Demands for better tax governance and risk management are increasing, along with pressure to deliver better value to the broader business. To address these needs, Australian businesses need to demonstrate robust tax performance and strong internal governance framework.

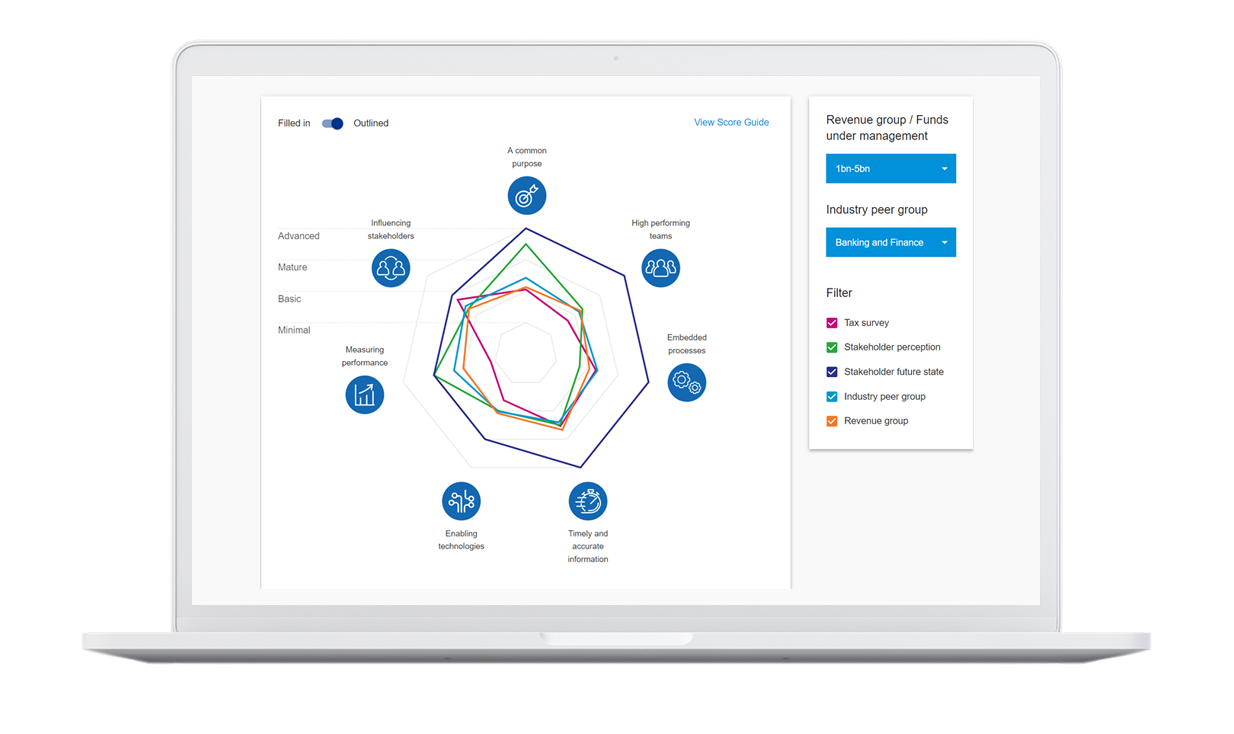

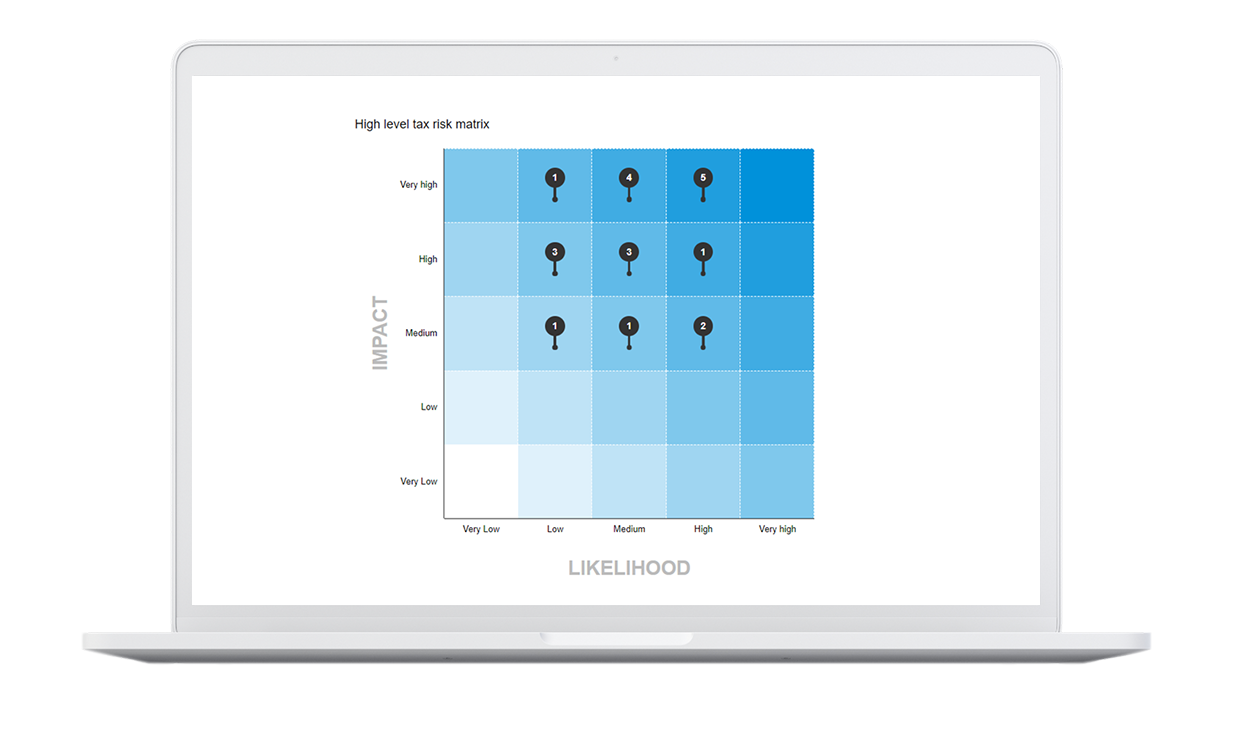

Backed by the expertise of our Tax Governance & Transparency professionals, KPMG Tax Control Room can help. Our innovative cloud-based solution provides tax insights designed to improve the management of tax within your organisation. Discover new perspectives on tax risks, issues facing head of tax reporting, insights into tax function performance and how to improve tax governance and controls.

Benefits

How KPMG’s Tax Control Room can help your business

Discover data-driven, experience-based, tax management insights on tax risks. Surface new perspectives through head of tax reporting and tax function performance, going beyond general tax governance & controls. Simply:

- Select the tax management components to be assessed and improved

- Complete self-assessment and stakeholder surveys issued

- Receive your customised tax management insights.

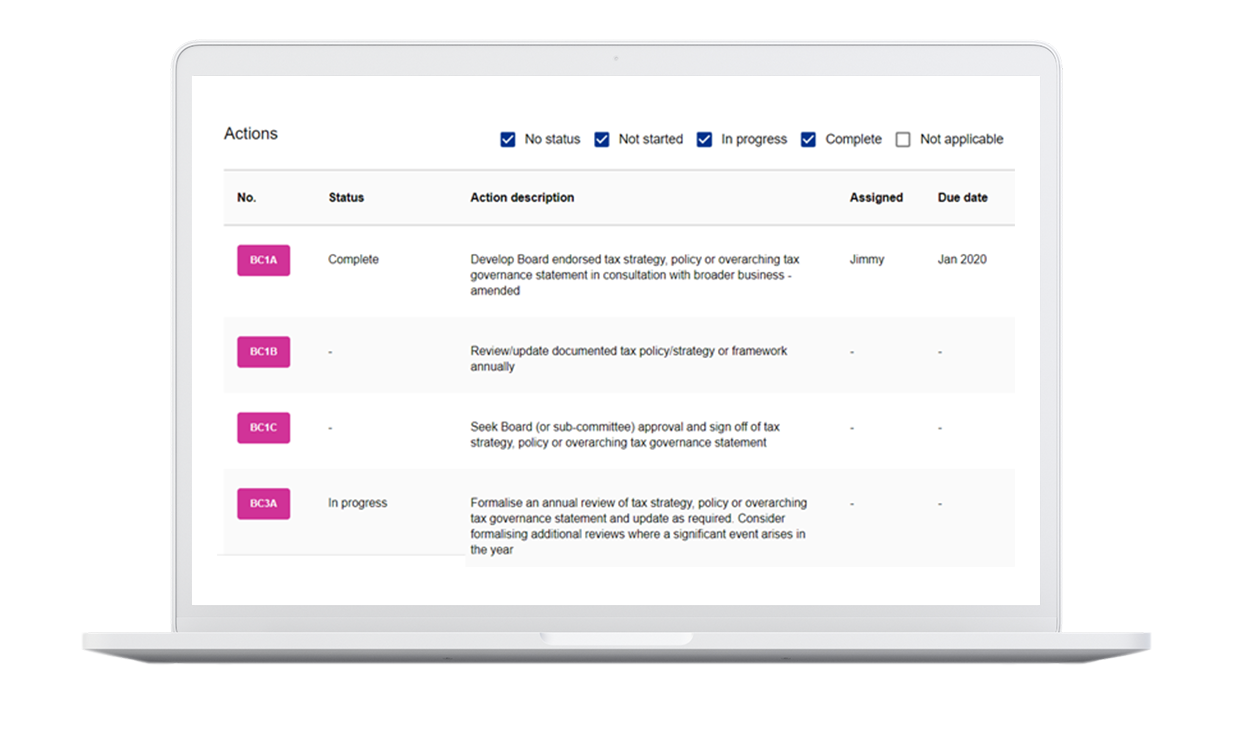

Plot the best course of action to improve your tax function.

- Workshop multiple stakeholder views to raise awareness, align efforts and focus efforts

- Undertake document reviews and appropriate assessment activities

- Plan and prioritise activities to address gaps and enhance the management of tax

- Use this plan to gain support for and demonstrate your actions.

- Improve head of tax reporting to internal stakeholders

- Enhance tax governance measures

- Respond to regulatory enquiries with a demonstratable framework and action plan

- Embed and demonstrate a value-adding tax operating model.

Why choose KPMG?

Tax governance – at the heart of tax management

KPMG's tax governance team supports leaders of tax, CFOs and boards to achieve confidence that measures to manage tax across the business have been designed well and are operating effectively. We help businesses establish, review and evidence tax governance frameworks and controls; enhance tax function reporting and stakeholder engagement; assist boards with their responsibilities; and develop tax transparency reports.

Our holistic approach combines tax governance with tax transformation and innovative models to unlock opportunities to harness technology and process enhancements to improve governance, efficiency and effectiveness. Through this approach, good tax governance frameworks help meet regulatory requirements, save time through clearer and better processes, and increase stakeholder confidence that tax is managed well.

As a result, tax governance empowers leaders of tax to drive business value by strengthening and articulating the tax mandate. For more information get in touch with us.

Contact us

Contact our team for more information about Tax Control Room or to request a demonstration.