraud and compliance issues, are increasingly coming under pressure to adapt their way of working in order to align with these changes. With this in mind, we should explore how data analytics techniques used for business optimization, can also be applied to assess and manage fraud risks and compliance issues.

Gain (unexpected) insights by proactively applying a ‘worst case scenario’ perspective

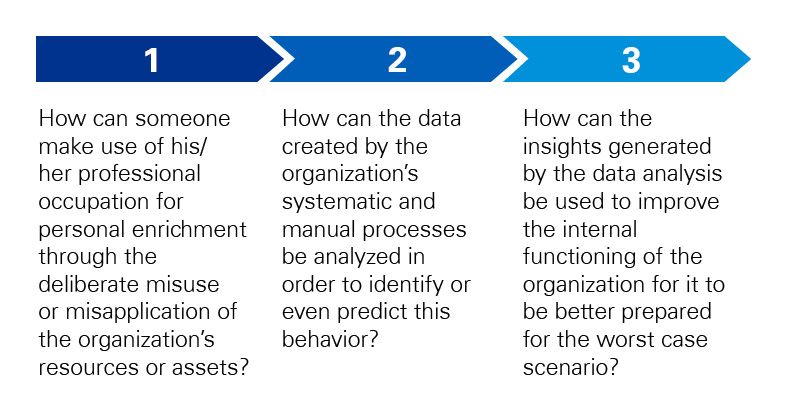

Forensic Data Analytics is about capturing data generated by everyday activities (not only machine-generated data, but also process-mediated and human sourced information) and analyzing it from a ‘worst case scenario’ perspective; i.e. by assuming bad intent or gross negligence. This approach entails asking three important questions:

Important to note in this regard is that Forensic Data Analytics, which is typically seen as a form of reactive analysis used during investigations, can prove to be even more valuable when applied proactively. In this way, it not only allows companies and organizations to identify abnormalities and deviations from what is expected; it often leads to insights that indirectly inform and/or improve (business) operations and even strategy. A clear example of this is process mining, where the primary goal is to identify past deviations from expected process flows, but which often leads to the identification of improvement opportunities in terms of internal control or even operations. Ultimately, by applying a ‘worst case scenario’ perspective, Forensic Data Analytics not only enables organizations to increase the effectiveness of risk management efforts, it also leads to an increase in the overall business transparency across all operations to which it is applied.

Benefits of using Forensic Data Analytics & Technology in your organization

Forensic Data Analytics can be a particularly powerful technique in managing fraud risks and compliance issues and it allows those charged with their management to better align with the radical changes in society’s technological and regulatory landscape. By taking a ‘worst case scenario’ perspective to assess and manage fraud and compliance risks at scale, Forensic Data Analytics allows organizations to:

- proactively identify anomalies within operational processes, which may be indications of noncompliance with existing policies, instances of fraud, waste, errors, miscoding/misclassification and/or abuse;

- determine improvement opportunities to enhance risk management, internal audit and internal control processes, but also to gain insights which can be used to improve (business) operations and strategy (e.g. by uncovering hidden inefficiencies and bottlenecks);

- respond more swiftly to external requests from regulators or to internal needs for investigatory support with regards to allegations of fraud or noncompliance.

Applied in conjunction with newer technologies in computer science (like robotics, AI and machine learning), Forensic Data Analytics can also be applied in risk & compliance transformation projects. In this context, it helps organizations streamline and automate (parts of) their risk management, internal audit & control, as well as compliance functions and reduce the operational costs of fraud risk management, fraud investigations and regulatory reporting.

What can we do?

Our KPMG team of Forensic Data Analytics & Technology experts offers expertise in: data mining, text mining, fraud & compliance dashboarding, predictive modelling, (automated) eDiscovery, social network analysis and process mining.

In addition, KPMG can also provide you with a multi-disciplinary team that offers an integrated approach to larger-scale issues such as holistic enterprise risk management or internal control and compliance transformation/automation.

Want to learn more about how your organization can benefit from our Forensic Data Analytics & Technology services? Do not hesitate to contact us.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia