IFRS 9 - Impairment - Creates Challenges for Corporates

*This article is available in Vietnamese.*

The new accounting impairment requirements for financial instruments impact all companies, not just banks. Corporates – are you good to go?

IFRS isn’t just for banks

IFRS isn’t just for banks. There are benefits for corporate companies in Vietnam to choose to apply IFRS Standards. Since the outbreak of COVID-19 pandemic in Vietnam, borders have closed, and the country has seen international trade reduced.

A stable and reliable financial reporting framework such as IFRS Standards will help mitigate the risks associated with market investment, helping both large and small corporates predict future capital outlays, assess risk and manage scarce resources during a time of constraint. There will be cost of adopting IFRS and we believe ultimately, early preparation and successful adoption of IFRS will benefit everyone in the corporate reporting chain.

IFRS 9 ECL brings additional challenges

The new impairment approach under IFRS 9 now requires both banks and corporates to recognize expected credit loss (ECL) and to update the amount of ECL recognized at each reporting date to reflect changes in credit risk of financial assets. For corporate companies that choose to prepare financial statements according to IFRS Standards, this means bad debt provision on receivables and debt investment securities could require a more extensive forecasting expertise.

IFRS 9 Standard, published in 2014 by the International Accounting Standards Board (IASB), is a comprehensive accounting standard that requires a combination of management judgment and detailed calculations that require comprehensive modeling for mission-critical business processes. When preparing for IFRS financial statements, corporates should consider additional requirements for data collection, disclosures and other financial processes at the date of initial application and on a go-forward basis. This generally also requires an update of the supporting systems.

Based on KPMG implementation experience, potential impact across key financial assets include:

First, debt investment securities: impairment losses (ECL) must be recognized for all investments not classified as FVTPL. These reflect probability-weighted estimates of expected credit losses (ECL) based on historical experience and forward-looking information: 12-month ECL for assets that have not suffered a significant increase in credit risk; lifetime ECLs for those that have.

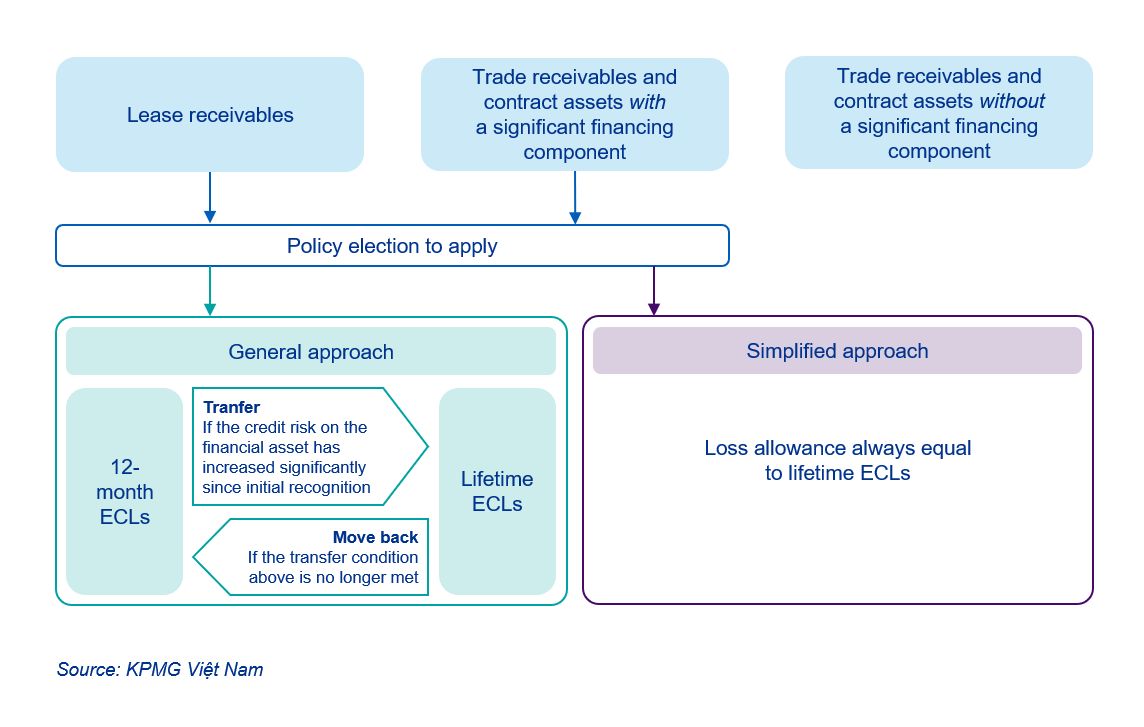

Second, trade and lease receivables: Impairment losses for receivables without a significant financing component will be based on lifetime ECL, using a simplified approach which is recognized practical expedient under IFRS 9. For receivables with a significant financing component, a corporate may choose to either apply the general approach or recognize lifetime ECL at all times.

The above challenges in classification of financial assets and calculation of ECL under IFRS 9 will reach beyond a corporate’s accounting policy and likely require changes to systems, processes, and its data retention strategy.

Simplified Approach and Provision Matrix

For trade receivables, the ECL model replaces the traditional approach of measuring bad debt provision. For trade receivables and contract assets with no significant financing component, IFRS 9 allows a simplified approach using a lifetime ECL measurement regardless of whether a significant increase in credit risk has been observed. IFRS 9 requires discounting of expected credit losses, but for trade receivables and lease receivables without a significant financing component that are short term, it may be possible to conclude that discounting is not material.

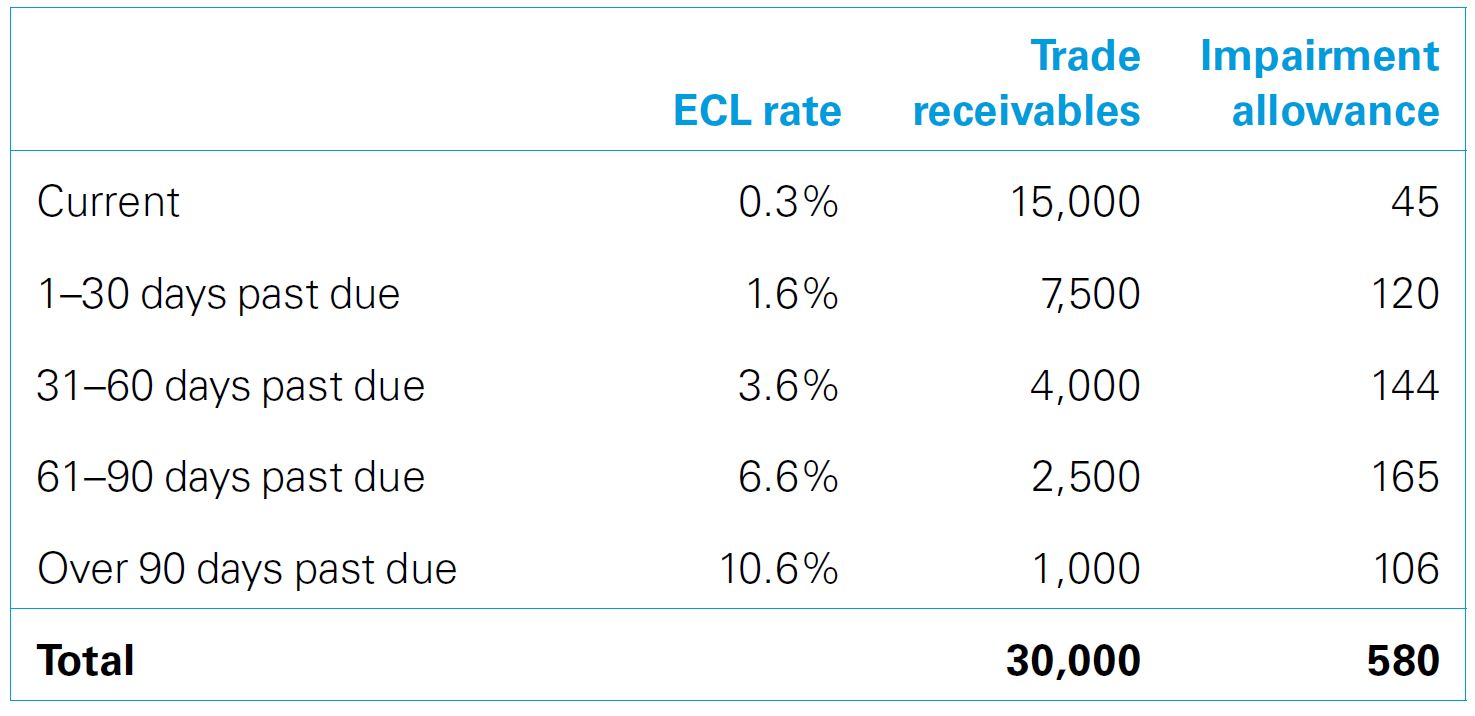

Fortunately, IFRS 9 provides a credit risk measurement practical expedient in the form of a provision matrix that may be appropriate. The provision matrix approach tracks historical trade receivable balances over a period of time, disaggregated based on credit risk characteristics, and divides them into delinquency categories, e.g. current, up to 30 days past due, between 31-60 days past due, and so on.

Using sufficiently long historical information, it is possible to determine the rate at which debtors move into a write-off category as time passes, enabling prepares to calculate a risk-based lifetime ECL ratios according to IFRS 9 requirements.

The diagram below explains when the simplified approach may be or has to be applied.

Here is an illustrative example of a provision matrix on trade receivables balance.

A provision matrix is an effective way of measuring ECL consistently from period to period. It may prove especially appropriate for corporates with a high volume of sales and cash collections from trade receivables. A corporate that intends to apply a high-quality provision matrix measurement method, might take some of the courses of action below:

First, it could consider whether it is appropriate to further segment trade receivables based on shared credit risk characteristics (e.g. geography or debtor credit rating) on top of delinquency categories.

Second, it could consider using historical loss experience on its trade receivables and adjust historical loss rates to reflect information about current conditions, and reasonable and supportable forecast of future economic conditions.

Third option is to consider providing ECL provision for all balances, including those in the current column.

Arguably the most challenging aspect of applying IFRS 9 ECL to trade receivables is the concept of reasonable and supportable forecasts and how to integrate this into the ECL calculation. This forward-looking estimate should consider changes in macro-economic conditions that impact the ability and continuation of debtors to pay. We encourage corporate companies that are interested in this area to seek support from experienced consulting firms to mitigate risks in IFRS conversion.

Measuring ECL in a changing environment and helpful tips

The COVID-19 pandemic has had and will continue to have far-reaching implications. The IASB issued a short document on IFRS 9 and COVID-19 in March 2020. Regulatory authorities have also provided additional guidance for financial institutions. Corporate companies across all industries are facing additional working capital pressure and a likely increase in the credit risk of their receivables. When transitioning to IFRS 9, corporates will likely recognize a material increase in impairment in the current environment. A few tips that are helpful to keep in mind are:

Significant judgment will need to be applied in assessing the range of potential macroeconomic outcome to meet IFRS 9 requirement that the ECL reflects an unbiased estimate. An unbiased estimate is one that is neither overly optimistic, nor overly pessimistic. Applying a zero rate for receivable that is current is an example of overly optimistic estimate.

In terms of methodology, the quality of ECL model will depend on local conditions and available data. Certain debtors may receive government support and such one-off support will need to be carefully considered when comparing historical information between pre and post COVID-19.

Also, IFRS 9 always require corporate companies to consider multiple scenarios. However, many corporates might not have done so due to a lack of past experience in forecasting or expertise.

Finally, the type and quality of data will be critical to the success of IFRS 9 adoption, corporate companies should plan in advance and identify the data that is ‘must-have’ and ‘good-to-have’, and digitize them as soon as they can.

Read other IFRS insights or attend upcoming events about IFRS conversion in Vietnam by IFRS Academy — KPMG in Vietnam here.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia