The COVID-19 pandemic has permanently changed the way we work and the places where we work, with many of these changes likely to persist even as the pandemic subsides.

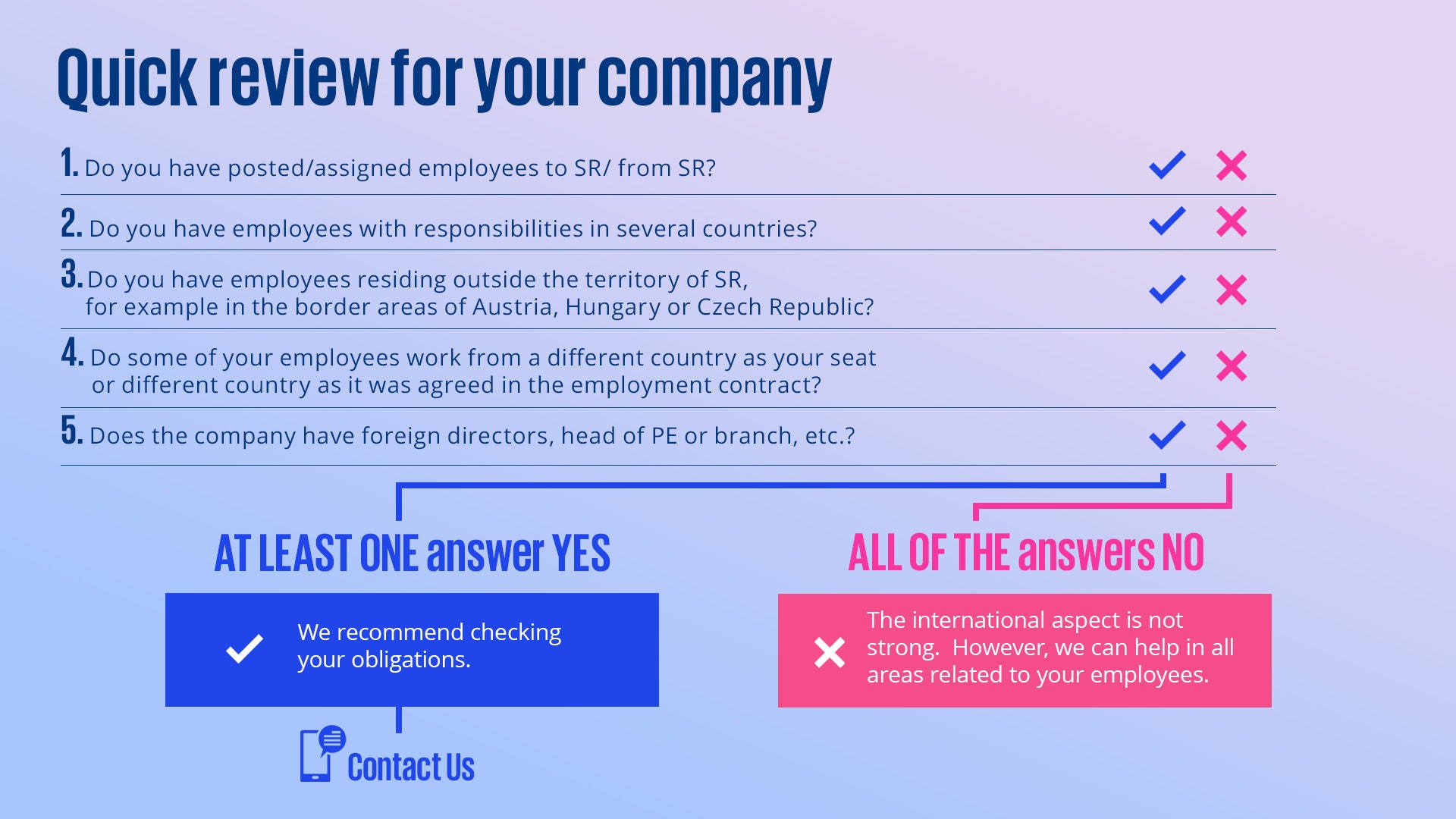

Home office has become a new normal in many companies. But remote work brings several risks, especially if performed from a country other than the employer‘s registered seat. Many assignments have been stopped, canceled or extended. These commitments need to be reassessed after each change.