Still, there are headwinds to be navigated in Singapore’s DC market, primarily on the regulatory and operational fronts, driven by greater pushes for sustainability and energy efficiency by local authorities.

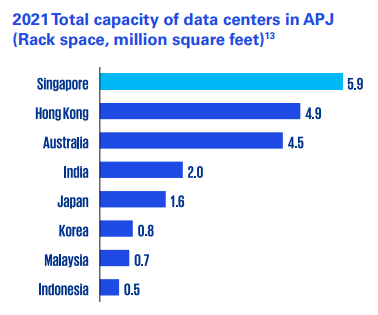

Singapore currently relies heavily on natural gas. DCs are projected to consume approximately 12% of Singapore’s total energy consumption by 2030. Notably, the state recently lifted a three-year moratorium on new DCs in January 2022, which aimed to curb the impact of DCs on the energy grid.

The resources that DCs typically consume is amplified in Singapore due to its tropical climate and limited land availability, translating to higher operating costs for data center operators. The cost of cooling is one of the key competitive disadvantages that Singapore faces when hosting DCs as they ideally operate at below 21 degrees Celsius.

Furthermore, land constraints mean that DCs are high-rise buildings, requiring more energy to facilitate cooling and air flow compared to their low-rise counterparts in Europe.

So how has Singapore managed to remain relevant as a Tier 1 DC location?

The unique challenges faced by Singapore position Singapore-headquartered data centre services companies to capitalise on the evolution of the market by driving innovation. These companies may have a greater incentive to develop novel designs such as floating DCs and more efficient, cost-effective builds.

Singapore’s ability to punch above its weight has transformed it into a global powerhouse for technological innovations. Its efforts to overcome natural resource constraints have spurred it to become an incubator of new ideas and technologies, including those related to data centres. These characteristics make the resource-scare innovation nation a valuable case study for European cities like Dublin seeking similar growth opportunities and solutions to pain points as Singapore.

On the whole, Singapore as a case study offers insight into how European cities can manage the deepening social and regulatory scrutiny on data centre construction and operation.