The case for technology in an increasingly risky world

The case for technology in an increasingly risky world

The industry’s traditional conservatism is holding back its ability to tackle the complexity of today’s projects.

The industry’s traditional conservatism is holding back its ability to tackle the complexity of today’s projects

As projects become bolder, they also become more complex, and with complexity comes risk. Take the ubiquitous shopping mall. Where once the most complex component was the building structure, now there are car parks, elevators, escalators, and a host of other facilities, as well as a sophisticated IT infrastructure.

It’s a similar story with airports, which have become enormous centers for retail and dining. And then there are the exciting mega-projects like bridges, fantastically tall skyscrapers, metropolitan transport systems, inter-continental railroads, tunnels under mountains, and unimaginably deep mines.

Designers are also coming up with new and exciting ideas for creating exotic shapes, textures and features, especially for the luxury market.

The respondents to this year’s survey recognize the impact of these advances on the risk landscape. Sixty-seven percent of all respondents believe project risks are increasing – a figure that rises to 76 percent among engineering and construction companies. When you factor in the 60 percent that are seeing rising project volume, then it’s evident the industry has to find a better way manage complexity if it wants to avoid failures, delays and cost overruns.

Technology is one of the key enablers for innovation: computer modeling means virtually anything that can be dreamt can be designed. Technology also provides the tools to facilitate construction cost-effectively, swiftly and safely. All of which should reduce inherent risks.

But when it comes to adopting technologies, conservatism within the industry remains, with most firms content to follow rather than lead. Many senior executives are worried about their organizations’ ability to integrate disparate technologies, along with the costs and the subsequent impact upon the bottom line.

A sector ripe for disruption

“Is technology a solution or a problem in and of itself? It is a challenge on its own.” This comment, from one of senior executive of an engineering and construction firm, sums up the dilemma facing many industry players.

On top of the pressures that go with complexity, this executive sees a wider range of issues facing organizations: “The future of the industry is one where the global, macroeconomic environment is one of diversification; increasing debt loads and financing of public sector projects; decreasing depth of personnel as older workers retire; transfer of more risk to contractors with no increase in margin; and deterioration of design – partially caused by economic pressures from owners.”

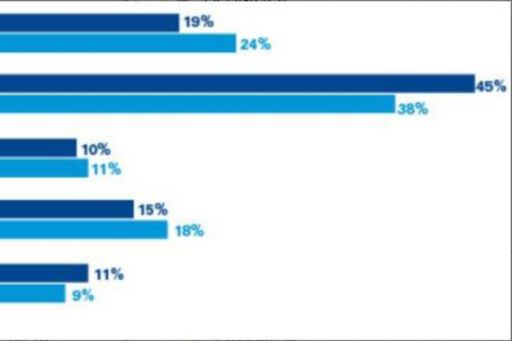

The survey suggests that the top drivers for innovation and disruption are, in order of importance:

- Efficiency, planning and cost reduction

- Competition and market forces

- New markets, growth and profitability

- Client needs, meeting demand

- Technology and talent

- Increasing regulation

Given these challenges, the question facing every leader in the sector is: “Do we disrupt now? Or do we wait to be disrupted?” One project owner, based in India, outlines the urgent need for change: “The construction industry in India is growing at very fast pace. More and more projects are being executed in a shorter duration of time. Technology is the only way to improve, perform and bring standardization, thereby reducing complexities and giving better results.”

Most of the respondents recognize the need for disruption, but differ in how they’re going about achieving it. Just over one-fifth (22 percent) claim to be aggressively disrupting their business models.

A mixed response to disruption

To view the full survey findings, download the complete report.