Following Resolution No. 110/2023/QH15 and in the context of Vietnam adopting the Global Minimum Tax rule (“GMT”) from 1 January 2024, the Government has initiated a draft decree on the establishment, management and use of an investment support fund (“the Fund”).

Some notable contents of the draft decree are as below:

- The investment support fund aims to support, encourage and attract strategic investments in certain priority sectors to Vietnam under government authorization;

- The funds would be generated from GMT's State budget collection;

- The support would be in cash, fully exempt from Corporate Income Tax, and would be provided for 05 specific categories of (i) training and human resource development, (ii) research and development (“R&D”) expenses, (iii) investment in fixed assets (“FAs”), (iv) high-tech product manufacturing expenses, and (v) and social infrastructure system;

- The support payment shall be granted upon the request of eligible entities, which are subject to review and approval procedures involving various authorities and the Prime Minister’s final decision;

- The Fund would provide support to the following eligible taxpayers:

(a) Entities investing in high-tech production, with capital scales from VND12 trillion or annual revenue of VND20 trillion;

(b) High-tech entities, with capital scales from VND12 trillion VND or an annual revenue from VND20 trillion;

(c) Entities with projects applying high technology, with capital scales from VND12 trillion or annual revenue from VND20 trillion; and

(d) Entities investing in a R&D center with a capital of VND3 trillion or higher.

- Within 03 years from the date of Investment Registration Certificate or from the approval date for investment policy, eligible entities from (a) to (c) categories must disburse its investment capital in a minimum amount of VND12 trillion, while eligible entities under (d) category must disburse it’s a minimum investment amount of VND1.5 trillion;

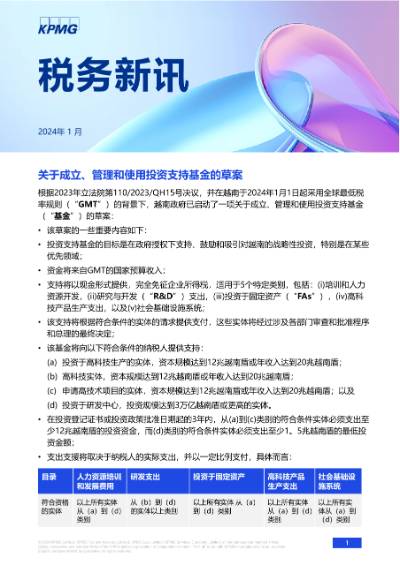

- The support payment shall be subject to the actual expenses of the taxpayers and be paid at a certain ratio, specifically:

| Content | HR training and development expenses | R&D expenses | Investment in FAs | High-tech products manufacturing expenses | Social infrastructure system expenses |

|---|---|---|---|---|---|

| Eligible entities | All entities from (a) to (d) categories above | Entities from (b) to (d) categories above | All entities from (a) to (d) categories above | All entities from (a) to (d) categories above | All entities from (a) to (d) categories above |

| Payment level | Up to 50% of training expenses related to the local labor force |

|

|

0.5% to 1.5% of added value of the high-tech products. | Up to 50% of the expenses for social infrastructure system development. |

- In case the requested support payments from taxpayers are higher than the budget payment of the Fund, the support payment may be reduced, which is assessed based on certain criteria such as the entity's economic and social contributions, state budget contributions, etc.

The draft Decree is open to comments and suggestions. Please kindly contact KPMG should you need any further assistance in this regard.

Download to your device here

Stay informed

Subscribe to our Tax and Legal Update newsletters for more insights and updates on the latest legislation

Subscribe here Opens in a new window