With the rapid development of social networks and video platforms, an increasing number of individuals are publishing or sharing content online and earning income through sharing revenue. On September 10, 2025, the Ministry of Finance (MoF) issued the Directions on the Levy of Business Tax on Individuals Who Regularly Publish Creative or Informational Content Online, which clearly define the VAT principles applicable to influencers and platforms, as well as the thresholds for tax registration.

However, for smaller-scale influencers who are not required to register for VAT, questions remained regarding how their income should be taxed. To address this, on December 23, 2025, the MoF released the Operational Guidelines for Levying Individual Income Tax on Individuals Publishing or Sharing Content Online and related interpretations (hereinafter referred to as the “Influencer Income Tax Guidelines”), clarifying the nature of influencer income and the criteria for distinguishing Taiwan-sourced and non-Taiwan-sourced income. In addition, the MoF issued supplementary rulings to specify withholding obligations and penalty waiver period for relevant parties. This article provides an in-depth analysis of the key provisions and highlights important considerations for influencers and platforms.

Transaction Parties under the Influencer Income Tax Guidelines for Influencers

Definition of transaction parties

The Influencer Income Tax Guidelines primarily targets the income tax obligations of smaller-scale influencers who are not required to register for VAT, platforms, and audiences. The following section first explains the definitions of these three transaction parties. It should be noted that each of these parties can further be classified as having either “domestic” or “foreign” status.

- Influencer: An individual creator who publishes or shares content on a platform. Such individuals may upload content to the platform and authorize the platform to monetize the uploaded content by displaying advertisements or providing paid E-services, thereby earning service income of a revenue-sharing nature from the platform (including advertising revenue sharing, paid subscription revenue sharing, live-streaming proceeds, viewer tipping, or other similar incomes).

However, if the influencer operates on a larger scale and reaches the VAT registration threshold (NT$50,000 for services; NT$100,000 for goods) , the individual income tax rules for influencers will no longer apply. Instead, taxation should follow the relevant provisions under the corporate income tax regime. - Platform: Online networks, including but not limited to social media, video streaming platforms, and digital media.

- Audience: Individuals who view influencer published or shared content on a platform, or purchase related paid services from the platform (such as paid subscriptions).

Determination of Domestic vs. Foreign Status

Under the Influencer Income Tax Guidelines, the domestic or foreign status of the three transaction parties affects their Individual Income Tax treatment. “Domestic” status is generally defined as:

- Having a fixed place of business in Taiwan; or

- For individuals, meeting any of the following:

1. Residence or domicile in Taiwan.

2. Device installation in Taiwan.

3. Mobile number with Taiwan country code (+886).

4. Billing address, bank account, IP address, or SIM card indicating Taiwan.

Taxable items under the Individual Income Tax Guidelines for Influencers

When an influencer authorizes a platform to monetize the uploaded content by displaying advertisements or providing paid E-services, and earns service income of a revenue-sharing nature from the platform (including advertising revenue sharing, paid subscription revenue sharing, live-streaming proceeds, viewer tipping, or other similar income), such income is classified as “Income from Professional Practice” under Category 2 of Paragraph 1, Article 14 of the Income Tax Act.

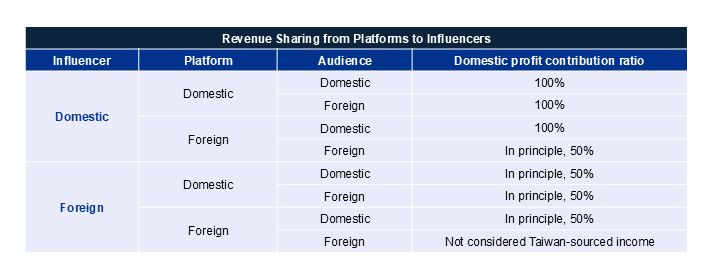

Since the influencer completes the provision of services by uploading published or shared information to the platform and transmitting them to audiences for viewing, this transaction process involves the joint participation of the influencer, the platform, and the audience. Therefore, if the influencer establishes any economic linkage with Taiwan at any stage of the transaction process, the income derived from the platform shall be considered to include a portion of profit attributable to Taiwan and thus treated as Taiwan-sourced Income. The following section explains the degree of profit contribution attributable to Taiwan (“Domestic profit contribution ratio”) under various circumstances.

1. Domestic Influencer

1) Domestic Platform

Regardless of whether the audience is domestic or foreign, the Domestic profit contribution ratio is 100%. Therefore, all income is considered Taiwan-sourced income.

2) Foreign Platform

• Domestic Audience

The Domestic profit contribution ratio is 100%. Therefore, all income is considered Taiwan-sourced income.

• Foreign Audience

In principle, the Domestic profit contribution ratio is 50%. Therefore, half of the income is considered Taiwan-sourced income.

2. Foreign Influencer

1)Domestic Platform

In principle, regardless of whether the audience is domestic or foreign, the Domestic profit contribution ratio is 50%. Therefore, half of the income is considered Taiwan-sourced income.

2)Foreign Platform

• Domestic Audience

In principle, the Domestic profit contribution ratio is 50%. Therefore, half of the income is considered Taiwan-sourced income.

• Foreign Audience

Not considered Taiwan-sourced income.

For ease of understanding, the various scenarios are summarized in the table below:

It should be noted that, with respect to the 50% Domestic profit contribution ratio, if the influencer can provide documentary evidence clearly demonstrating the relative contribution of domestic and foreign transaction processes to the total profit of the entire transaction flow, the influencer may apply to the tax authority for an actual determination of the domestic profit contribution when filing individual income tax.

Alternatively, in cases where non-resident influencer withholding tax has already been withheld by platform, the non-resident influencer may, within ten years from the date of withholding, submit an application form together with supporting documents to request a refund of any over-withheld tax.

Income Calculation Rules for Influencers

Influencers shall be classified into two categories: (1) individuals residing in Taiwan as defined under Paragraph 2, Article 7 of the Income Tax Act (hereinafter referred to as “resident”); and (2) individuals not residing in Taiwan as defined under Paragraph 3, Article 7 of the Income Tax Act (hereinafter referred to as “non-resident”). Income shall be calculated and tax obligations fulfilled in accordance with the following methods:

1.Influencer as a Resident

First, the influencer shall separately calculate Taiwan-sourced influencer income and non-Taiwan-sourced influencer income as follows:

- Taiwan-sourced influencer income = influencer income × Domestic profit contribution ratio

- Non-Taiwan-sourced influencer income = influencer income - Taiwan-sourced influencer income

1) Where the influencer can provide accounting records and supporting documents to substantiate actual costs and expenses:

- Taiwan-sourced influencer taxable income = Taiwan-sourced influencer income -(costs and expenses × Domestic profit contribution ratio)

- Non-Taiwan-sourced influencer taxable income =(influencer income - Taiwan-sourced influencer income) - costs and expenses ×(1 - Domestic profit contribution ratio)

2) Where the influencer fails to maintain proper books and vouchers or cannot provide supporting documents to substantiate taxable income:

Costs and expenses shall be calculated based on the standard expense rate prescribed by the MoF for each taxable year (for 2024, the expense rate for performers under professional practice income is 45%).

- Taiwan-sourced influencer taxable income=Taiwan-sourced influencer income×(1-expense rate)

- Non-Taiwan-sourced influencer taxable income=(influencer income-Taiwan-sourced influencer income)×(1-expense rate)

3) If the tax authority discovers that the actual taxable income exceeds the amount calculated under the above methods, it may assess taxable income based on the verified data.

2.Influencer as a Non-Resident

1) Influencer receives income from a domestic platform or a foreign platform that has completed tax registration:

Tax shall be withheld at source. The withholder shall calculate the Taiwan-sourced influencer income based on the Domestic profit contribution ratio, withhold tax upon payment, file the withholding return, and issue the withholding statement.

2) Influencer receives income from other platforms:

The influencer shall calculate the Taiwan-sourced influencer income based on the Domestic profit contribution ratio and either file the tax return personally or appoint an agent to handle tax filing and payment.

Withholding Obligations of Platforms and Corporate Income Tax Rules for Foreign Platforms

To align with the aforementioned Influencer Income Tax Guidelines, MoF separately issued a tax ruling No. 11404615672 to emphasize that, domestic platforms and foreign platforms that have completed tax registration, when paying Taiwan-sourced influencer income to influencers, shall be deemed withholders under the Income Tax Act. Hence, starting from January 1, 2026, such platforms must withhold tax in accordance with the law, file withholding returns, and issue withholding (or exemption) statement.

In addition, when a foreign platform sells advertising display services to a foreign advertiser and the advertisement is viewed by domestic non-paying audiences, such service is considered as being sold within Taiwan. The platform thereby derives Taiwan-sourced income and must file and pay corporate income tax either directly or through an appointed agent.

KPMG Observation

The newly introduced individual income tax guidelines for influencers aim to fill gaps in the existing tax framework for the influencer economy. Domestic influencers who meet the VAT registration threshold must complete tax registration and issue Government Uniform Invoices (GUI). Their income will then be taxed under the relevant corporate income tax provisions. For influencers who do not meet the VAT registration threshold, income should be follow these guidelines to determine its nature, whether it constitutes Taiwan-sourced income, and how to calculate allowable costs and expenses, ensuring proper payment of individual income tax and alternative minimum tax.

Based on these guidelines and related MoF interpretations, we highlight the following observations and reminders:

The domestic profit contribution ratio will vary depending on the domestic or foreign status of the transaction parties involved

For influencers below the VAT registration threshold—whether domestic or foreign—the income received from platforms is categorized as “income from professional services.” This income must be divided into “Taiwan-sourced income” and “non-Taiwan-sourced income” and taxed under the income tax act and the alternative minimum tax act. The proportion of Taiwan-sourced income, referred to as the “domestic profit contribution ratio” depends on the domestic or foreign status of the influencer, platform, and audience. Generally, if any party is domestic, Taiwan-sourced income is involved; if all parties are foreign, the income is not Taiwan-sourced. Where Taiwan-sourced income exists, such as income earned by a domestic influencer from a domestic platform or income earned by a domestic influencer through a foreign platform attributable to domestic audiences, the domestic profit contribution ratio is 100%. In other cases, the contribution is 50%, meaning half of the income is considered non-Taiwan-sourced.

The method in which an influencer’s tax obligations are fulfilled varies depending on the individual’s status

If the influencer is a resident, they must file an annual income tax return. When calculating income, they may deduct costs and expenses from professional service income. If proper books and supporting documents are provided, actual costs and expenses may be claimed. If not, expenses will be calculated based on the statutory rate for performers under professional service income (45% for 2024).

If the influencer is non-resident. Tax obligations depend on whether the platform acts as a withholder and whether Taiwan-sourced income has been withheld. If not, the influencer must report and pay tax on such income.

Withholding and Reporting Obligations for Platforms

Domestic platforms and foreign platforms registered for tax purposes are designated withholding agents under the Income Tax Act. Accordingly:

- For resident influencers, platforms must withhold 10% on income from professional service and issue withholding statements.

- For non-resident influencers, the withholding rate is 20%.

In addition, if a foreign platform sells advertising services to foreign advertisers and the ads are viewed by domestic free-paying audiences, the platform must file and pay the Taiwan corporate income tax either on their own or through an agent.

Data Retention Requirements

In light of the foregoing, audience location is critical for determining the questioned income tax implications. Therefore, it is recommended that platforms build the backend data management systems to track the domestic or foreign status of audiences for each revenue share. Relevant data includes audience distribution reports, content production location, and payment records. These records directly affect withholding compliance and tax reporting accuracy. Failure to provide complete audience location analysis may result in non-compliance with withholding obligations.

Similarly, Influencers should also retain audience data to calculate domestic profit contribution, e.g., obtain and preserve platform analytics showing audience sources and interaction to substantiate income and expense calculations when requested by tax authorities, reducing the risk of reassessment or penalties.

Penalty Waiver Period and Compliance Reminder

In addition, to allow sufficient transition time for the newly implemented Influencer VAT Guidelines, the MoF has introduced a penalty‑waiver period under which failures to withhold or pay the relevant taxes on or before June 30, 2026 will not be subject to penalties.

It is important to note that current VAT and income tax guidelines for influencers are based on existing tax laws. While penalties are waved during the waiver period, tax filing and payment obligations remain. Influencers and platforms should review their transaction structures and seek professional tax advice to ensure timely compliance.