Global Mobility Services (International Assignments)

Managing international assignments requires careful coordination across borders. Our Global Mobility Services provide comprehensive support for expatriates and inbound employees, covering immigration, personal income tax, payroll, and social insurance compliance. We help organizations ensure smooth transitions, reduce risks, and maintain compliance with local and international regulations, so employees can focus on their roles while employers gain peace of mind.

Domestic Employment Compliance Services (Local Employees)

For businesses operating locally, compliance with tax, payroll, social health, and unemployment insurance regulations is critical. Our services deliver accurate payroll administration, ensure timely contributions, and safeguard adherence to prevailing laws. We partner with employers to streamline processes, minimize compliance risks, and protect both the organization and its workforce.

Our cohesive tax, payroll, and immigration service delivery model is designed to create exponential value and broad coverage for you and your workforce. Learn more about our services below.

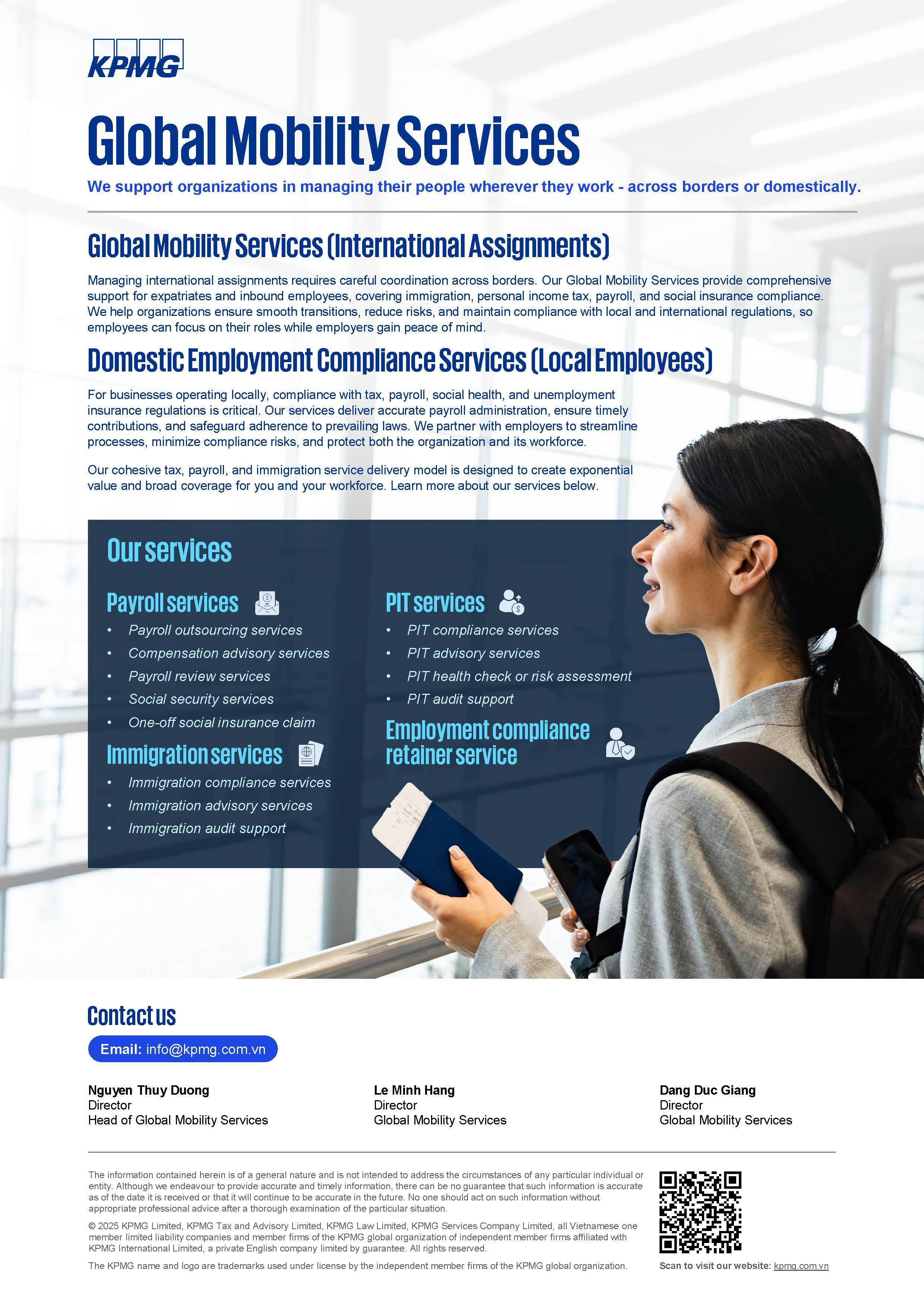

Our services

Payroll services

- Payroll outsourcing services

- Compensation advisory services

- Payroll review services

- Social security services

- One-off social insurance claim

PIT services

- PIT compliance services

- PIT advisory services

- PIT health check or risk assessment

- PIT audit support

Immigration services

- Immigration compliance services

- Immigration advisory services

- Immigration audit support

Employment compliance retainer service

Global Mobility Services

We support organizations in managing their people wherever they work - across borders or domestically.

Download brochure (694 KB) ⤓