Building effective fintech partnerships can enable banks to succeed on digital innovation trail

Banks navigate the innovation trail

Dynamic partnerships with fintech startups will help banks introduce digital innovation.

As banks and financial institutions globally navigate the transformation trail, there’s no doubt that new entrants such as fintechs and e-commerce giants are bringing fresh and innovative ideas and services to a marketplace of eager consumers.

Invariably, every strategy and change initiative will require very careful consideration for such large, complex, highly regulated organizations to truly reinvent themselves amid disruption of the entire ecosystems in which they operate.

It raises questions about the role of innovative new partnerships and sourcing of new capabilities, and where to invest in and/or acquire fintechs or smaller tech companies. Innovative partnerships can offer tremendous capabilities to the big banks to solve problems and drive effective changes to operations, technology, processes and services.

Banks form non-traditional relationships with fintechs

Exploring and facilitating such partnerships to drive change will require financial institutions to recognize that they are dealing with a whole new category of third-party service providers. Such initiatives will need to be more experimental and collaborative in order to rapidly solve specific problems and address evolving needs as disruptive changes keep rewriting the rules for doing business.

Banks will need to figure out how to augment their traditional sourcing and procurement practices in ways that are more conducive to working effectively with smaller fintech companies in a more-agile, experimental environment where the change is low cost, low risk and quick.

Banks develop near- and longer-term innovation strategies

Big banks that are prepared to engage with fintechs will also need to adopt a very strategic approach that addresses two key perspectives. First, they need to have in place strategic priorities for the changes and new services or models they need to implement. This includes identifying capability gaps that need to be filled or addressed by the bank itself or a fintech relationship. Banks should also explore and assess opportunities that transcend the immediate ecosystem in terms of future capabilities or services.

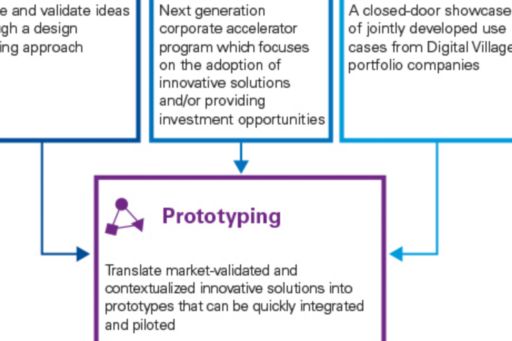

The need to remain forward-looking amid the constantly changing landscape will remain critical, meaning banks need to be committed to the innovation trail. Many organizations have set up or are turning to innovation labs, incubation hubs and accelerators that provide crucial links between financial institutions and fintechs. An accelerator or incubator can provide crucial support in providing ideation, exploration, experimentation and piloting of certain opportunities or solutions.

Banks and fintechs embrace digital collaboration

KPMG’s new Digital Village in Singapore, and mLabs Fintech Accelerator Program in Australia, are two examples of initiatives designed to bring together the key players, expertise and capabilities needed to drive effective transformation for financial institutions.

KPMG recently launched mLabs, a new fintech accelerator connecting seven Australian mutual banks with 14 fintech start-ups that want to identify and develop commercial solutions to business challenges. KPMG’s mLabs is designed to drive various commercial outcomes for participants, whether designing and launching new digital products and services, enhancing the customer experience or improving internal efficiencies.

Beyond driving change, such initiatives are demonstrating to banks how to work effectively with fintechs in the future.

For start-ups, the Digital Village is designed to provide or facilitate:

- Mentorship;

- Market access;

- Proposition support including market validation and business-case development;

- Fundraising and access to investors;

- Operational support.

For corporates, the Digital Village offers:

- Innovation workshops to explore challenges and opportunities;

- Access to start-ups;

- A methodology to test and validate product innovations;

- Global expertise in digital strategy, innovation and design.

In this environment, organizations can test or assess whether new strategies and initiatives are desirable to the market, technically feasible and commercially viable.

While many schemes exist to support innovative start-ups from concept to early funding, much more can be done to bridge the gap between ideation and the commercialization of innovations. The Digital Village program will help start-ups to further accelerate and grow to the next stage and equip corporate clients with the latest innovation technology.

In these challenging times for financial institutions, there is no time to waste as disruption of markets and business models continues to entirely reshape traditional ways of doing business along with the expectations, needs and demands of customers everywhere. With challenge comes opportunity and forward-looking organizations are embracing new initiatives and relationships that will drive new forms of competitive advantage and value.