e-Tax alert 168 - Taiwan MOF Finance has amended and promulgated the Guidance on Application of Income Tax Treaties

Taiwan MOF Finance has amended - e-Tax alert 168

To be in line with the global trend, the MOF has referred to the OECD Model Tax Convention and relevant guidance and amended the Guidance on 12 August 2021 to provide clear and up to date rules on assessing cases that involve income tax treaties.

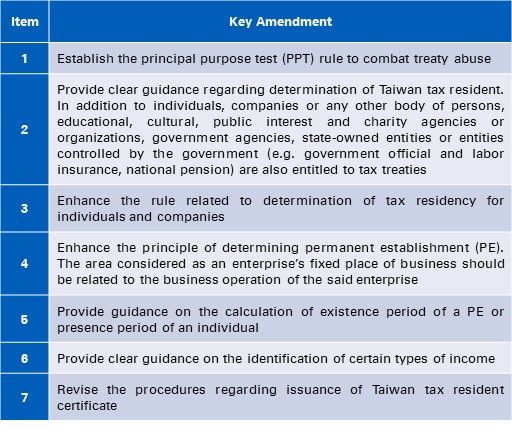

The Ministry of Finance (MOF) had announced the Guidance on Application of Income Tax Treaties (Guidance) back in January 2010 which has been adopted by tax authorities for assessing the applicability of treaty benefits. While the global tax environment has changed substantially especially with the introduction of BEPS, the MOF has followed closely on this subject. To be in line with the global trend, the MOF has referred to the OECD Model Tax Convention and relevant guidance and amended the Guidance on 12 August 2021 to provide clear and up to date rules on assessing cases that involve income tax treaties. The key amendments are shown in the table below:

With respect to the effective date of the amended Guidance, except for the Article in connection with reduced tax rate for dividends, which is effective since 1 January 2019, the rest of the Articles are effective since the day the amended Guidance is promulgated.

Given the Guidance was amended substantially, we have summarized the items that may have direct impact to the application of tax treaties and therefore worth noticing as follows:

Taiwan Tax Authorities Can Refer to the General Anti-Avoidance Rule (GAAR) Stipulated in Domestic Tax Law for Treaty Abuse Cases

To prevent treaty abuse, some tax treaties will contain a limitation of benefit (LOB) clause, which rules out certain situations that are specified in the clause to be eligible to such tax treaties. While in other tax treaties, there may be a PPT clause, which is a general rule that excludes a situation to be eligible to the said tax treaties if one of the principal purposes of the transaction or arrangement is to enjoy treaty benefits.

Among the tax treaties Taiwan has signed, not all of them contain a LOB or PPT clause. Thus, to echo BEPS Action 6, the MOF added the PPT rule in Article 4, Item 5 of the Guidance to address treaty abuse. If based on facts collected by the tax authority when investigating or assessing treaty cases, the tax authority can reasonably believe that one of the principal purposes of a transaction or arrangement is to directly or indirectly obtain treaty benefits, and granting such treaty benefits does not meet the intention of the tax treaty, should the tax treaty does not contain a LOB or PPT clause, the tax authority can refer to the GAAR stipulated in the Taiwan Taxpayer Rights Protection Act.

In other words, even if a tax treaty does not contain a clause to address treaty abuse, i.e. a LOB or PPT clause, Taiwan tax authority can still disallow the person or entity that is considered to have abused the tax treaty to be eligible to treaty benefits according to domestic GAAR.

Determination of PE: Identifying Fixed Place of Business

Based on the guidance on Article 5 of the OECE Model Tax Convention, with respect to identification of “fixed place of business”, the connection and coherence of the business operation and the geographical area framed should be taken in account.

Identification of Royalties for Computer Programs and Industrial, Commercial or Scientific Experience

Due to lack of a clear and unified definition of royalties, the MOF referred to the OECD Model Tax Convention and relevant guidance and further defined royalties in Article 14 of the Guidance as follows:

‒If royalties in a tax treaty are considerations paid for the use of or have the right to use copyrights, where the copyrights are for computer programs, royalties should mean the considerations for the use of, the reproduction of, or have the right to use or reproduce of combination instruction codes in the software for the purpose of directly or indirectly allowing computers to generate certain outcomes. If the considerations are for the use, operation, or reproduction of the software for the purpose of self-usage of the output of computer software, entertainment, or saving and backup, such considerations are not regarded as royalties under the tax treaty.

‒If royalties in a tax treaty are considerations paid to obtain industrial, commercial, or scientific experience, such considerations are:

1.The information provided is formed but has not been made available to the public yet and should be kept as a secret.

2.The information provider is not required to do additional work for customization purpose and does not guarantee the effectiveness.

This article has referred to OECD Model Tax Convention and domestic Copyright Act to further explain in what circumstances payments for use of or the right to use computer software should be considered as royalties under tax treaties. In addition, in the legislative reason of Article 14 of the Guidance, the MOF also indicates how to distinguish “royalties” from “technical service fees”. That is, royalties are remunerations received for licensing others to use an existing expertise or know-how that is not available to the public (passive activities). While technical service fees are remunerations received for provision of services utilizing one’s expertise or know-how (active activities).

Applying Different Articles of a Tax Treaty to a Single Payment

‒Article 20 of the Guidance stated that, if a payment applied to be eligible to treaty relief consists of different types of income (e.g. business profit, royalties, or properties transaction income), the payment should be split according to the types of income and each income type should be reviewed based on respective rules.

‒It is specified in Article 21 of the Guidance that, if the Taiwan source income (TSI) derived by a tax resident of a treaty country can be defined as business profits as well as other type of income stipulated in the tax treaty, the rules for other type of income should prevail over the rules for business profits.

For example, if a foreign enterprise, who is a tax resident of a treaty country and does not have a PE in Taiwan, receives a payment from Taiwan that contains both royalties and technical service fees, the payment should be split into two portions (i.e. royalties and technical service fees) according to Article 20 of the Guidance. For the portion of payment that falls in the scope of royalties, pursuant to Article 21 of the Guidance, the reduced WHT for royalties should apply. As for the portion of payment that is considered as technical service fees, the treaty benefit regarding business profits or technical service fees should apply.

KPMG Observations

The Guidance establishing the PPT rule has met the minimal requirement of BEPS Action 6. However, the Guidance does not provide further or more detailed rules on how to identify whether one of the principal purposes of a transaction or arrangement is to obtain treaty benefits. This will be the area that needs further observation on how tax authorities apply this principle after implementation of the amended Guidance.

Further, the Guidance has provided more specific rules on the definition of royalties and other types of income. Specifically, it clarifies the order of applying different income types for payments relating to mixed contracts and if a foreign enterprise derived TSI in different income categories such as dividends, capital gains or royalties/technical fees, the rules for such income types should prevail over the rule for business profits.

Overall, the amended Guidance not only follows the latest development of international tax, but also provides more clear rules related to application of tax treaties. The announcement of the amended Guidance should be beneficial to foreign enterprises engaging in trades and business in Taiwan.

Authors

Lynn Chen Partner

Larry Wu Manager

Jack Chen Assistant Manager

© 2026 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。