The year 2023 marks an important milestone in the Vietnam antitrust regime. The Vietnam Competition Commission (“VCC”), which has been designated as the official agency to oversee, among others, merger control in Vietnam under the Law on Competition 2018, has been officially established and became operational since 1 April 2023, replacing its predecessor, the Vietnam Competition and Consumer Authority (“VCCA”). With such development, the VCC is anticipated to increase its regulatory oversight activities with renewed vigor in merger transactions, both retrospectively and upcoming, for enforcement of antitrust regulations. With that said, however, it is also anticipated that the VCC will not re-write the playbook but will inherit and continue developing the practices which the VCCA has accumulated over the years.

Recap On Vietnam Merger Control Management Regime

In Vietnam, merger filing of a transaction is mandatory, should the transaction be classified as an ‘economic concentration’ (i.e., being either a merger, consolidation, acquisition, or joint venture), and any of the following thresholds are met:

- Assets: one of the transactional parties, or the group of affiliated enterprises of which this party is a member, has the total asset value of VND 3 trillion or more in Vietnam in the latest fiscal year prior to the year that the transaction takes place;

- Turnover: one of the transactional parties, or the group of affiliated enterprises of which this party is a member, has the total sale or purchase sale turnover of VND 3 trillion or more in Vietnam in the latest fiscal year prior to the year that the transaction takes place;

- Transaction value: The transaction is worth VND 1 trillion or more;

- Combined market share: The combined market share of the transactional parties represents 20% or more in the relevant market.

Of note, the third threshold (i.e., transaction value) is only applicable for acquisition transactions in Vietnam.

The regime operates under a pre-closing and suspensory mechanism, meaning that the parties are obligated to notify the VCC of the transaction if the transaction falls within the definition of an economic concentration subject to merger filing, and that the transaction is put on hold until such time that it is cleared by the VCC, either automatically or after appraisal.

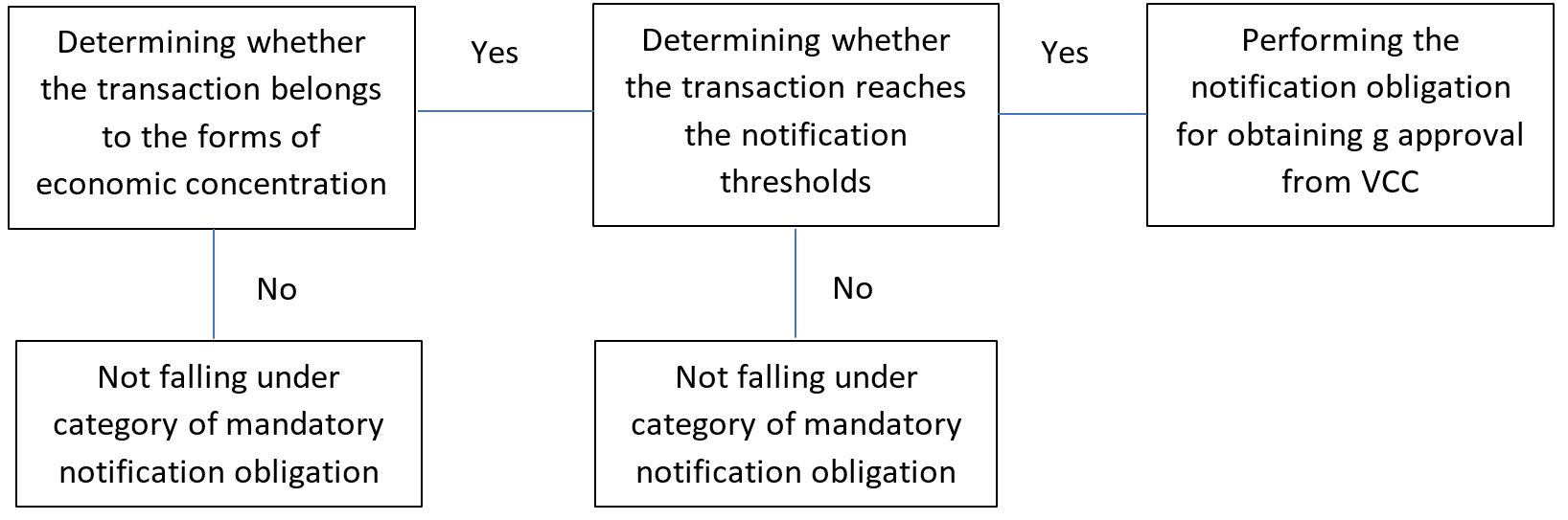

The appraisal process of the VCC, like the VCCA, is two-fold: namely a “Preliminary assessment” and thereafter, an “Official assessment”. In practice, the majority of merger transactions notified to the VCC are transactions which fall under the category of a combined market share below 20% which will be released or approved after the preliminary assessment stage, as they are determined to have no impact or not likely to have any competitive restriction effects over the relevant market. For transactions subject to official assessment, the likelihood being that the transaction will be released or approved with conditions. The diagram below briefly illustrates the decision-making tree of a particular merger transaction:

Practical observations and takeaway

The VCC may or may not follow the current merger filing assessment practices developed by the VCCA, save for the procedures which adhere to the skeleton framework established pursuant to the Law on Competition 2018 and Decree 35/2020/ND-CP providing guidance on the Law on Competition. We set out below several noteworthy practices of the VCCA observed based on our experience with numerous transactions, which we are of the view are likely to be retained by the VCC:

- Historically, the VCCA has applied a rigid interpretation of the transaction labelling system, meaning to apply a literal interpretation of Vietnamese competition laws thereby causing many transactions having no apparent market impacts (i.e., internal restructuring) to go through the clearance procedures without exception. It is anticipated that the VCC may need a more robust assessment procedure such as a “fast-track” system to expedite the administrative process for such transactions, including employing expedited procedures, new classification instructions or similar fast-tracking tools, etc.

- In determining if a particular transaction reaches a notification threshold, there is no official guidance on the calculation of turnover or assets in Vietnam, especially in relation to parties in an offshore transaction. To this end, the transaction parties may rely on, and the VCCA has historically accepted the most recent audited fiscal report as the basis for calculation of the total assets or turnover.

- Market share level plays a crucial role in the assessment of a merger transaction. For a horizontal acquisition, a combined market share of below 20% is commonly observed to be a safe harbor threshold for securing approval from the VCCA. That said, in practice, the VCCA may not strictly view the transaction as of negligible impact, thus prompting the issuance of clearance, but thoroughly assess the underlying effects to determine the actual degree of anti-competitiveness (if any) of such transactions. The level of market share will also dictate the level of market data or analysis required.

- The VCCA (and the VCC) may consult with other regulators in Vietnam and overseas, who have an interest in particular transactions. It will not rely solely on the market impact assessment submitted by the stakeholders of transactions but will refer to inter-governmental or inter-body data sources as well as requesting opinions form other competent agencies for independent data and resources.

In any case, Vietnam’s merger control regime is constantly evolving to adhere to the ever-changing nature of merger transactions, both from a regulatory and an economic or marketplace perspective. It is important to bear in mind that a competitiveness impact assessment should be viewed with an open mindset as they, in their simplest forms, are economic transactions. To get the latest insights in Vietnamese antitrust regimes, we, KPMG Law Limited as one of the leading law firms in this sector, focus on practical aspects of advising and supporting our clients with such merger filing.

If you have any questions or require any additional information, please contact Richard Stapley-Oh, Thi Quynh Ngoc Pham of KPMG in Vietnam.

This alert is for general information only and is not a substitute for legal advice.

About KPMG Law in Vietnam

KPMG Law is a leading provider of legal services in Vietnam. Our team comprises approximately 100 legal professionals spread across four offices representing the major financial and commercial hubs in Vietnam and Cambodia. This coverage ensures that we are able to bring our depth and breadth of experience to support our clients when and where they need it most.