Taiwan’s current VAT regime for new forms of electronic service transactions in the digital economy is primarily based on the Directions on the Levying of Business Tax on Cross-Border Electronic Services Transactions (referred to as “Foreign E-service Provider tax regime”), which impose registration and VAT filing obligations on offshore e-service suppliers. However, with the rapid development of social networks and streaming platforms, more individuals are creating or sharing content online and earning income through advertising revenue sharing, paid subscriptions, and live-stream tipping.

These new transaction models have raised numerous VAT-related questions. For example, if a Taiwanese game streamer broadcasts on a US-based platform and receives subscription fees or tips from Taiwanese viewers, should this transaction be subject to VAT in Taiwan? Does the domestic or foreign status of the influencer, platform, and audience affect tax liability and calculation? Furthermore, how should VAT apply to advertising spend, which is an integral part of the influencer economy?

To address these issues, on September 10, 2025, the Ministry of Finance issued the Directions on the Levy of Business Tax on Individuals Who Regularly Publish Creative or Informational Content Online (hereinafter referred to as the “Influencer VAT Directions”). The Directions clearly define the tax principles and registration requirements for influencers economy, as well as clarify income characterization and VAT collection standards. This article provides an introduction of the key provisions and highlights important considerations for domestic and foreign influencers and platforms.

Participants in the Influencer Economy

Definition of transaction parties

The influencer economy consists of four core participants: influencers, platforms, audiences, and advertisers. The Influencer VAT Directions primarily address these parties, each of which can be classified as domestic or foreign:

- Influencer: An individual creator who publishes or shares content on a platform and earns income through advertising revenue sharing, live-stream proceeds, subscription fees, or viewer tips.

- Platform: Online networks, including but not limited to social media, video streaming platforms, and digital media.

- Advertiser: Purchasers of advertising services from platforms, i.e., businesses placing ads.

- Audience: Viewers of influencer content, categorized as paying or non-paying.

VAT registration obligations for domestic Influencers

The Influencer VAT Directions explicitly state that influencers who produce content or performances must register for VAT and issue Taiwan Governmental Uniform Invoice (“GUI”) when meeting either of the following conditions:

- Maintain a physical business presence in Taiwan, operate under a trade name, or employ staff to assist with sales activities.

- Monthly sales of goods or services via the internet reach the VAT threshold (currently NT$100,000 for goods and NT$50,000 for services).

Foreign influencers are exempt from registration for administrative simplicity. Therefore, VAT registration obligations apply only to domestic influencers. Domestic influencers who meet the above criteria but fail to register will be subject to penalties under the Tax Collection Act, VAT Act, and related regulations.

Determining domestic vs. foreign status

Under the Influencer VAT Directions, the domestic or foreign status of the four transaction parties affects VAT treatment (please refer to the later part of the article for details). “Domestic” status is generally defined as:

- Having a fixed place of business in Taiwan; or

- For individuals, meeting any of the following:

1. Residence or domicile in Taiwan.

2. Device installation in Taiwan.

3. Mobile number with Taiwan country code (+886).

4. Billing address, bank account, IP address, or SIM card indicating Taiwan.

Taxable Items in the Influencer Economy – Platform Revenue Sharing, Advertising Fees, Subscription or Tipping Fees

In transactions involving influencers, platforms, audiences, and advertisers, the VAT taxable items include:

1. Revenue Sharing from Platforms to Influencers

Influencers contract with platforms to provide performances or digital content; platforms pay revenue shares accordingly.

2. Advertising Service Fees from Advertisers to Platforms

Advertisers contract with platforms to deliver ads to audiences; advertisers pay service fees for ad placement.

3. Subscription or Tipping Fees from Audiences to Platforms

Paying audiences subscribe or tip via platforms for influencer content.

VAT Treatment for Different Transaction Scenarios

Once the taxable parties and items are identified, VAT treatment depends on the domestic or foreign status of the parties. Below is an overview for the three taxable items:

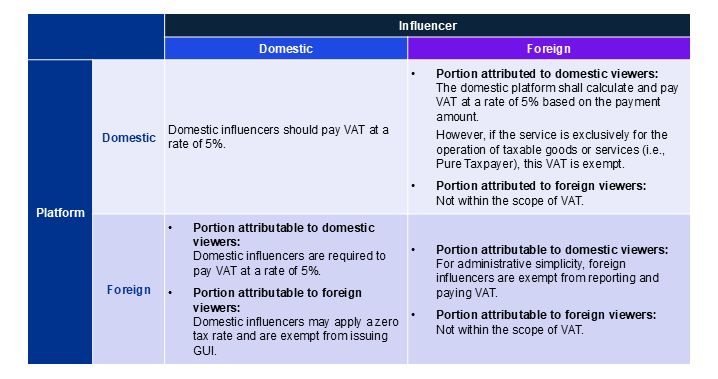

1. Revenue Sharing from Platforms to Influencers

VAT treatment varies based on whether the influencer and platform are domestic or foreign:

Domestic Influencer

1. Domestic Platform: Regardless of audience location, VAT at 5% (or 1% for the Assessed Taxpayers with minor sales who are exempt from GUI issuance obligation) applies; GUI required.

2. Foreign Platform – determined based on the proportion of domestic or foreign viewers

- Portion attributable to domestic viewers: VAT at 5%, GUI required.

- Portion attributable to foreign viewers: Zero-rated VAT (or 1% for the Assessed Taxpayers with minor sales); GUI exempt.

Foreign Influencer

1. Domestic Platform – determined based on the proportion of domestic or foreign viewers:

- Domestic viewer portion: Domestic platform is subject to VAT under reverse charge rules under Article 36 of Business Tax Act; exemptions apply when the domestic platform is a Pure Taxpayer who only engages in taxable sales, i.e., not involved in non-taxable sales.

- Foreign viewer portion: Outside VAT scope.

2. Foreign Platform – determined based on the proportion of domestic or foreign viewers:

- Domestic viewer portion: Due to administrative simplicity, VAT is exempt.

- Foreign viewer portion: Outside VAT scope.

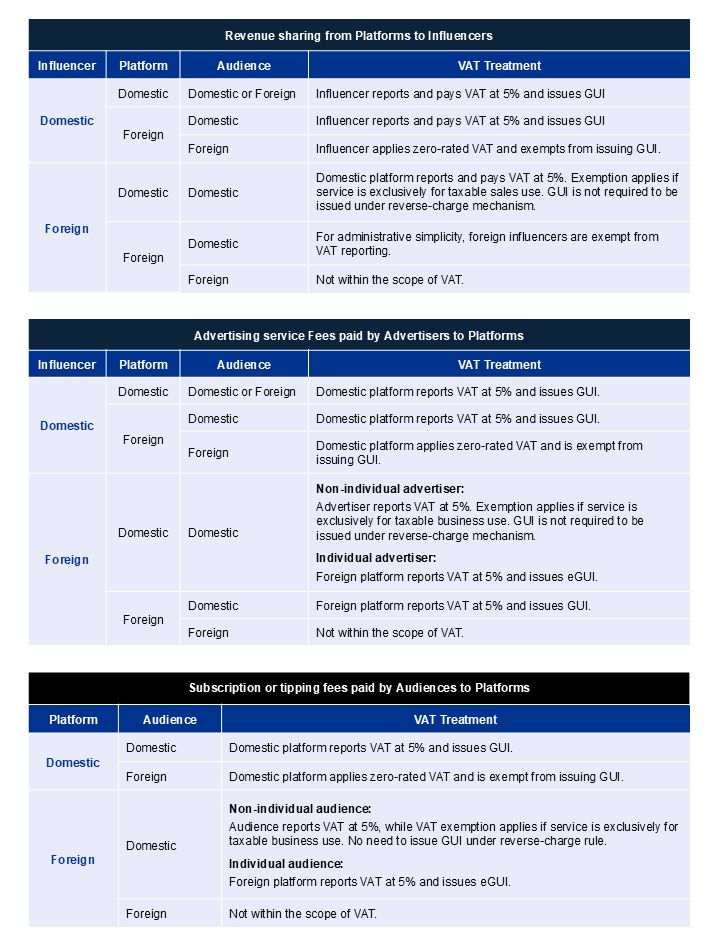

For ease of understanding, please find below the table summarized the VAT treatment:

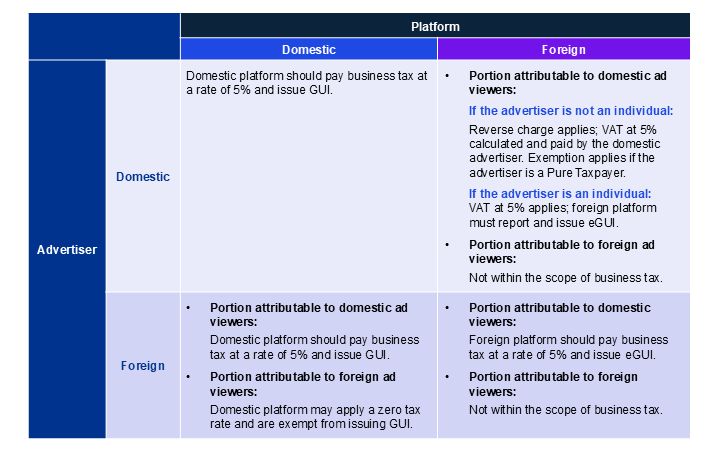

2.Advertising Service Fees from Advertisers to Platforms

VAT treatment for advertising service fees depends on the domestic or foreign status of the platform and advertiser:

Domestic Platform

1.Domestic Advertiser: VAT at 5% applies; GUI required.

2.Foreign Advertiser – determined based on the proportion of domestic or foreign viewers:

- Portion attributable to domestic ad viewers: VAT at 5%, GUI required.

- Portion attributable to foreign ad viewers: Zero-rated VAT; GUI exempt.

Foreign Platform

1.Domestic Advertiser – determined based on the proportion of domestic or foreign viewers:

- Domestic ad viewer portion: VAT treatment varies:

−If the advertiser is not an individual: Reverse charge applies; VAT at 5% calculated and paid by the domestic advertiser. Exemption applies if the advertiser is a Pure Taxpayer.

−If the advertiser is an individual: VAT at 5% applies; foreign platform must report and issue electronic GUI (eGUI).

- Foreign ad viewer portion: Outside VAT scope.

2.Foreign Advertiser – determined based on the proportion of domestic or foreign viewers:

- Domestic ad viewer portion: VAT at 5% applies; foreign platform must report and issue eGUI.

- Foreign ad viewer portion: Outside VAT scope.

For ease of understanding, please find below the table summarized the VAT treatment:

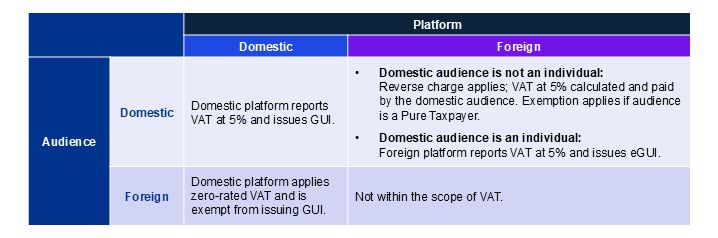

3.Subscription or tipping fees from audiences to platforms

VAT treatment for subscription or tipping fees depends on the domestic or foreign status of the platform and audience:

Domestic Platform – determined based on the proportion of domestic or foreign viewers:

1.Portion attributable to domestic audiences: VAT at 5% applies; GUI required.

2.Portion attributable to foreign audiences: Zero-rated VAT; GUI exempt.

Foreign Platform – determined based on the proportion of domestic or foreign viewers:

1.Domestic audience portion - VAT treatment varies:

- If the audience is not an individual: Reverse charge applies; VAT at 5% calculated and paid by the domestic audience. Exemption applies if the audience is Pure Taxpayer.

- If the audience is an individual: VAT at 5% applies; foreign platform must report and issue eGUI.

2.Foreign audience portion: Outside VAT scope.

KPMG Observation

The Influencer VAT Directions introduce a comprehensive VAT framework for influencer economy transactions. While the rules appear complex, they align with fundamental VAT principles: if either the service provided or used occurs in Taiwan, VAT applies; if provided domestically but used abroad, zero-rating may apply. Determining “foreign use” depends on the recipient’s location (e.g., advertiser or audience). For services provided abroad, existing cross-border VAT rules apply, including reverse charge for domestic business recipients.

For ease of understanding, please find below the table summarized the VAT treatment for the three taxable items.

In light of the explanation and summary above, key legislative highlights of Influencer VAT Directions include:

VAT treatment for subscription or tipping fees depends on the domestic or foreign status of the platform and audience:

- Domestic influencers whose monthly sales exceed the VAT threshold (NT$100,000 for goods; NT$50,000 for services) must register and issue GUI for taxable revenue shares to the platforms. On the other hand, foreign platforms can use the GUI obtained from domestic influencers as input VAT credit to offset against its output VAT imposed on its e-service sales to Taiwan B2C sales.

- Foreign influencers are exempt from registration; reverse charge applies for domestic platforms.

- Domestic platforms and advertisers must confirm whether transactions qualify for reverse charge exemptions.

- Foreign platforms must comply with Taiwan current cross-border E-services VAT rules, report taxable revenues (including advertising and subscription/tipping fees), and issue eGUI for B2C sales.

Based on the above, under Influencer VAT Directions, audience location is critical for determining VAT scope, applicable rate (5% or 0%), and tax base allocation. According to the Ministry of Finance’s official Q&A, parties claiming foreign use must provide evidence such as backend analytics showing audience distribution by country. To this end, influencers, platforms, and advertisers should ensure proper data collection and retention in relation to the said information.

In addition, in order to reserve buffer time for the newly implemented Influencer VAT Guidelines, the Ministry of Finance has announced a penalty waiver period:

- Failure to register or issue GUI before June 30, 2026 will not incur penalties.

- Failure to pay VAT before July 15, 2026 will not incur penalties.

As the new rules take effect, influencers, platforms, and advertisers should promptly review their transaction structures, seek professional tax advice, and ensure compliance with registration and VAT filing obligations. In addition, foreign platforms should revisit whether Taiwan VAT registration is required and accurately report taxable revenues (including VAT and corporate income tax) to avoid penalties based on the current Taiwan Foreign E-service Provider tax regime.