e-Tax alert 171 - New amendment to Article 15-1 of TSI Guidance & Income Taxation on Cross Border Electronic Services

New amendment to Article 15-1 of TSI - e-Tax alert 171

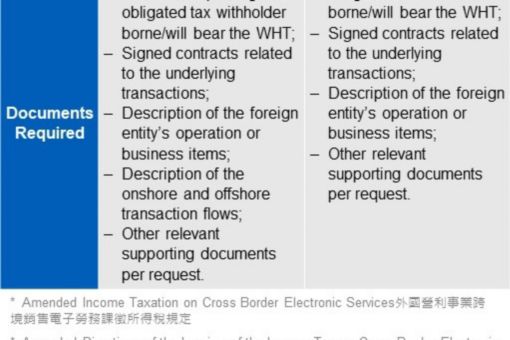

On December 16, 2021, MOF announced amendments to the tax rules relevant to applying for DPR/CR. MOF has amended the tax rules allowing Taiwan withholders who borne or will bear the WHT on the Taiwan sourced income (TSI) received by foreign companies to apply for DPR/CR.

Under current Taiwan Tax regime, for the Taiwan sourced service income or business profit paid to foreign companies, the Taiwan payers are obligated to make withhold on such payments. Considering the fact that it is difficult for foreign companies to claim actual costs and expenses in Taiwan, the Taiwan Ministry of Finance (MOF) has introduced tax treatments for foreign companies to apply an pre-approval for calculating their taxable income by adopting Deemed Profit Ratio (DPR) and Contribution Ratio (CR). For the detailed introduction, please refer to e-Tax alert Issue 102 and Issue 134.

On December 16, 2021, MOF announced amendments to the tax rules relevant to applying for DPR/CR. To be more specific, previously, only foreign companies are eligible to act as applicants for DPR/CR application with Taiwan tax authorities. However, MOF has observed that some Taiwan service recipients as the obligated withholders are bearing the actual withholding tax (WHT) cost. Due to the fact that foreign companies have no related tax burden, it is common that foreign companies are uninterested in assisting Taiwan service recipients in applying, which then resulted in unfair taxation with Taiwan withholders. MOF has thus amended the tax rules allowing Taiwan withholders who borne or will bear the WHT on the Taiwan sourced income (TSI) received by foreign companies to apply for DPR/CR and the key amendments are summarized as follows:

KPMG Observations

For foreign companies who have already applied for DPR/CR with Taiwan tax authorities and shared approval letters with their local obligated tax withholders, the amendments mentioned above would have no effect.

For Taiwan service recipients, the main benefit of the amendment rules is that it offers Taiwan withholders who bears the WHT the opportunity to act as the CPR/CR applicants without the need to seek consent/assistant from the foreign service providers for such applications.

It should be noted that in order for Taiwan withholders to be eligible under the amended rules, the Agreements signed between foreign companies and Taiwan service recipients should stipulate clearly that the Taiwan contractors are to bear the WHT.

In terms of the review practice, based on our experience, tax authorities tend to focus on what is the foreign company’s operation and whether the desired DPR is appropriate. In such case, tax authorities often request for foreign entities’ internal documents, e.g. financial statements and organization chart for investigation purpose. For foreign companies, such supporting documents may be too sensitive to provide to Taiwan withholders. As a result, it is still unclear and hence deserves further observations on what other supporting documents will be required and accepted by the tax authorities when a Taiwan withholders become the applicants. Besides, foreign companies should be aware that Taiwan withholders may contact the companies for assistance if there are questions raised by the tax authorities that they are unable to address.

Further, please note that under Article 15-1 of the TSI Guidance tax regime, only foreign companies are eligible to apply for CR used to determine taxable income. That is, Taiwan withholders are not able to apply for CR as only foreign service suppliers have relevant information and supporting documents regarding how much Taiwan assistance is involved when the services are provided to Taiwan service recipients.

Overall, permitting local obligated tax withholders to apply for the applicable DPR/CR without power of attorney from foreign entities would make the WHT levied more in line with the regulating purpose of such taxation rules. Going forward, the parties may consider and discuss the bearer of WHT and compliance cost on applying DPR/CR with Taiwan tax authority to reach maximum efficiency.

Authors

Lynn Chen Partner

Ethan Hsieh Partner

Tiffany Chou Assistant Manager

© 2026 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。