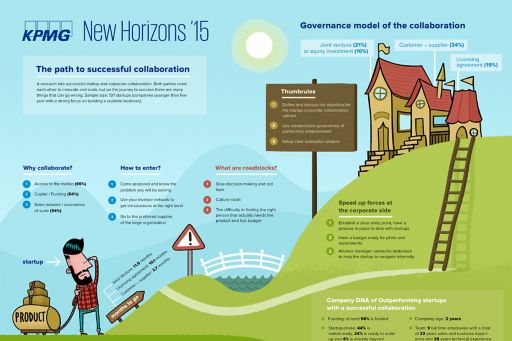

Starting your business

Starting your business

Now is the time to turn your entrepreneurial ideas into a business reality. Let KPMG Enterprise help with the heavy lifting, from establishing your operations and raising capital, to international expansion, and complying with regulatory requirements.

Business planning

Developing a strong business plan is critical to the success of any startup business. KPMG Enterprise works with entrepreneurs to help build robust plans that include detailed strategy around all aspects of their organization: finance, sales and marketing, operations, supply chain, procurement and engineering. As part of our business planning process, we look to assess current processes, analyze data for trends and identify the areas of greatest opportunity.

Startup financing

You have a fantastic business plan – now you need the financial support to bring your plan to life. But what financing options are available to entrepreneurs? Are there government programs for startups in your sector? Can your concept attract strategic or angel investors?

KPMG Enterprise advisers can help you identify the financing plan that you need to fuel your growth. From helping you identify early-stage financing options to helping you connect with potential investors – we’ll work with you every step of the way to help turn your vision into reality.

R&D incentives

As an entrepreneur, you recognize the importance location has on business success. When it comes to research and development (R&D) initiatives, location can have a major impact on your costs due to the availability of R&D incentives and the impact of R&D costs on other tax benefits.

KPMG Enterprise business advisers in KPMG firms can help you conduct a review of R&D incentives and tax implications so that you can better evaluate the after-tax cost of performing your R&D in one country, state or province over another. Advisers can also highlight other government grants and incentives that you can tap into. KPMG Enterprise advisers will work with you to help determine the best location for your activities – so you can focus on the future.

Business strategy services

When it comes to doing business, status quo will not work for long. There’s little doubt you’ll face ongoing threats, whether from new technologies, competition, or industry changes. As an owner-manager, you need to think about the future today so you can build a sustainable model for your business.

KPMG Enterprise advisers can work with you to review your business model and help identify strategic initiatives that will support your objectives. We do this through facilitated sessions focused on helping you develop the right strategy for your business – and by helping you execute, monitor and make ongoing adjustments to your strategy.

Corporate tax

Having an effective corporate tax program means keeping on top of trends and key issues. When tax changes or rulings are announced, timely analysis can help you understand how your business will be affected so you have time to adjust your tax processes accordingly.

KPMG Enterprise advisers in KPMG firms work with entrepreneurial businesses like yours to develop comprehensive plans that can manage or reduce your corporate tax burden. From assessing the effectiveness of your business structures to helping you identify tax savings opportunities, KPMG firms can work with you to develop a customized tax program that works for your business.

Expanding internationally

When it comes to growth, you’re thinking beyond your borders. International expansion presents many opportunities, from expanding your market base to lowering your costs. It also presents unique risks – different regulatory rules and requirements, tax implications, and culture or language barriers.

KPMG Enterprise advisers span 156 different countries, providing you with access to the resources and information you need to be confident in your expansion strategy. We’ll leverage our global expertise through local experts to help you understand your risks and how you can mitigate them so you can take your business anywhere you might want to grow.

Assurance

The need for effective risk management and controls is crucial in an environment of increased scrutiny. It is important to minimize these risks in an entrepreneurial business, not only for the business itself, but also for the family, property holdings and capital. Implementing controls, securing new financing, efficient tax management and optimization can all have a positive impact on the bottom line of your business.

Personal tax

As the owner-manager of a business or a new entrepreneur, corporate tax shouldn’t be your only concern. To manage your overall tax burden effectively, you need to understand how tax rules and changes may affect both your personal tax situation and that of your family.

The challenge is that personal tax law is complex and rules can change quickly. KPMG Enterprise advisers can work with you to assess the tax rules and tax issues that affect, or may affect, your personal and family taxes, so that you can better manage your overall tax burden while remaining compliant with all tax laws.

Going public

Taking your company public is an exciting process. It brings with it prestige and higher visibility in the market. At the same time, going public brings new risks, including complex accounting and reporting requirements and the need to manage new stakeholders – like the board and your shareholders.

To get the most reward, you need to be well informed and well prepared. KPMG Enterprise advisers can work with you to decide whether going public is the right choice for your business. If you go forward, we can help you manage the IPO process and begin to operate in the public company environment.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia